--By Niranjan Phuyal

Harry Markowitz suggested a model in 1952, nowadays popular as “efficient frontier,” for the selection of efficient portfolio. According to this model, a portfolio will be efficient if the covariance (co-movement) of return of the assets in the portfolio is negative. In general terms, diversifying investment in different sectors would minimize risk. Though many other theories have evolved at risk and return since then, it is still considered appropriate measure for minimizing risk. But the irony in Nepali capital market is that it is mostly concentrated on bank and financial institutions (BFIs).

Out of the total companies listed on NEPSE at the end of BS 2070 (mid April, 2014), more than 77 percent are BFIs and they account for 75 percent of the total listed shares. Until the last fiscal year (FY 2069-70 that ended on Mid-July 2013), more than 75 percent of the total trading volume was contributed by BFIs while companies other than commercial banks were rarely included in the top ten trading companies. The concentration ratio, i.e. a ratio of the trading volume of top ten companies to total trading volume, normally remained more than 50 percent in the previous FYs and it was 55.73 percent for the FY 2069-70. Similarly, very few companies other than BFIs enter into the capital market to issue shares for general public. This trend reflects higher concentration on BFIs in primary as well as secondary market.

In an emerging capital market like Nepal, such high concentration may create number of problems. Firstly it hinders formation of an efficient portfolio as is suggested by the Markowitz model. So, reduction of risk through diversification is almost impossible. A research conducted by Kunt and Levine in 1996 showed that concentration can be the cause of volatility in the market and could have liquidity constraint for the other stocks. So, the second problem created by concentration in Nepali capital market is volatility and we are experiencing the ups and downs of BFIs mirrored in total capital market. Thirdly, in such concentrated market, other stocks are normally less liquid. Many manufacturing, trading, hotels and few insurance companies are very thinly traded in NEPSE. The shareholders of such companies may not be getting enough opportunity to sell their shares. Less liquidity in secondary market could be one of the causes for less capital mobilization in primary market and it’s true in Nepal as none of the ‘real sector’ companies are interested to enter the capital market.

Although there are many issues and challenges in the market, trading volume, investors’ activities, and other market indicator shave increased significantly during the year 2070 BS. Average trading volume per day has jumped to NRs. 230 million from the last year’s NRs. 119 million. During the year, the total trading volume has been recorded as NRs. 50.72 billion, which is 94.1 percent more than 2069 BS. During the same span of time, NEPSE index increased 56.22 percent and reached 817.65 points. Shareholders’ wealth in the market measured in terms of market capitalization has also increased significantly and reached more than NRs. 800 billion by the end of 2070 BS.

With these corrections, few symptoms of diversification have also been seen in the market as more hydropower companies have entered and continue entering through IPOs. This may provide different options for investors to select companies for efficient portfolio. Most importantly, the trading behaviour of investors seems to be more matured. It seems that Nepali investors are willing to diversify their investment in the coming days. Although overall trading volume has increased significantly within this year, sharp increase in the trading volume for hotels, insurance companies and hydropower companies has brought down the share of BFIs in the total trading pieduring this year. In the year 2069 BS, the BFIs trading amount in comparison to the total trading amount was 73.25 percent. This has decreased and came down to 63.98 percent in the year 2070 BS. More interestingly, the concentration ratio has dropped to 39.44 percent, which has never been lower than 50 percent, in the previous years.

Growth in Investors Number

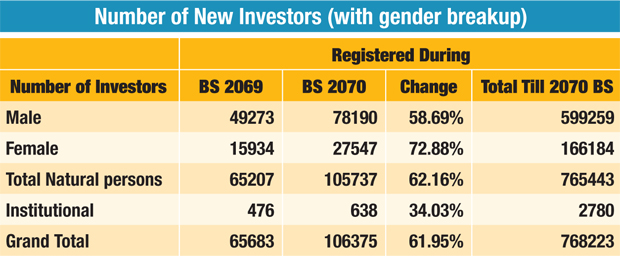

With the market trend on an upward movement, the numbers of investors at secondary market have also increased in the year 2070 BS. The data extracted from NEPSE trading system shows that additional investors, around 62 percent, registered for trading in the secondary market in year 2070 BS in comparison to the previous year. With a growth rate of 72.88 percent for female investors, it was evident that the growth rate was higher for the females.

At the end of the year 2070, 768,223 investors registered at NEPSE to trade secondary market. Similarly, a total of 2,780 institutional investors, one percent less than the previous year, were registered with the NEPSE. As reflected by the trend numbers of institutional investors is increasing, and as they normally have more holding power, it can be expected that Nepali capital market will be less volatile in the coming days.

Similarly, the trading volume from out of Kathmandu has also increased during this year. Altogether, there are 10 broker outlets in the major cities out of Kathmandu. Their total trading comprises of 4.48 percent (up from about 1 percent previously) of Nepse’s total trading volume. All these show that Nepali capital market is diversifying and increasing its scope. Specially, behaviour of investors also seems to be more matured than in the past.

As an emerging and small market, there are lots of issues that need to be addressed in Nepali capital market. We are very late in adopting new technology. The Central Depository System in not functioning in full-fledged way as of yet. All potential investors throughout the country are not yet tapped. There is no legal provision for NRNs and foreign institutional investors to trade in secondary market. Financial literacy is very weak. Corporate governance issues, proper rules and regulations, efficient and strong regulator etc are some of the other challenges in the market. But the trading indicators, confidence level among the investors and their behaviour during the year 2070 shows that the investors are one step ahead to pitch in for bringing modification in the market.

Writer is Assistant Manager at NEPSE. He is a part - time faculty at KUSOM.