--By Janardan Dev Pant

Everyone of us agrees that financial inclusion is the prerequisite for inclusive growth.Inclusive growth in our terms is making sure that every Nepali is included in equitable growth. Financial inclusion is that every adult Nepali citizen is financially and socially included and has access to the formal financial system.

People living in extreme poverty (below USD 1.25 a day) have been reduced from 53 percent in 2003-04 to less than 25 percent in 2015 and this will continue to reduce. This is partly because of micro finance and partly because of remittance. Our hope is that we can eliminate extreme poverty in Nepal by 2020.

According to the findings of Fin Scope’s demand side survey conducted in late 2014 on financial inclusion, 61 percent of Nepali adults are found to be formally financially included. The survey findings also show that 57 percent of Nepali adults claim to be making savings and 45 percent claim to be borrowing money.

In practical terms, people living in extreme poverty make up the largest segment of those excluded from the financial system. We can assume that most of the remaining 39 percent of Nepali adults who are financially excluded are the people below the poverty line. This situation seems very difficult and must not be allowed to continue. Nevertheless, the solution is very simple. Microfinance is one of the effective available vaccines to this situation. A loan of Rs 60,000 will make a transformation in their lives. They can start and expand micro enterprises and enhance their income. Micro enterprises range from raising goat and cattle to selling meat or milk to opening a bicycle repair shop or tea and bakery shop to increase their incomes.

Borrowers can easily repay because their return on investment is very high since they have very low administrative costs, high turnover, and normally no tax.

Towards a Rich Nepal

During the course of micro finance group meetings we have observed that group members have so many capabilities, so many talents, and so much potential that they end up saying things like ‘I did not know that I am able to do this and that.’ That feeling is most probably the greatest asset. Poor women may not have the experience and expertise, but to get them excited about doing something and then seeing them doing it, is tantamount to her personal growth in terms of her income and social status. That personal growth creates further excitement and action, creating wealth for her family and ultimately for the nation. That is how we can make Nepal a rich and developed nation.

Micro Entrepreneurs

Presently, microfinance institutions are creating thousands of women entrepreneurs in Nepal. They are the real financial revolutionaries and innovators. An entrepreneur does not leave an idea in an idea stage; she actually makes an idea happen and brings the change.

The only way we can solve the situation of poverty is through the creation of jobs and the only way we can create jobs is through entrepreneurship.

It has been empirically proven that a small amount of money can also create large companies and enormous opportunities. In India, Infosys Limited was started in 1983 with a small capital of Indian Rupees 10,000 and their profit was USD 2.01 Billion in 2015.

However, for those who are sick or unlucky, microfinance may not work. Micro insurance will play a big role at this time. That is why microfinance firms distribute other products such as micro insurance (life insurance, cattle insurance, agricultural insurance), housing loans, financing of solar lamps and water purifiers that can help them combat poverty.

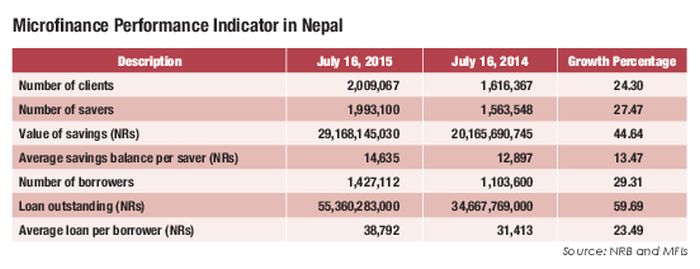

Growth Pattern

The table below gives the positive growth pattern of this social business. Microfinance has witnessed continuous growth suggesting micro finance institutions enhance financial literacy, and micro business development techniques.

In 2015, Nepal Rastra Bank increased the limit of microfinance loans for group members who have been using for the last two years and who have been categorised as good borrowers from Rs 200,000 to Rs 300,000. Similarly the regulator has increased the collateral based micro enterprise loan from Rs 500,000 to Rs 700,000.

However, we must avoid over lending and duplication of microfinance services. Pushing too hard they can over borrow, driving the poor into unwanted distressful situations. What we all do not want is microfinance acting like money-lenders. At the same time microfinance institutions should not be allowed to collapse, reasonable profitability should not be destroyed or over stretched regulations imposed on them.

Conclusion

In conclusion, microfinance is helping to create assets rather than simply debt generation. Microfinance borrowers have been able to prove that by prudently controlling both the costs and risks in micro enterprises even a five figure sum can create extremely large opportunities. It has been proven that when someone takes the risk they are more likely to work harder for the success of the project. We have observed that if there is proven income-generating activities, poor Nepali people are willing to invest their own money.

Microfinance institutions for the first time in the history of Nepal have moved the capital closer to the poor, making it available to virtually everyone who needs it. Poor Nepali citizens are learning financial literacy thmeselves, creating their own financial discipline and growth opportunities.

The writer is CEO of Nirdhan Utthan Bank Ltd. He can be contacted at [email protected]