Away from the traditional wisdom in economics, Thaler has shown the factors affecting the economic decision making of humans.

Do you remember when you last argued with a shopkeeper refusing to pay higher for a nice warm jacket during the freezing winter season? Do you remember when you rejected a friend’s offer to buy your beloved smartphone at Rs 50,000 that you purchased a few months earlier at Rs 45,000? When was it when you purchased a 50-inch Ultra-HD TV set from the money you saved from expenses of daily essentials?

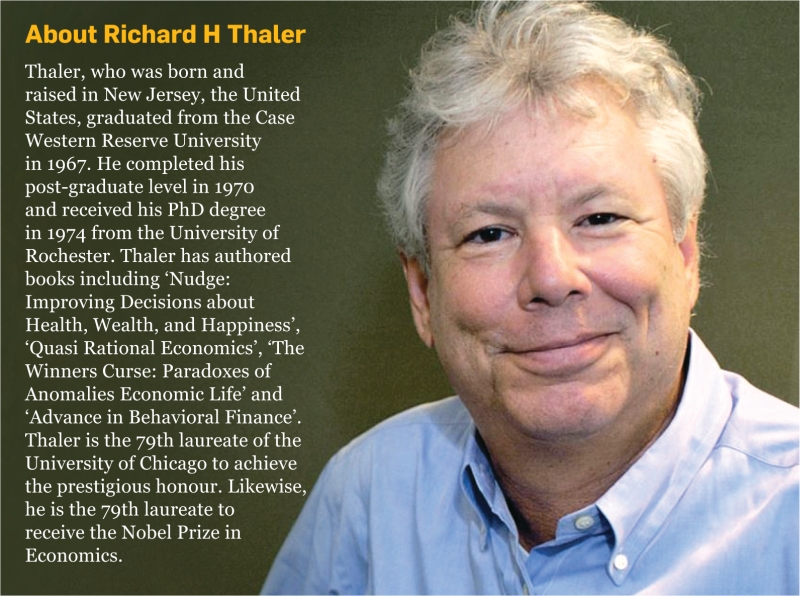

These are some of the few examples that indicate how human behaviour and psychology determine the outcome of people's economic decisions. This tendency of ‘bounded rationality’ leads people to act differently from what are stated in the established theories of economics that say human being always behave in rational ways when it comes to economic decision-making. This concept is attributed to American economist Professor Richard H Thaler, the winner of the 49th Sveriges Riksbank Prize in Economic Sciences, which is commonly known as the Nobel Memorial Prize in Economic Sciences. Thaler, now 72 and a Charles R. Walgreen Distinguished Service Professor of Behavioral Science and Economics at the University of Chicago Booth School of Business, was named the recipient of the prestigious award worth USD 1.1 million for this year for his contributions to the field of ‘Behavioral Economics’ on October 9 by the Royal Swedish Academy of Sciences (RSAS), the awarding body of the prize. According to RSAS, Thaler has contributed significantly with his research on how human behaviour can affect market growth and their decision making ability.

He is considered as an academic who focused on the psychological part of the Global Financial Crisis of 2008. Appearing in a cameo alongside pop star Selena Gomez in the critically acclaimed and multiple award winning 2015 movie The Big Short, Thaler explained why banks and investors keep on investing in the housing and real estate assets even when the associated risks become dangerously higher.

Thaler has developed the concept of ‘Mental Accounting’ which describes that financial decisions made by humans are the reflection of their own behaviour. According to this, individuals separate the money they have earned from different sources, to spend in different areas separately.

Thaler is co-author with Harvard Law School professor Cass R Sustein of the famous book ‘Nudge: Improving Decisions about Health, Wealth, and Happiness’ which is focused on psychology and behavioural economics, libertarian paternalism and choice architecture.

According to Thaler, economic analyses are correlated to three psychological traits of humans- bounded rationality, perceptions about fairness and lack of self-control.

Bounded Rationality

Thaler’s concept of ‘Mental Accounting’ describes how human behavior affects their economic decision making. In his research, Thaler primarily focused on studying the long term effects human behaviors have rather than studying the short term effects. He has also developed the ‘Endowment Effect’ which says that individuals value something they own more than something they do not own. The Nobel Prize committee in a press statement has said, “Thaler was one of the founders of the field of behavioural finance, which studies how cognitive limitations influence financial markets. He also showed how aversion to losses can explain why people value the same item more highly when they own it than when they don't, a phenomenon called the endowment effect.”

Perceptions about Fairness

His theory of ‘Fairness’ describes how perception of humans bars companies and firms to raise the price of commodities even during the time of higher demand. The theory has also described why companies don’t hesitate to raise price of the products when the production cost is high. A game called ‘Dictator’, developed by Thaler and his team has been used in different studies by researchers to measure different group of people’s perception on fairness. The game is played between two players, where one of the individual is given some amount of money, and the second one is given nothing. The first player, who has money, should offer some amount of money to the second player. The player receiving the money should accept any amount of money the first player offers, even if the amount is zero. Even if the second player finds the amount unsatisfactory, he/she cannot argue with the first player. In this game, the player receiving the amount remains solely passive, as the game tries to determine the individual behavior of the players.

Lack of self-control

Thaler has also highlighted why many people fail to fulfill the resolutions they make on every New Year day. He also proved that people cannot self-control by using the planner-doer model, and has suggested solutions for it. This theory is like the one framework psychologists and neuroscientists use to analyze internal conflict between long-term planning and short-term doing. “People fail to save for future because they are unable to control their emotions to purchase their immediate needs,” he says. Thaler has also described how one can have better self-control after saving pension for their old age.