--By Akhilesh Tripathi and Sanjeev Sharma

Despite obstacles, some sectors of the economy have progressed and their future looks bright. We could call them the “rising stars” of the economy. In this issue, NewBiz has tried to highlight some of these rising stars, which include: Hotels, Hydropower, Construction Material, ICT, Education, and Banking Sector.

We all know that all is not well with the Nepali economy. Insecurity, much-aggravated industrial atmosphere, power shortage, transport obstacles, strikes and closures and labour unrest stand as barriers in the path to Republic Nepal’s economic progress. The country’s economic growth rate, according to official government estimate is below four per cent at present as there is lack of political commitment on a common economic agenda, investment-friendly environment, energy and physical infrastructure in the country.

But despite these obstacles, some sectors of the economy have progressed and their future looks bright. We could call them the “rising stars” of the economy. In this issue, NewBiz has tried to highlight some of these rising stars, which include: Hotels, Hydropower, Construction Material, ICT, Education, and Banking Sector. The entry of the Nepali private sector into these areas, especially after the liberalization of the economy post 1990, has resulted in significant growth in these sectors.

Similarly, the continuity of the economic liberalization policy in republican Nepal has produced a significant group of entrepreneurs and businesspersons who are now successful in these areas. This breed of entrepreneurs and business persons thinks that if there is political will and stability, adequate power supply, supportive policy and peaceful industrial environment, then these rising stars will rise even higher.

However, political stability is the first condition for economic development. Political parties do have their respective ideologies and differences too, but there needs to be a minimum understanding on common issues of economic development, which would help build atmosphere conducive to investment and trust. This would help the rising stars of the economy to attain newer heights.

Construction Materials: Market Picking Up

.jpg)

The construction industry is a growing industry in Nepal. It contributes around 10 to 12 per cent to the national GDP and uses around 35 per cent of the government’s annual budget. As the country plans to invest more in infrastructure such as roads, railways, airports, bridges, and irrigation and hydropower projects and as the housing sector shows sign of improvement, the prospects for the construction industry in the country look brighter.

It is estimated that the construction sector has created employment opportunities to more than one million people in the country. When it comes to development of any physical infrastructure, construction materials are the major components. With the growth in the construction industry, the demand for construction materials too has risen.

In the last one decade, over 150 construction material factories from cement, paint and bricks to steel factories have been established with an eye on the realty sector and the government’s infrastructure development projects. These factories have helped reduce import of construction materials. The country has also become almost self-reliant in bricks, steel and paint; cement production is also on an encouraging trend. The price of construction materials is growing by 20 to 22 per cent every year.

The realty sector, which is one of the major buyers of construction materials in the country, has shown some signs of improvement. According to Ichchha Raj Tamang, president of Nepal Land and Housing Developers’ Association, the sector has started taking a turn for the better. “In the recent couple of years, the realty sector has been improving by over 30 per cent annually,” claims Tamang.

Lately, according to construction material dealers, the demand from housing developers and the general public that had slowed down a couple of years ago, has shown some progress. “A couple of years ago, the demand went down by around 50 percent due to the government’s failure to release the budget on time,” said Manik Tuladhar of the Kathmandu Construction Materials’ Dealers Association. With the situation in the housing sector showing indications of improvement, developers have been speeding up work at their projects.

Meanwhile, construction material dealers said that with demand for construction materials slowly picking up, prices too have increased. Shil Ratna Tamrakar, proprietor of Shristina Traders, which deals in paints, said that the demand had increased remarkably compared to last year and that prices had risen by up to 10 percent depending on the brand.

It is estimated that around 90 percent of the country’s requirement of paints is fulfilled by domestic products. Along with a growth in housing activities in the past one decade, the number of paint factories too has gone up. There are 32 paint factories in the country with a combined investment of around Rs 6.5 billion.

The Nepal Steel Rolling Mills’ Association said that local steel factories had been able to exist mainly due to the demand from housing developers. There are around three dozen steel plants in the country, and of them, 12 are run in full-fledged operation. All these factories produce 400,000 tonnes of iron rods annually.

