--BY ASHIM NEUPANE

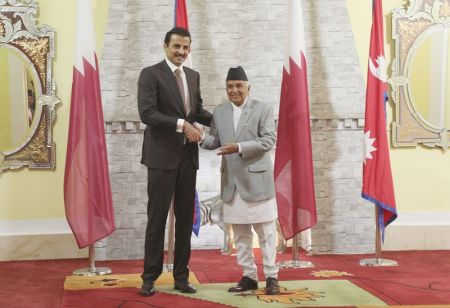

Neelesh Man Singh Pradhan

Neelesh Man Singh Pradhan

CEO, Nepal Clearing House Ltd

Evolution is critical to the success of any product, brand, entity or system. Constant adaptation and improvement are visible in every sphere. With the technological boom signalled by the arrival of the 21st century, a fundamental aspect of human society; the millennia-old method of transaction, has been undergoing a paradigm shift. Cashless transactions are now the norm rather than the exception in more developed parts of the world.

The process of digitisation has made transactions seamless and efficient, and the trend is growing at a rapid rate. In 2016, across the world, the total transaction value in the digital payments segment amounted to USD 2.4 trillion, the corresponding figure for 2018 has risen to USD 3.4 trillion. By 2022, the segment is expected to amount to USD 5.7 trillion, a Statista study estimates.

Cash is still the king though. Over 85 percent of transactions across the world are still cash-based. However, it is worth noting that the corresponding figure for developed countries is remarkably lower. In the USA, cash transactions represent 40 percent of all transactions, and in Sweden, the figure is an astonishing 2 percent; cash is close to achieving obsolescence. Closer to home, India, and China, in particular, have made swift strides in their bid to establish a cashless society. According to a study conducted by BNP Paribas, Asia as a whole is expected to grow by 30.9 percent in terms of non-cash payments in the near future. While cash is indeed king worldwide, the writing is on the wall.

State of Digital Transactions in Nepal

Digital and electronic payment transactions are still in their infancy in Nepal. According to Neelesh Man Singh Pradhan, CEO of Nepal Clearing House Ltd. (NCHL), excluding cheques, over 95 percent of transactions in Nepal are cash based. The lack of infrastructure and a sizeable rural population are prime factors. However, Pradhan believes while digital literacy is increasing, the rate of adoption of financial technology-based services is slow.

“As the rate of adoption is slow, the number of businesses that accept digital payment is also low. The overall ecosystem should be developed along with the payment infrastructure for the country to be ready for cashless transactions,” Pradhan says.

The government has now put in place the needed policies and taken a step to digitise many of their own payment transactions at Government offices. Further, the central bank has introduced a separate Payment Systems department, which has issued multiple licenses to various institutions to operate payment systems, mainly to aid the government in promoting digital payment transactions. Pradhan believes that there has been a great traction for digital payments in Nepal and it is expected to hit new heights over the next 5 years.

However, despite efforts to promote electronic transactions, some of the regulatory policies, in particular, the transaction limits on mobile banking and internet banking, are at odds with the desire to improve the digital economy. However, Pradhan hints that the concerned regulator may review such restrictions in due course and in line with the market demands.

“The need for increasing awareness among people to promote cashless transactions is the key. The private sector alone cannot promote the use of digital and e-payment and hence there are requirements for government intervention,” he says.

Talking about international online payment systems such as Paypal, Alipay and others, Pradhan said the market and the regulatory policies drive the entry for such international payment systems in the country. “The government, along with the private sector need to work together to open bank accounts for every citizen, this step will contribute towards achieving a cashless society,” Pradhan said, adding that NCHL is also working to raise awareness about electronic payment services among people.

NCHL Takes a Step

NCHL launched the Interbank Payment System (NCHL-IPS) in August 2016 to promote non-paper based transactions directly from/to bank accounts. The system has helped improve the efficiency of payments; as such transfers have become faster and much easier. The instruction-based payment system enables individual fund transfers and has a provision for bulk transactions as well. NCHL-IPS has been in use for customer transfer, remittance, dividend payouts, salary, fees payment, government payouts (G2B and G2P), etc. A total of 75 banks and financial institutions (BFIs) are associated with NCHL-IPS, the figure was 58 when they launched the product. The customers can enjoy the service through over 4,300 branches of the BFIs across the country.

“The system processed over 1,116,514 transactions equivalent to NRs 419 billion in the first four months of the fiscal year 2075/76. This is equal to a daily average transaction of over 13,000 and a daily settlement value of 5.2 billion,” Pradhan added. Pradhan believes that the number of daily transactions in NCHL-IPS may increase to 100,000 in a couple of years.

Like NCHL-IPS, the company recently launched connectIPS e-Payment system as a single payments platform, with an objective to promote electronic transactions in Nepal. According to Pradhan, connectIPS e-Payment is an extension of NCHL-IPS system, which allows the users to initiate and process their transactions from alternate channels such as web and mobile. Current services that are available in this system include online fund transfer, government revenue payments, credit card bill payment, mobile wallet top-up, stockbroker payments, and online merchant payment among others. 47 BFIs are currently associated with the system with over 37 BFIs in operation.

The system can be accessed from www.connectips.com and a mobile app (currently available on Android). Various divisions of the Government of Nepal have already used this for P2G payments, informs Pradhan. The users can link up more than one bank account in the system and have the option to select the bank account at the time of payment. All the transactions are processed through the bank accounts and hence do not require any intermediary.

Challenges

Services such as NHCL-IPS, connectIPS and similar payment systems are paving the way for the payment industry revolution in Nepal. However, getting all the relevant stakeholders of the digital payments ecosystem onboard is the major challenge. Significant hurdles, such as ensuring collaboration between various infrastructure providers, including payments and telecom; increasing awareness at the banks, end customers and the merchants (service providers) do exist. Collaboration among all such stakeholders is a must if services of digital and electronic payment are to make a significant dent in the cash-based landscape of Nepal.

Looking Ahead

With the policy intervention by the government including direct participation in the electronic payments and the increasing adoption of financial technology-based services, the outlook for the payments industry in Nepal is positive. And this is expected to rise in the coming days.