.jpg)

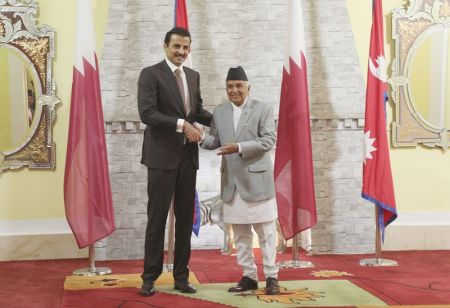

--By Hom Nath Gaire

The efficiency of capital markets depends on well-developed securities laws, stock exchange regulations and enforcement mechanisms that ensure that all issuers and investors are treated fairly and equitably. It also depends on companies providing timely, accurate and reliable information to investors, especially financial reports, to help them assess the performance and financial condition of listed companies and make investment decisions.

As Nepal has a developing capital market, so is the case of securities laws and regulations. The growth of Nepali capital market is reflected in the increased turnover, market capitalization and number of listed companies. In such a situation, the unique characteristics of the Nepali economy must be taken into account while reforming its securities legislation and regulation. Effective market regulation that encompasses the needs of both large and small public companies is particularly challenging for Nepal, a relatively small market that is yet to be integrated with global markets.

Keeping this in mind, Nepal Stock Exchange Limited (Nepse), the operator of the country's secondary market as well as the frontline regulator, has been stepping up process for reforming Nepal’s capital market. The latest example of such reform initiatives is reflected in the introduction of draft 'Trading Automation Bylaw-2070' and draft 'Rights Trading Bylaw-2070' as well as providing multiple login facility to registered stock broker companies.

Rights Trading Bylaw

In Right Share offering, issuers give existing shareholders the right to buy new shares at a specified price, generally at face value of company's shares. As they allow current shareholders to avoid dilution, regulators in most of the countries favour rights offerings. Theoretical descriptions of rights offerings often assume that shareholders who do not want to exercise their rights can sell them instead. However, this assumption does not always hold true. In some countries, rights cannot be traded at all; in many other countries, the issuer itself decides whether or not rights will be tradable. Even though rights markets are often illiquid, investors appreciate rights tradability as it makes their rights tradable. But many countries still restrict the tradability of rights.

In this context, Nepse has formulated a draft 'Right Trading Bylaw-2070' and has made it public for comments and suggestions. It has requested for constructive inputs and value addition from the regulators, stakeholders and experts so as to make the bylaw more practical and instrumental to make trading of rights transparent and efficient. It is claimed that the introduction of right trading would further enhance the country's secondary market. Fundamentals of rights trading are as follows:

Trading of rights

In the rights offerings of listed companies, shareholders who choose not to exercise their rights can trade them in a secondary market during the offering period. In absence of such mechanism trading of rights is rare and costly, and it typically involves larger blocks of rights, which is informal in Nepal till date.

Non-exercised rights

Presently an issuer only can sell any rights that were not exercised to a standby buyer or place them in the public auction after the subscription period. Standby buyers are usually controlling shareholders, related parties, or underwriters. Public placements typically occur in an accelerated book-building process that is comparable to cash offerings. In order to avoid such situation some issuers also provide shareholders an “oversubscription privilege” that entitles subscribers to a second premative right to the unsubscribed shares.

Regulations

Rights offerings, tradability, and reimbursements have to be regulated by securities laws and listing rules. Otherwise, it makes rights offerings susceptible to possible conflicts of interest between groups of shareholders. For example, issuers in most countries exclude foreign shareholders from the distribution and/or tradability of rights. Further variants arise as a function of differences in brokerage agreements. In many European countries, most brokers can sell rights even when shareholders give no instructions to exercise or sell. Therefore, the trading of rights offerings should be well regulated and managed in order to avoid possible frauds and malpractice in the markets.

.jpg)

Highlights of Proposed Rights Trading Bylaw

1.The listed companies will provide a receipt of right to the current shareholders clearly mentioning the number of existing shares, ratio of rights offerings, face value of the rights offerings and the rights entitled to the current shareholders. Such receipt of rights must contain at least 10 units share.

2.The receipt must have an option for right holders –whether to exercise the entitled rights or offer for sell. Accordingly, the right holders should specify all the required information.

3.The receipts of rights must be listed in Nepse for trading within 10 days of rights offerings. The listed rights can be traded in a separate window of Nepse's trading mechanism up to 35 days of listing. The interested buyers as well as sellers must participate in trading of listed rights within the given time span.

4.The first trading price of rights shall be determined by adjusting the ratio of rights from the last traded price before closing the books for right offerings purpose. Then after the rights would be traded at the price determined by market forces of demand and supply.