Similarly, there are more than 70 cement factories that have obtained operating permits from the Department of Industry. The cement industry already has an investment of around Rs 30 billion. Pashupati Murarka, senior vice-president of the Federation of Nepalese Chambers of Commerce and Industry (FNCCI), said that even though the number of companies receiving government permits has gone up, only around 40 plants are in regular operation.

The country’s annual requirement of cement amounts to 3 million tonnes, of which nearly 80 percent is being met by local products. “There are no authentic records, however, most of the production is going for construction of private houses and commercial buildings of housing developers,” said Murarka. He added that if construction of physical infrastructure receives a boost, the country would be self-reliant in cement too.

It is estimated that the construction sector is creating employment opportunities to about one million people. That means it generates employment next to the agriculture sector in the country. Similarly, about 60 percent of the nation's development budget is spent through the use of contractors. From this, it is clearly seen that construction is a major sector and any productivity enhancement activity in this sector will have a positive impact on the overall improvement of the national economy.

| Government Efforts Realizing the need for enhancement of the construction industry, Construction Business Act 2055 was promulgated and came into force from April 14, 1999. This is an effort made to institutionalize and systematize the construction sector. The Act has defined the procedures and requirements relating to issues and renewal of license and classification of and obligations of construction entrepreneurs. The law has established Construction Business Development Council (CBDC) under the chairpersonship of the Minister for Physical Planning and Works, and Construction Business Development & Implementation Committee (CBDIC) under the chairpersonship of Joint Secretary (technical) designated by the Ministry for Physical Planning and Works. These both are regarded as the apex institutions to develop the Nepali construction industry. Establishment of the CBDC and CBDIC is the important step taken by the government to promote the country’s construction industry. |

Education: On Private Sector Shoulders

.jpg)

With private investment standing at nearly Rs29 billion at present, the education sector is well on the path of evolving into a lucrative service sector business in Nepal. Nobody needs to frown at the idea of education being compared with business. It has done much more good than bad. Even big business houses have started to invest in education.

Private investment in the education sector has grown consistently over the past few years. It now stands at more than Rs29billion, including the investments in schools, colleges, educational consultancies and training institutes. Out of this investment, nearly Rs25 billion is in private schools and colleges, according to the statistics maintained by the Company Registrar’s Office (CRO).

.jpg)

Statistics also reveal that the investment has been increasing since 2006, the year when the government decided to register privately-owned educational institutions as companies. New private investment in schools and colleges stood at more than five billion rupees and six billion rupees in 2010 and 2011, respectively. Similarly, private investors have committed an investment of Rs 2.53 billion in the first three months of 2014.

.jpg) According to Umesh Shrestha, president of the Higher Secondary School Association Nepal (HISSAN), private investment in the education sector has increased because it provides good return. “This is why even big business houses have pitched into the sector lately,” he explains “Leading Nepali industrialists and entrepreneurs have launched huge education projects. There will be more such projects in the future.” Population growth and increasing demand for quality education are the other major factors behind the increase in private investment in education, he adds.

According to Umesh Shrestha, president of the Higher Secondary School Association Nepal (HISSAN), private investment in the education sector has increased because it provides good return. “This is why even big business houses have pitched into the sector lately,” he explains “Leading Nepali industrialists and entrepreneurs have launched huge education projects. There will be more such projects in the future.” Population growth and increasing demand for quality education are the other major factors behind the increase in private investment in education, he adds.

Educational expert Mana Prasad Wagle credits it to the hype of the phasing out of the Proficiency Certificate Level (PCL) in the year 2010 that invited high investment in ‘Plus Two’ colleges. In 2009, five new colleges with an authorized capital of more than Rs 100 million each were established. Since then, on an average, more than half a dozen such colleges have been established every year. In the eyes of education experts, an investment of Rs 100 million should be more than enough to ensure quality education.

The number of private educational institutions with massive investment is also increasing every year in the major cities, especially in Kathmandu. “The number of students leaving the country after SLC for higher studies has drastically decreased now. This is because they find quality education within the country, thanks to a number of good private colleges. This has also prevented millions of rupees from going abroad,” says Shrestha.

