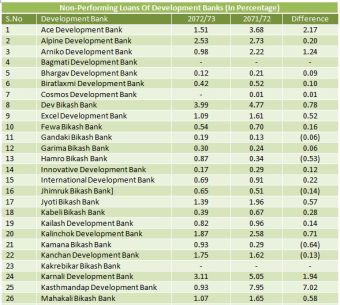

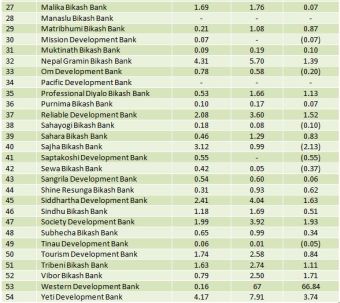

August 28: Non-performing loans of development Banks are apparently decreasing in recent times. It is indicated by the annual financial reports of 54 operating development banks in the last FY. During the last FY, non-performing loans of development banks have decreased by 1.82 percent average. According to the unaudited fourth quarter financial reports of 54 development banks, non-performing loans have limited to 1.05 percent average. Experts opined that reduction in non-performing loans can be attributed to Nepal Rastra Bank’s tighten loan management policy and improved performance of the banks.

NRB (the Central Bank of Nepal), as a regulatory financial institution of the country, has classified the loan basically into the pass loan, sub-standard loan, doubtful loan and loss or bad loan. Pass loan is that type of loan whose interest or principal payments are less than three months in arrears. Sub-standard loans whose interest or principal payments are longer than three months in arrears of lending conditions are eased. Doubtful is liquidation of outstanding debts appearing uncertain and the accounts suggest that there will be a loss, the exact amount of which cannot be determined. Loss loans are regarded as not collectable, usually loans to firms which applied for legal resolution and protection under bankruptcy laws. Pass loans are under the category of performing loans whereas sub-standard loan, doubtful loan and loss loan are under the non-performing loans.

Increase in non-performing loans is considered risky in banking sector. Therefore, NRB has directed banks and financial institutions (BFIs) to maintain such loans below 5 percent of total loans. After the NRB directive, Western Development Bank has succeeded to reduce its non-performing loans by 66.84 percent. The bank had 67 percent non-performing loans in the previous FY which has decreased to 0.16 percent during the last FY. Similarly, non-performing loans of Ace Development Bank has decreased to 1.51 percent in the last FY from 3.68 percent in the previous FY. Meanwhile, Sajha Bikash Bank has highest non-performing loans of 2.13 percent. The bank had 0.19 percent non-performing loans in the previous FY that has increased to 3.12 percent in the last FY.

At the same time, 5 development banks have zero non-performing loans. The banks having zero non-performing loans are Bagmati, Cosmos, Kakrebihar, Manaslu and Pacific Development Bank. Similarly, 30 development banks have below 1 percent non-performing loans.