Nepal suffers an infrastructure defi cit on an epic scale, stifl ing vast human potential on several fronts.

--BY HOM NATH GAIRE

Infrastructure has various effects on an economy. Primarily, infrastructure stimulates economic development by encouraging production activities. It produces various crowding in effects, including in production activities and quality of life for households, which thus benefits the entire society.

Moreover, infrastructure is the capital stock that provides public goods and services. Therefore, it is instrumental in reducing income disparities. Infrastructure also creates multiplier affects in developing countries, implying a close relationship between infrastructure and economic development.

Nepal suffers an infrastructure deficit on an epic scale, stifling vast human potential on several fronts. A World Bank estimate of the country’s “infrastructure gap” pegs investment needs this decade at between 8 and 12 per cent of the national income to achieve Nepal’s medium-term ambition of graduating to a middle-income nation by 2030.

Uplifting from the status of a Least Developed Country (LDC) is only possible with high growth rates sustained by productive capital stocks. This demands rapid development of infrastructure driven largely by a private sector (local and foreign) that has the technical, managerial and financial clout to deliver efficient, high-quality and cost-effective results on the ground.

Nepal Infrastructure 2014

In this context, CNI one of the leading apex bodies of the country's private sector has organised the 'Nepal Infrastructure Summit (NIS)' since 2014. In line with the growing recognition for private investment in infrastructure projects, the summit had focused on the theme of "Accelerating Investment in Infrastructure" for stimulating economic growth.

The main aim of the first ever Nepal Infrastructure Summit was to facilitate discourse on the importance of infrastructure development so that Nepal can accelerate its economic growth by fast-tracking domestic and international investments in the sector. To this end, the summit has been impactful in increasing the budget allocation in areas of infrastructure development including energy, tourism, agribusiness, mass transit, water management and urban development.

The results have been visible in the total budget allocation in the infrastructure sector which went up by around 30 percent in Fiscal Year 2016/17 as compared to Fiscal Year 2013/14.