It would not be an exaggeration to say that higher secondary (HS) education rests (and grows) on the strong shoulders of the private sector. Let’s consider the following numbers: more than 60 per cent of the nearly a million HS students in the country get their education from private institutions; more than 80 per cent of the students who pass the HS level every year are from private institutions.

There are around 3600 HS schools in Nepal at present. Out of them 291 are 0+2 colleges, which run classes for only the 11th and 12th grades. The remaining are 10+2 colleges, which run classes from grade 1 to 12.

Private sector institutions have not only played a vital role in boosting Nepal’s educational capacity but have also brought along a whole new market dimension. Consider these facts: The annual business transaction of private educational institutions amounts to Rs 22 billion – Rs 11 billion at school level, five billion rupees at HS level and six billion rupees at university level education.

“The private sector has been helping the government by a great deal by making such a huge investment in the education sector,” says Rajendra Baral, Chief Executive Officer at Caspian Valley College.

On the other hand, HISSAN chief Shrestha sees an immense possibility of educational tourism in the country. “Nepal’s naturally air-conditioned climate makes it a good educational destination for international students, if we can establish schools and colleges of international standard or open affiliates of internationally recognized universities here,” he says.

| Government Efforts The government’s efforts in education are mainly focused on primary and secondary level education. The government has been increasing the budget allocated for the education sector year on year. The government has earmarked Rs 80.95 billion to this sector for the current fiscal year - up by Rs 60.13 billion of current fiscal year’s revised allocation. Similarly, Nepal’s education budget increased by more than double in just four years reaching Rs 63.91 billion in fiscal year 2011/12 from Rs 27.06 billion in 2007/08. Nepal allocates 3.4 percent of its GDP and almost 17 percent of the national budget to the education sector. The country, however, does not meet the global standard of allocating at least 5 percent of GDP and 20 percent of the total budget to the education sector. Only 9.92 percent of the total education budget has been allocated for higher education, and merely 7.85 percent for university education. Government investment in higher secondary education is even less—two percent of the total education budget—despite having around one million enrolments a year. Education expert Dr Tirtha Khaniya observes that there is scope for private sector investment and growth in higher study institutions. “The government’s negligence to the higher secondary level education provided an opportunity for the private sector which cashed in on the opportunity. A similar opportunity lies there for the private sector in university level education too. We will gradually see more private sector investment in this category,” he says. |

Banking sector: Time for Consolidation

.jpg)

Starting from the government-owned Nepal Bank in 1937, the banking industry in Nepal has come a long way. The industry grew tremendously, especially after the entry of the private sector after 1990. It is one of the sectors of the economy that have grown significantly over the past one decade. The sector has immense growth prospects as nearly 60 per cent of the population is still out of the range of formal financial channels. Today, the banking sector is more liberalized and modernized, systematic and managed.

There are various types of banks and financial institutions (BFIs) working under the modern banking system in Nepal. It includes central (1), commercial (30), development (87), finance companies (59), co-operatives (15), NGOs (30) and others (3). Technology is changing day by day. And the use of new technologies has affected the traditional method of the service of banks. Banking software, ATM, E-banking, Mobile Banking, Debit Card, Credit Card, Prepaid Card etc., services are available in banking system in Nepal. Nepal’s banking sector has flourished over the years despite numerous challenges and is trying to be at par with international standards.

“Today, there are ample opportunities for the banking sector to explore the small and medium enterprises and rural markets in Nepal via innovative products such as microfinance, mobile banking etc.,” says Anil Shah, CEO of Mega Bank.

“Nepal is an agro-based economy with nearly 84 percent of the population in the rural areas. The BFIs need to develop ingenious products and adopt new technologies to cater to the rural sector. By reaching remote locations, BFIs could contribute towards poverty alleviation as well,” observes Nepal Rastra Bank Spokesperson Bhaskar Mani Gyawali.