5.The buyers and sellers of the rights should file a request to Nepse within 3 days of trade (T+3 days) for clearing of transactions and settlement of payments. Along with the request all the supportive documents must be submitted.

6.The issuing company must prepare a list of final right holders who are entitled to obtain additional shares. For that the company must complete all documentation, including name transfer, within the stipulated period.

7.Unless the receipts of rights are not converted on share certificates the rights holders (whether original or new buyers) would not be entitled to participate in Annual General Meeting (AGM) as well as cash dividend and bonus share offerings of the concerned company.

Proposed Trading Automation Bylaw

A fully automated trading system (ATS) is one that can trade various types of market securities during the trading day without user monitoring. All aspects of trading, such as obtaining market prices, analysing price patterns, making trading decisions, placing orders, monitoring order executions, and controlling the risk are automated according to the user preferences. The Automatic Trading system can work systematically and consistently following a predefined set of rules.

Now most of the stock exchanges worldwide have been operating through ATS. However, Nepal's stock market still operates through a semi-automated manual trading system. In such a situation Nepal Stock Exchange Ltd. has recently planned to introduce 'Automated Trading Bylaw'. This is expected to expedite the modernization of country's secondary market. The proposed bylaw will replace the existing 'Trading Bylaw 2055' and is thus expected to enhance the efficiency as well as transparency in securities trading. Nepse has requested comments, inputs and suggestions on this bylaw draft from concerned stakeholders including the regulators, stockbrokers, investors, experts and the academia.

Benefits of Trading Automation

The proposed concept of 'Securities Dealer' in the trading bylaw draft is expected to stabilize the stock market. It will come into operation, once the draft is finalized and approved by the Securities Board of Nepal (SEBON). Nepse lays the concept of securities dealer is proposed with an aim to contain the unwanted and unnatural fluctuation in stock prices that take place in the market time and again. In absence of securities dealer in the secondary market, market operator as well as the regulator has not been able to protect small investors from unwanted price fluctuations.

Promoter and Public Shares

The trading bylaw draft has proposed to remove the difference between the prices of promoter and public shares of Banks and Financial Institutions (BFIs). Presently there is discrepancy between the prices of promoter and public share of BFIs. There are various flaws in trading, clearing and settlement as well as in taking loan against the collateral of promoter shares because of such discrepancies. In order to remove them the bylaw draft has envisioned a separate 'Block Trading Window' under Nepse's trading system. Presently such block trading is carried out manually. According to the new bylaw, the price of promoter shares of BFIs will be determined through negotiation between the buyers and the sellers.

Block Trading

An act of sell or purchase of a large quantity of securities is known as block trading. A block trade involves a significantly large number of shares or bonds being traded at a predetermined price between parties, outside of the open markets. Block trading mechanism is considered instrumental in order to minimize the impact of such a large trade hitting the market index. Although the definition of 'Block Trading' may vary in different countries, the bylaw draft has defined the purchase and sell of more than 10 thousand units of shares (whether promoter or public) as 'Block Trading'.

.jpg)

Blank Transfer

A share transfer form in which the name of the transferee and the transfer date are left blank is known as Blank Transfer (BT). The registered holder of the form signs the form so that the holder of the blank transfer has only to fill in the missing details to become the registered owner of the shares. Blank transfers can be deposited with a bank, when shares are being used as a security for a loan. A blank transfer can also be used when shares are held by nominees, the beneficial owner holding the blank transfer.

The bylaw draft of trading automation has proposed to formalize the BT in Nepali stock market as well. So far though BT is allowed to trade in the secondary market they are not recognized as regular shares. As a result BT holders were deprived of using their shares to take loan from BFIs. Once the proposed trading bylaw will come into action, BT holders will be allowed to take loan against their share certificates. However, BT will not have place after the Central Depository System (CDS) comes into full-fledged operation.

End Note

In order to maintain fair and steady growth in capital markets, regulatory policies should be directed by reasonable and thoughtful methods. Therefore, the operator and regulator of capital markets should be equipped with well developed methods and best practiced tools of capital market regulation. This is essential to identify inconsistencies in the actual characteristics of capital markets and to correct the deviations, if any, to serve as the foundation for economic growth.

Who Are Securities Dealer?

Securities dealers include individuals or firms that specialize in security market transactions and assist firms in issuing new securities through the underwriting and market placement of new security issues, and trade in new or outstanding securities on their own account. Only underwriters and dealers that act as financial intermediaries are classified within this category. Security brokers and other units that arrange trades between security buyers and sellers but do not purchase and hold securities on their own account do not fall under the category of securities dealer. By their nature, securities dealers facilitate both primary and secondary market activity in securities. In particular, these institutions can help to provide liquidity to markets, both by encouraging borrower and investor activity, not least through the provision of information on market conditions and through their own trading activity.