Nepal Infrastructure 2017

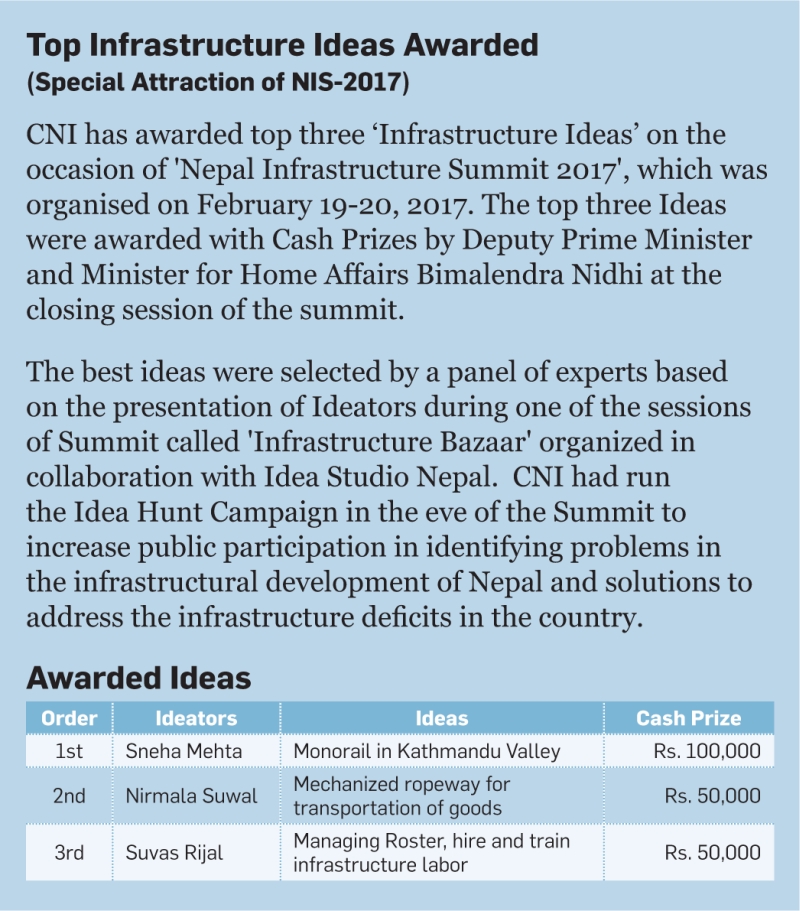

The 2nd series of the Nepal Infrastructure Summit was organised on 19th and 20th February 2017 by the same team of organisers and co-organisers. The main aim of the second summit was to facilitate discourse on attracting large scale private investment in areas of Nepal’s core needs and strengths i.e. large and strategic infrastructures under the theme of "Private Sector as an Indispensable Partner". Accordingly, the summit focused on Public Private Partnership (PPP) in infrastructure projects, forging stronger networks and alliances in the region for seamless connectivity and raising voice on why investment in infrastructure needs an urgent push in the country.

Nepal Infrastructure Summit 2017 has stressed on the requirement of building big infrastructures for the economic development of the country. The summit also interpreted that the current investment of the country in infrastructure is insufficient, thus it stressed on increasing infrastructural investment in close cooperation with the private sector.

The Summit discussed not only the importance of Public-Private Partnership but also delivered suitable PPP models for the regional and international level, conditions for successful PPP projects on infrastructure development including green and resilient infrastructures. Terming infrastructure as a prerequisite for higher economic growth, speakers and experts urged the government and the private sector to ramp up investment in the construction of physical infrastructure.

The government also echoed that the policies have been reformed to encourage the private sector as the major agent for infrastructure development. It was nice hear that the government was committed to ensuring the security of all private investment and working to create an enabling environment to attract foreign investment.

Likewise, it was noticed that the private sector and development partners were eager to invest in infrastructure development as it is needed for economic prosperity. The organisers believed that the Summit turned out to be useful in advocating for investment in infrastructure development, particularly in the agricultural, energy and transportation sectors of the country.

CNI, the lead organiser of the Summit, requested the stakeholders including private investors, development partners and the government agencies to work in the spirit of the synergy that was seen during the Summit for boosting up investment and developing an investment-friendly environment in the country.

The Major Takeaways of the Summit

• It is reaffirmed that Nepal’s infrastructure investment gap is high and requires a huge investment. The current level of investment of around 4-5 percent of GDP is grossly inadequate as the need is more than 10 percent of the GDP.

• It is essential for the government to leverage the resources available in the private sector and Foreign Direct Investment to meet the urgent infrastructure needs of the country.

• It is observed that several policy and regulatory constraints urged the government to take urgent action to achieve transformational changes that will help attract investment in the infrastructure sector.

• It is also emphasised that the current focus on the physical infrastructure needs to be expanded to include the social sector such as health, education, clean energy, etc.

• The importance of infrastructure investment to make the infrastructure resilient in terms of natural disaster and climate proofing was discussed in the summit.

• The infrastructure being developed is in the infancy level and therefore, there is a need to develop internal capacity.

• It is essential for the government and the private sector to build capacity so that more infrastructure planning, design and construction works could be done within the country.

• The summit noted that the currently available financial instruments and modalities for infrastructure investment are not adequate. Therefore, there’s a role for the government to facilitate and assist in the development of such instruments and facilities.

Specific Recommendations on Infrastructure Financing

• Infrastructure Fund which can be operated by either government, PPP Modality or with the funding of government and Multilateral Development Banks or with the combination of any of those.

• Private Equity Fund that would be focused on the Infrastructure Sector

• Infrastructure Development Bank as envisioned by the Proposed bill of Bank and Financial Institution

• Non-Financial Institutions for development of infrastructure that can be consulting, construction and others

• Green Investment Fund/Global Climate Fund that would tap the potential investment of solar, energy efficiency modalities or other renewable energy

• Credit Rating Agency that has worldwide recognition which would ensure the confidence of the investors

• Local Currency Bonds that can be made against the PPA, PDA and other financial instrument