The public is gradually turning to the organized financial service providers i.e. the BFIs. At present, only 15.1 percent of the total households in Nepal borrow from local money-lenders, while 10 years ago some 40 per cent households were indebted to money lenders, according to the latest Nepal Living Standard Survey (NLSS) released by the Central Bureau of Statistics (CBS).

Today, nearly 40 per cent households have access to commercial banks’ branch within 30 minutes walking distance. This was merely 22 percent a decade ago. Similarly, the presence of co-operatives within 30 minute walk radius has also increased from 25.9 per cent to 53.9 per cent during the same period.

“Though the growing number of financial intermediaries is not as successful as expected in increasing the financial accessibility, the expansion has definitely helped in general population’s access to finance,” says Gyanwali.

Going through the trends seen over the past few years, the country’s financial sector seems heading for consolidation through mergers and acquisitions. According to experts, the number of banking and financial institutions (BFIs) will reduce by half over the next one decade. Statistics support this fact. Forty-three BFIs have merged with each other to become 18 over the past three years. According to NRB, another 25 BFIs are in the final stage of merger to become 10. NRB sources say that the central bank will continue with its merger campaign in the new Nepali Year.

As a part of this campaign, the NRB is soon going to introduce the Acquisition Bylaws and there are signs that the minimum capital required to run banks could be increased significantly.

Apart from banking, other financial sectors, too, are coming up. Credit rating, portfolio management, mutual funds and central depository system companies have already come into operation. This has opened new opportunities for investment.

Due to stiff competition, banks are trying to provide specialized services such as investing in hydropower, infrastructure and agriculture. The trend is low at present but it has started. Similarly, expansion of branches of BFIs, especially in the urban areas, has reached almost a saturation stage. Now the banks are looking at cheaper ways to increase their outreach; so they are attracted towards branch-less banking, e-banking and mobile banking.

The last one decade has been significant for the banking sector. Many good things happened. As a result, financial access increased by five times over the past one decade, according to statistics maintained by the CBS. Similarly, the statistics maintained by NRB reveal that 40 per cent of Nepalis have access to formal banking channels. These statistics incorporate only the A, B, C and D class BFIs licensed by the NRB. There are nearly 20,000 Savings and Credit Cooperatives operating throughout the country. Similarly, there is a large number of women’s groups, farmers’ groups etc., which also provide banking services. If we consider these institutions, the number of Nepalis having access to financial services will increase significantly. This doesn’t mean that the situation of financial access is great in Nepal; what it means is what has been achieved over the past one decade is more than satisfactory.

“Increasing access to finance is one of the main roles of the central bank so that central bank is also encouraging the BFIs to venture into unbanked areas through its policy measures,” informs Gyawali.

The achievement made by the banking sector over the past one decade can be broadly categorized into three parts: growth in financial access, expansion of loans and development of corporate culture. The rate of financial access increase is high for this period. Similarly, new areas for investment have been discovered. Today, banks have started investing in specialized long-term projects such as hydropower. Likewise, there has been development of corporate culture in the banking sector over this period. This has made the banking sector more transparent, credible and professional.

| Weaker Side: - All kinds of BFIs are allowed to mobilize deposits - Lack of adequate financial literacy - Increasing operational risks of BFIs - Failure to identify new areas for investment - Inadequate supervision capacity of NRB |

Hotels: More Room for Growth

.jpg)

Nepali hotel industry is rapidly heading towards booming growth. After sluggishness for about a decade, during the conflict years, the country's hospitality sector is now looking more and more lucrative with hoteliers- both domestic and foreign- investing into multi-billion projects. Surge in visitor numbers with Nepal becoming a prime destination for international, regional and domestic tourists is leaving the country's hotels sector without much room. Recent tourism rankings published by reputed institutions points out that the country is gaining significant attention from travelers and visitors across the globe.

Industry leaders estimate the size of Nepali hotel sector- ranging from five star hotels to lodges- has reached about Rs 300 billion. "It is one of the fastest growing sector which is providing considerable number of employment," says Madhav Om Shrestha, executive director of Hotel Association of Nepal (HAN). According to him, the sector is providing direct employment to over 3, 00,000 people and indirectly benefitting around one million. "With big international hotel chains entering Nepal, the industry is treading on to track to healthy revival."

