.jpg) |

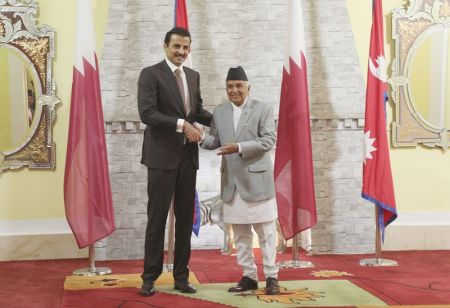

| Dr Posh Raj Pandey Executive Chairman, Sawtee |

There are different views whether or not Nepal should open outward FDI. What’s yours?

I do not oppose the idea of opening up the outward FDI. The country should allow investors to go abroad. If some businessmen have expertise in noodles industry and its market has been saturated in the country, they should be allowed to go abroad and to make profit in the global market. The country cannot impose them to invest in hydro sector where they might not have expertise.

It seems the government is not ready to accept this?

It is not fair to create barrier to businessmen who are eying global market. It is the duty of the government to facilitate the process if corporate houses want to go global in a convincing manner. I do not favour blanket policy, which will allow all investors to take capital out of the country. They shuold be made to fulfill same conditions. But the government should not restrict genuine businessmen who have possibilities in global market.

What may be such major conditions in your opinion?

There might be some pragmatic conditions that will be helpful to stop outward FDI with bad intention. Some of major conditions may be:

1. Approval to corporate firms not individual: The government should allow only corporate houses not individuals to invest abroad. Corporate houses, which are doing good business in the home country, may be more responsible. This will help ensure genuine outward FDI

2. Proven track record: Before approving for outward FDI, the government should make a provision of inspecting track record of the concerned corporate house. The government should assess at least 3—5 years performance of any corporate house applying for outward FDI.

3. Clause of repatriation: The government should make mandatory provision of repatriation of certain percent of profit which will help of capital inflow into the country’s economy.

Some experts oppose the idea of opening up outward FDI given the macroeconomic scenario. How do you see this?

I do not think existing macroeconomic scenario is bad. We can bring policy allowing corporate houses to invest abroad in such situation.

One common understanding is that businessmen want to go outside the country because the country lacks investment climate. Will it be wise decision to allow investors go abroad without improving our own investment climate?

Laxity of the government has increased due to remittance inflow. The government is not willing to take any risk at this time due to remittance money. This is not good condition for the long term economic situation. The government is literally idle in terms of bringing any policy to foster an environment favourable for investment.

I think, the provision of allowing outward FDI may compel the government to be more serious to foster investment climate. The government neither builds investment climate nor allows investors to invest abroad. This is not good situation. I think, the policy of outward FDI will have positive impact in the economy as it forces the government to take action to create investment-friendly climate.

What are the outward FDI practices that other developing nations follow?

I don’t see any point to see outward FDI in negative light. All countries need not open capital account convertibility and outward FDI provision without putting any condition. All governments put some conditions even in inward FDI. Similarly, developing countries can put some conditions in outward FDI.

What may be the beginning point in the policy front?

The government should initiate to amend the existing Act Restricting Investment Abroad, 1964 or introduce a new one. It is duty of lawmakers to bring new policy and they need to be serious while formulating or amending laws. Broader consultation is a must to formulate a new policy.