Recent activities have breathed new life into the iron and steel industry. But problems still need to be ironed out.

--BY SANJEEV SHARMA

Yes, you heard it right. The iron is hot, especially for the country’s iron and steel industry.

New iron and steel products are being launched and existing companies are upgrading their manufacturing plants to further enhance production capacity in order to meet the rising demand of the essential construction materials. Jagdamba Steels, for instance, in August 2016 introduced the Rhino 500D Rebar. Similarly, the sector has also been observing a slew of new investments. As per an industry source, six new iron and steel projects are in the pipeline at present. Meanwhile, Narayani Strips, a member of the Birgunj-based Keyal Group, is preparing to start commercial production of coloured and colourless corrugated iron sheets using the latest technology after two months. Earlier in 2013, Kathmandu Steels started its operations with the production of Reidbar brand steel bars.

Towards self-sufficiency

Nepal which used to be mostly dependent on the import of iron and steel construction materials over a decade ago now seems to be on the way to become self-sufficient in such products. Steel bars, rods and galvanized corrugated sheets for roofing are the major items produced in the country. Similarly, a number of items including angles, beams, channels, galvanised iron (GI) wires, annealed wires, binding wires, bending wires, barbed wires and iron nails along with different types of metal pipes (GI and steel pipes) and fittings are also being manufactured within the country.

Industrialists point to the increase in construction of houses, commercial buildings alongside infrastructure developments activities as the major attributing factors for the rising demand of iron and steel. “The demand for iron and steel in the country is approximately 1.3 to 1.4 million tonnes annually,” says Shahil Agrawal, President of the Nepal Steel Rolling Mills Association (NSRMA), the umbrella organisation of Nepali iron and steel industries. Agrawal, who is the Managing Director of Shanker Group which owns the Jagdamba Steels, puts the annual demand for long iron and steel products at around 900,000 tonnes. “The demand for flat products is approximately of 400,000 tonnes and 100,000 tonnes for others,” he mentions. It was estimated in 2015 that Nepal produces 850,000 tonnes of steel bar, 235,000 tonnes of GI sheet and 78,300 tonnes of GI wire annually.

The post-quake reconstruction activities have been among the factors increasing iron and steel consumption in the country. Houses and properties destroyed or damaged by the devastating 2015 earthquake are being reconstructed creating a huge demand for steel bars, corrugated sheets, beams and different other types of iron and steel materials. According to Anil Kumar Rungta, Director of Jagadamba Enterprises, the domestic demand for iron and steel currently stands at around one million metric tonnes annually which is increasing by 10 percent per year. However, he observes that the demand is somewhat dampened given the uneven pace of the country’s development. “The per capita annual consumption of iron and steel products in advanced economies is 100 kg. In China, it is 200 kg, whereas in developing countries it is 50-60 kg. In India, the per capita consumption of iron and steel products is 60 kg. Nonetheless, it is hardly 30 kg in Nepal. Our per capita consumption should be 40-50 kg at present,” he mentions.

Industry overview

Himal Iron and Steel, a part of the Jyoti Group, is considered as the first rolling mill in Nepal which was established in 1961. Since then, over 20 companies have come into existence to produce and supply quality products to the domestic market becoming major forces in the Nepali manufacturing sector. It is estimated that the total investment in the domestic iron and steel industry hovers at around Rs 15 billion till date providing employment opportunities to over 15,000 people. Almost all major business houses own iron and steel units with the major players being Panchakanya Group, Jyoti Group, Saakha Group, Shanker Group, Golchha Organisation, Vishal Group, Ambe Group, Keyal Group, Shalimar Group and Kedia Organisation.

The domestic rolling mills have witnessed significant changes in terms of technologies over the years. The producers have been aware to introduce new technologies in a timely manner to address the demand in the market both quality and quantity wise and to manufacture new products. “Earlier we used to produce TOR steel bars. Now we are producing TMT steel bars that are improved products enabling engineers to design structures consuming less steel ultimately yielding in higher savings for the developers,” says Arun Goenka, Director of Goenka Group, the producer of Goenka Gold brand TMT bars. Meanwhile, Nepali industries have started manufacturing wire rods and ingots which were not produced earlier.

Nepali iron and steel companies have focused their efforts on producing products with higher levels of strength after the earthquake of 2015 to ensure the safety of the structures. The sector has also seen Nepali industries pioneering in introducing some of the advanced technologies in South Asia. Kathmandu Steel, for example, was the first company to introduce the Reidbar technology in the region to produce steel bars.

Import

Imports of iron and steel products and raw materials play a crucial role in fulfilling the internal demand despite the increasing production activities within the country.

The statistics is supplemented by the import of raw materials and other related items that are required to manufacture steel products.

In the first six months of the current FY, the import of MS billet, the main raw material for the steel bars, amounted to Rs 21.10 billion. The total amount of the import of all types of raw materials used in the steel sector stood at a whopping Rs 45.89 billion during the review period. Almost 90 percent of raw materials are imported from India and the remaining from third countries.

Entrepreneurs say that various factors have contributed to the huge import figures. “The import of TMT bars last year was nearly 100,000 tonnes,” shares Suraj Upreti, Managing Director of SR Group, adding, “The domestic production was not sufficient to meet the demand because of the insufficient supply of electricity and the severe problems caused by the Terai stir and border blockade of 2015.” According to him, the drastic increment in demand was due to the resuming of major construction works and the start of reconstruction activities in the earthquake affected areas.