Nepal, which has witnessed the departure of some big hotel chains in the past, is again set to become a rewarding market for renowned international hoteliers. Last year saw the US-based multinational hotel chains Marriott and Sheraton announce their entry into the Nepali market. In May 2013, Nepal Hospitality Group (NHG), a company under Nepal's leading conglomerate Maliram Shivakumar (MS) Group, signed an agreement with Marriott International to open a four-star hotel with an investment of around Rs 650 million. Dubbed as "Fairfield by Marriott Kathmandu", the 10-storey business hotel with 108 rooms is under-construction at Thamel, a prime tourist and commercial location in Kathmandu.

The hotel targeted towards mid-income guests will start its commercial service by the beginning of 2016. Fairfield is a brand of hotels franchised by Marriott International. NHG is also constructing a 250-room, four-star luxury hotel in Naxal, as a joint venture with the Marriot International.

In this foray, Sheraton Hotels and Resorts announced its re-entry into Nepal. Shesh Ghale, the Nepal born Australian millionaire businessman, has come up with a joint venture with Sheraton to operate a five-star hotel in Kathmandu. In April 2013, Ghale's investment company, MIT Group Holding Nepal set the project rolling by signing an agreement with Sheraton's owner Starwood Hotels and Resort Worldwide Inc.

Slated to open in February 2018, the cost of 225-room Sheraton Kathmandu project is expected to be around Rs 7 billion. Sheraton, the largest brand of Starwood Hotels and Resorts Worldwide has history of managing five-star hotel in Nepal. The chain in 1980s' and 90s' managed the Hotel Everest Sheraton in Kathmandu.

Meanwhile, Indian hotel chain Lord Hotels and Resorts has already started its operation in Nepal. The company opened its first international hotel in Kathmandu, the Mirage Lords Inn at Battisputali with an investment of Rs 200 million. The 40-room budget hotel is targeted to serve domestic and international guests ranging from religious visitors to adventure seekers.

Investment Hotspot

The hotel investment frenzy has also wrapped Nepali business community. Many have announced to open new hotels while some have already opened doors to welcome guests into their newly built auberge. The Hotel Shambala, a 65-room, four-star Tibetan- styled boutique hotel, located at Bansbari started its operations few months ago. Similarly, construction of the Chhaya Center at Thamel is in full swing. The structure upon its completion will accommodate a 200-room four-star hotel along with an exclusive shopping mall. Likewise, The Centurion Group has been constructing a 120-room hotel in Biratnagar.

Meanwhile, Muktishree Group, Vaidya's Organization, Non-Resident Nepalese Association (NRNA) and Civil Aviation Authority of Nepal (CAAN) have made their announcements to establish five-star hotels. In the meantime, other major tourist destinations such as Pokhara, Lumbini, Biratnagarand Nepalgunj are also experiencing rising investments in the sector.

This sector is becoming a center of attraction for Nepali banks and financial institutions (BFIs) as well. According to recent Nepal Rastra Bank (NRB) data, total investment of BFIs in the sector reached an estimated amount of Rs 21 billion by the end of April. The central bank also notes that in the first nine months of current fiscal year (FY), the sector welcomed an investment of Rs 3.16 billion, up by 20.8 percent from last FY's 2.30 billion.

| Time to be Cautious Despite the significantly increasing activities in the hotel sector there are also cautionary calls arising within the industry itself. "The overall trend in investment and the growth in infrastructure is satisfactory, but marketing of Nepal in international arena is lacking," opines Binayak Shah, vice president of Summit Group of Hotels. Shah, who is also the Managing Director of Airport Hotel, said that as the sector will have more than enough infrastructures amid the rise in number of international hotel chains coming to Nepal and growing domestic investments. "In addition, unsold apartments are also being converted in to hotels. If we cannot market our resources innovatively, in a few years time, we will have more supply than demand," he says. "This has to be balanced." |

ICT: Explosive Growth

.JPG)

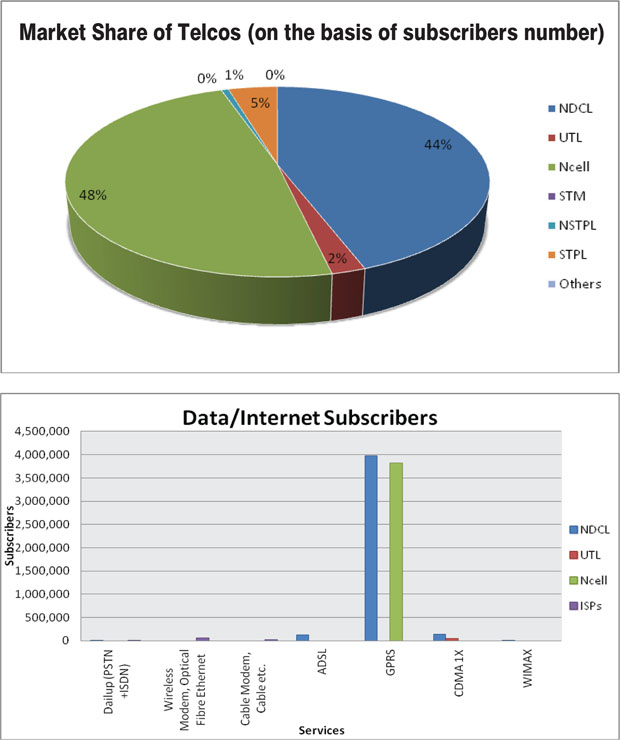

The Information, Communication and Technology (ICT) sector has grown in a geometric proportion over the last few years bringing speedy transformation. The explosive growth and rapid infrastructure developments led the sector, nascent only some years ago, to around Rs 50 billion worth strong sector in a year.

Nepal has been enjoying remarkable growth in ICT sector due to expanding telecom sector, increasing use of email/internet, emerging social media and steady growth in the use of state-of-art gadgets.

The pace of mobile phone adoption in the country was surprising in the last couple of years as nearly two third households have access to telephone facility. The overall teledensity has increased to 87.20 per cent by mid-March, according to the telecom regulator Nepal Telecommunications Authority.

It is likely that the transaction of overall ICT products will double in the next few years. Internet penetration rate increased to around 30.99 per cent till mid- March, and the rise of Internet users will have a direct impact on the trade of computers, claims Computer Association of Nepal (CAN).

High competition among world class brands including HP, Samsung, Dell, Asus, Compaq, MAC, Sony, Lenovo and Acer have not only contributed to lower the price, due to hard competition, but also have provided quality products to Nepali customers.

Along with hardware parts, the software market is also experiencing a steady growth in the country. Experts and professionals involved in this business are taking this growth as a positive aspect of developing awareness related to information technology.

The overall trade of software has increased in the domestic market though there is not actual data available from concerned authority. Amrit Kumar Pant, General Secretary of CAN, said, the market and activities related to this business have been increasing as the people have been using software and application as necessity while it was used in the form of luxury till some years ago.

ICT has provided enormous opportunities from various aspects, according to the regulator Nepal Telecommunications Authority (NTA). Nepal’s telecom sector has created employment opportunities for at least 50,000 people and contributed more than Rs 20 billion as revenues every year to the national coffer.

Even the government has come up with some ambitious plan including that of connecting east and west via Optical Fibre network. For the purpose, the government has planned to utilise the Rural Telecom Development Fund (RTDF), the fund collected by Nepal Telecommunications Authority from telcos.

However, the sector is not without problem. According to telcos, there are many problems in the policy front. The telecom sector has been witnessing government’s dillydally in bringing relevant laws and policies.

Similarly, there are still room to improve in terms of quality. On the one hand, telcos and internet service providers need to ensure quality of service. On the other, Nepal should not become trading hub for low quality ICT goods. In such situation, the government need to bring policies ensuring consumers’ rights.