Ashok Baid of Shalimar Group notes that the underutilisation of the production capacity of iron and steel factories is the main reason for the dependency on imports. “As the plants are not running at their full capacity, the cost of production is high,” he says. “The use of diesel for power generation pushes the cost of production further. All these factors have allowed other countries to export their products to Nepal.” According to NSRMA President Agrawal, the rate of capacity utilization of Nepali iron and steel industry is about 65-70 percent at present.

Another reason for the high import numbers, industrialists say, is the VAT exemption and customs duty subsidy on import of steel provided to the large infrastructure projects. Construction of large infrastructure projects usually requires steel bars higher than 32mm. The developers of such projects have been enjoying the incentive as the government thinks that Nepali producers aren’t able to manufacture steel bars of higher dimensions. However, entrepreneurs say that domestic companies are fully capable of manufacturing such types of steel bars. “This facility started at a time when Nepal was not self-sufficient in iron and steel rods. It was intended to speed up the country’s development. Now, as we have become self-sufficient, the VAT and duty subsidies on importing iron rods by the large infrastructure projects are not necessary,” opines Jagdamba Entreprises Director Rungta. “Nepali industries are capable of producing all types of essential construction materials for such projects. The removal of the subsidies on import is important for the market expansion of domestic industries,” he suggests.

Suraj Upreti of SR Group agrees. “The subsidy makes the imported products cheaper, making it hard for the Nepali industries to compete. There is no doubt that we can provide quality products on time if we get the same incentive,” he mentions. Upreti says that if domestic producers get actual demand and a certain timeframe for production, they can produce TMT bars of any size at the required grade. As per NSRMA President Agrawal, certain domestic industries have the capacity to even produce 36 mm and 40 mm iron rods.

Entrepreneurs stress the need for exploiting the natural iron ore reserves discovered at various locations of the country to lower the import of some of the raw materials. Reserves holding about 23 million tonnes of iron ore deposits have been identified across the country so far.

Export

Presently, though imports are considerably high, the gradually increasing exports suggest a bright prospect for the Nepali iron and steel industry in the international market. Iron and steel products have topped the list of the country’s exports in recent years. From Rs 393.56 million in 2004, the value of such exports has risen multifold in the last 5-6 years. Besides neighbouring India, China and Bhutan, Nepali iron and steel products also reach the markets Japan, Egypt and Chile. Steel rods, angles, tubes and pipes, GI wires and flat-rolled products are the major exports of the country.

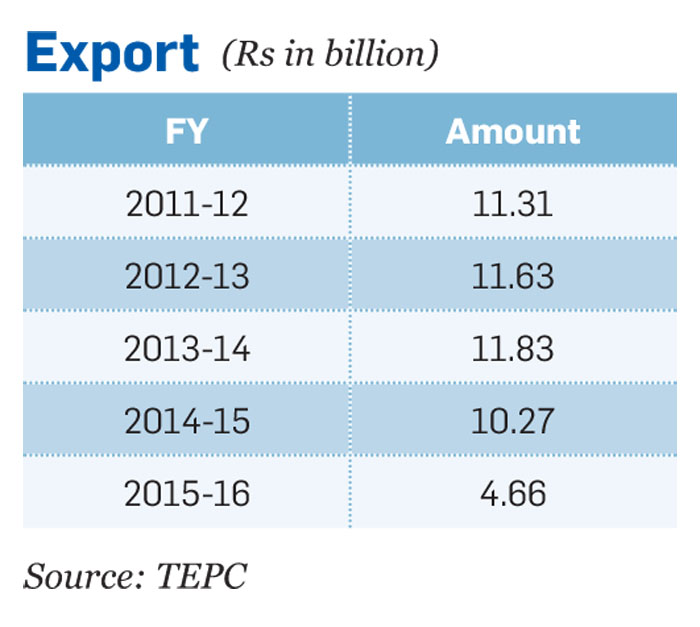

Exports which have been constant since FY2011/12 fell sharply in the FY2015/16 because of the long Terai stir and border blockade that severely disrupted manufacturing activities. Nevertheless, with the end of the border blockade and strikes in early February last year, things have improved for the Nepali iron and steel exporters. In the first six months of the current FY, exports have amounted to Rs 2.79 billion, as per the TEPC.

In spite of the promising export numbers of the last few years, industrialists say that Nepal has not been able to tap the full export potential of steel products. “India is the market for such products. The cost of production in India is less due to subsidies and high scale production. Due to this, we must first reduce the cost of production to compete with the Indian products,” thinks Anuj Keyal, Director of Narayani Strips. Besides the raw materials, electricity also plays a vital role in the cost of production in the iron and steel industry. Industries here are charged Rs 9 to Rs 10 per unit of electricity which is highest among the South Asian nations. Entrepreneurs suggest that subsidising the rate would be a step forward to lowering the costs, thereby making the products competitive. As per Agrawal, in Bhutan, the power is supplied to industries approximately at the rate of Rs two per unit.

Problems

The iron and steel industry has been facing a lot of problems with the main ones being the inadequate supply electricity, deficient connectivity to transport products from one part of the country to another and lack of a skilled workforce. The supply of electricity has improved in recent months, but it is still inadequate, say industrialists. “Despite the reduction in power cuts, there is no improvement in the quality due to problems such as low voltage and tripping,” Keyal states, adding that the supply system must be upgraded to solve this problem. Meanwhile, the pace of improvement and innovation in steel is also low due to the lack of R&D facilities. “We can produce better products and manufacture innovative items if the government provides us with research opportunities and design facilities,” views Baid.