ICT is still an untapped market in Nepal, an expert told New Business Age. “All concerned stakeholders need to put sincere effort to take this sector to the next level.”

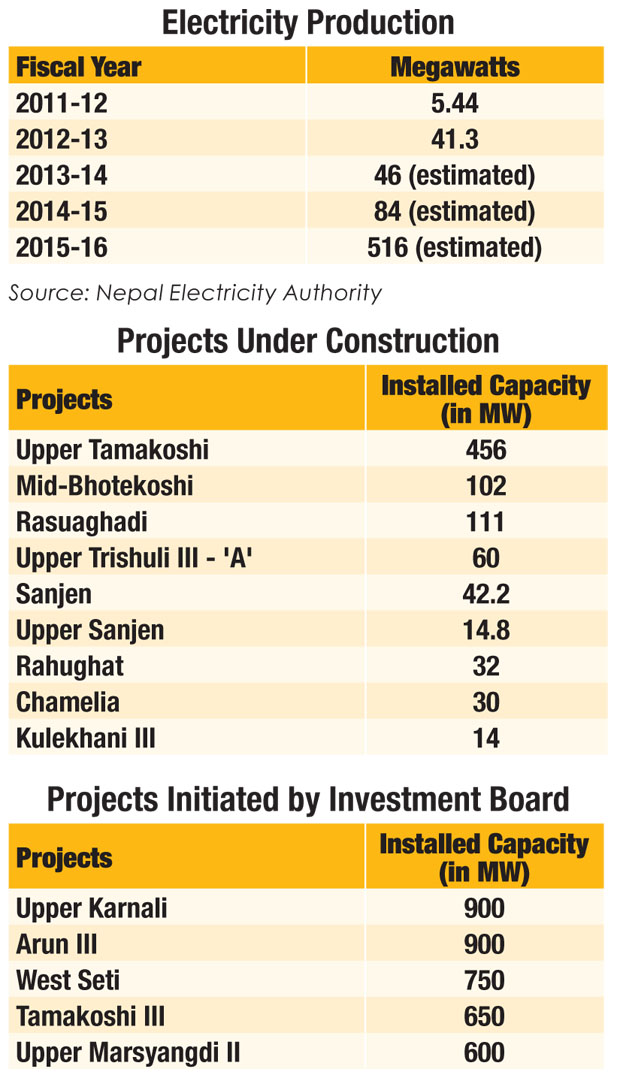

Hydropower: From Deficit to Export Considerations

Forced to live under electricity cut averaging 10 hours a day during dry seasons, Nepal is gradually developing its hydropower projects to escape the long-standing power crisis. Things have changed positively in the recent years as the dust of political uncertainty is finally showing signs of settling down. 87 hydel projects totalling 2,345 megawatts are under construction. Both the government and private sector have ramped up their investments in these projects. The projects, upon completion, are expected to add electricity into the national power grid within the next seven years. Similarly, the Investment Board Nepal (IBN) has also taken initiatives to construct five mega-hydel projects of 3,750 MWs. IBN, which was formed four years ago to fast-track mega projects, is said to be involved with promoters for power development agreement (PDA). The promoters have assured to start the construction of projects immediately after the finalization of PDAs.

This indicates the increasing involvement of private sector in the country's hydropower development. Nepali private sector has thus far managed to produce 232 MWs electricity after the electricity act of 1992 came into effect. According to Independent Power Producers Association, Nepal (IPPAN), the private sector has invested Rs 55 billion in 25 hydro projects till date since the establishment of the first private power plant in 2000.

Increasingly positive tones of bilateral donors have also raised hopes in this sector. The World Bank and Asian Development Bank (ADB) are planning to raise their stakes in Nepal's hydropower development. The World Bank (WB),which has already provided development related financial assistance worth Rs 200 billion to Nepal is further adding investments in hydropower projects. The International Finance Corporation (IFC) of the World Bank Group has recently agreed to provide USD 84.6 million for the 37 MW Kabeli-'A' project. The electricity output from the run-of-river project situated in Panchthar district will be then connected to the national grid through the 132 KVA Kabeli Corridor Transmission line. The transmission line, which is jointly financed by the WB and Nepal Electricity Authority (NEA) is in the construction phase. Likewise, IFC has also expressed readiness in Arun III (900 MW), Upper Marsyangdi (600 MW), Upper Karnali (900 MW) and Upper Trishuli (213 MW). During his visit to a WB program in US and Mexico in April, Finance Minister Ram Sharan Mahat received commitment from the IFC for investing for Rs 600 billion in developing hydropower projects of 3,000 MWs. Similarly, ADB is also stepping up to invest in the country's big hydel projects. Last year the bank agreed to provide soft loan of Rs 13 billion for 140 MW Tanahu Hydropower Project. Likewise, the European Investment Bank (EIB) which also agreed to loan Rs 1.5 billion for the above mentioned project has also committed to provide Rs 12 billion to build the Kaligandaki and Marsyangdi Transmission line along with another Rs 3 billion to build the Trishuli Corridor Transmission Line.

The sector is also grabbing significant attention from foreign investors. Official data shows that hydropower sector has attracted highest FDI commitments in the recent months. According to data published by Department of Industry (DoI), foreign investors pledged Rs 11.8 billion worth FDI commitments in the first nine months of the current fiscal year against Rs 2.65 billion during the same period, last year.

Rising Export Potential

Few years back it was almost unimaginable for power crisis marred Nepal to even think of supplying electricity to neighbouring countries. The scenario, however, is looking more and more real for Nepal to make its way forward to become a net power exporter. Nepal after producing 2,345 MW by 2018-19, will have surplus energy after consuming its annual demand of estimated 1,700 MW by that time. In this circumstance, India will be the most likely market of Nepali electricity as the energy hungry southern neighbour is increasingly looking to import power from its himalayan proximate.

Few years back it was almost unimaginable for power crisis marred Nepal to even think of supplying electricity to neighbouring countries. The scenario, however, is looking more and more real for Nepal to make its way forward to become a net power exporter. Nepal after producing 2,345 MW by 2018-19, will have surplus energy after consuming its annual demand of estimated 1,700 MW by that time. In this circumstance, India will be the most likely market of Nepali electricity as the energy hungry southern neighbour is increasingly looking to import power from its himalayan proximate. The construction and installation of countrywide and cross-border high capacity transmission lines indicates the rising power trade potential between India and Nepal. The tower installations in Nepal section of 400 KVA Dhalkebar-Muzzafarpur Cross-Border Transmission line has started earlier this year. The construction of the project, which started in January is scheduled to be completed within 16 months of its commencement. Similarly, feasibility study of 400 KVA Bardaghat-Gorakhpur Transmission Line has also begun. The high capacity cross-border transmission lines would facilitate power transmission between the two countries. A secretary-level agreement between Nepal and India has already paved way to build the framework for power trading.

Private power producers say that both countries should look into effective modalities of power trading. "Energy banking agreement model is the best option," says Er Gyanendra Lal Pradhan, Chairman of FNCCI's Energy Committee. According to Pradhan, if the model is adopted, Nepal can send surplus power to India in rainy season and bring back the same amount of electricity in dry seasons. He said that countries across the world are adopting this model owing to its flexibility and practical approach. "The model is being effectively practiced by New York Electricity Exchange of United States and Hydro Quebec of Canada, they do banking up to 90 per cent of electricity they trade and remaining 10 per cent is priced." Pradhan stressed the need for building strong network of nationwide transmission lines as it would further help if Nepal and India engage in energy banking.

However, absence of clear policies and other problems such as inefficient bureaucracy, rampant corruption, lack of nationwide transmission grid, issues related to infrastructure and land compensation are regarded as the bottlenecks in Nepal's hydropower development efforts. For instance, the draft of electricity bill, 2065 introduced in the parliament has seen little or no progress over the past five years. Similarly, issues related to power purchase agreement (PPA), higher bank lending rates in hydropower projects, value added tax (VAT) levied to private producers and low allocation of national budget are also seen as problems hindering the sector's overall development.