--BY SANJEEV SHARMA

Of late, both the public and private sectors seem to have realised the importance of infrastructure growth and investment. While the Confederation of Nepalese Industries (CNI), a major umbrella organisation of the Nepali private sector organised a mega event titled Nepal Infrastructure Summit (NIS) 2017 on February 19, the Ministry of Industry, Investment Board Nepal (IBN) and National Planning Commission (NPC) jointly held the Nepal Investment Summit 2017 on March 2. Both events, which were organised in the space of 12 days, saw the participation of a large number of delegates including prospective foreign investors, the Nepali business community, high profile foreign government representatives, top officials of bilateral and multilateral agencies and domestic and foreign experts from across the world.

Nepal Opens Up for Business

Marred by the prolonged political turmoil, Nepal saw its business environment degrade, especially after 2000. Industrial and agricultural activities in the country sharply declined and Nepalis began to flock abroad in large numbers in search of jobs. Meanwhile, the development of infrastructures slowed drastically as uncertainty and unpredictability ruled the country leaving the Himalayan nation unable to tap its economic potential. However, the last few years have seen notable signs of improvement in terms of easing the difficulties that businesses here to undergo with an observable stability in policy on the horizon. This has exhilarated the private sector as the country’s political leadership seems to be increasingly committed towards the agenda of economic development despite the ongoing political instability dragging on.

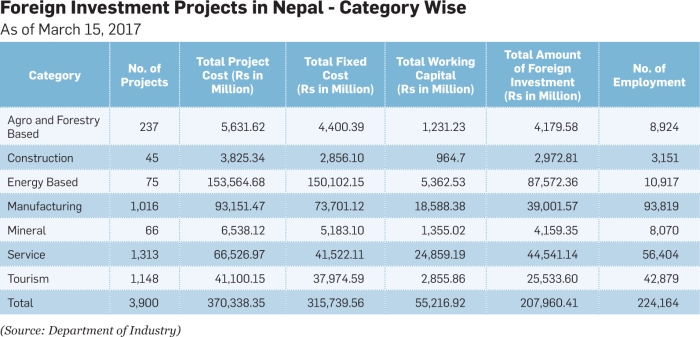

Conveying a message that ‘Nepal is open for business’, the Nepal Investment Summit 2017 garnered foreign investment intents totaling USD 13.52 billion across various nations, the highest foreign investment pledge Nepal has received till date. The size of the investment intents has sharply grown in the days following the summit as IBN has received additional LoIs across various sectors totaling USD 22 billion till date, according to IBN CEO Maha Prasad Adhikari. The LOIs submitted by the interested Chinese investors largely outpaced the intents made by investments from other countries. Investors from China pledged USD 8.2 billion in investments, a staggering 61 percent of the total LOIs signed during the two-day event. Bangladesh came second in the list with the investment intents amounting to USD 2.4 followed by Japan and the United Kingdom with both nations pledging USD one billion each. Similarly, investors from Sri Lanka and India pledged intents of USD 500 million and USD 317 respectively. Meanwhile, Nepali investors also signed LOIs totaling USD 11.5 million. (See Dataspeak at page 36 for the list of companies, amount of investment intents and sector of interests)

Infrastructure Development for Overall Economic Growth

NIS 2017 organised with the theme “Private Sector as an Indispensable Partner” also drew significant attention with participants stressing on the need for infrastructure development to harness the economic potential available in Nepal. “It has become rather a necessity than a choice for us today,” said Vishnu Kumar Agrawal, Vice-president of CNI while addressing the summit. He added that Nepal has to invest Rs 10 trillion and attain an economic growth of six to seven percent annually, out of which two-thirds is expected to come from the private sector, to graduate to a developing country status from least developed by 2022. “This shows the need for high and sustainable investments especially in the sector of infrastructure,” he mentioned.

Lack of adequate infrastructures has always been a major bottleneck for Nepal to achieve higher levels of economic growth. The sluggishness in the government’s capital expenditure mobilisation is attributed to the serious problems related to physical infrastructures in energy, connectivity and water supply, among others. It is estimated that Nepal needs to spend over 10 percent of its GDP in infrastructure development annually which hovers around four to five percent at present. Wencai Zhang, Vice-President of the Asian Development Bank who was among the dignitaries of NIS 2017 cited weak infrastructure as one of the most critical binding constraints for Nepal, and that the country needs to annually invest 8–12 percent of GDP to resolve the bottleneck within a decade. He drew out nine “key enablers” such as clear vision of the government, establishment of a project bank, timely approval and release of the budget, timely selection of contractors with sufficient competition and discipline and more stringent compliances with contractual provisions for efficient implementation regarding infrastructure development.

The lack of proper infrastructure in Nepal has led its two large neighbours to compete in the development of the strategically positioned Himalayan nation. China is already keen to invest in various areas including large hydropower projects along with railway systems. India has also joined the race in this regard. Nepal’s southern neighbour has been expressing its interests to develop large projects in hydroelectricity, highways, and the latest in railway connectivity. NIS 2017 was marked by the announcement from the Indian railways minister Suresh Prabhu that India is willing to develop two railway lines connecting Kathmandu to the Indian capital New Delhi and the port city of Kolkata.

Attracting FDI: The Bottlenecks

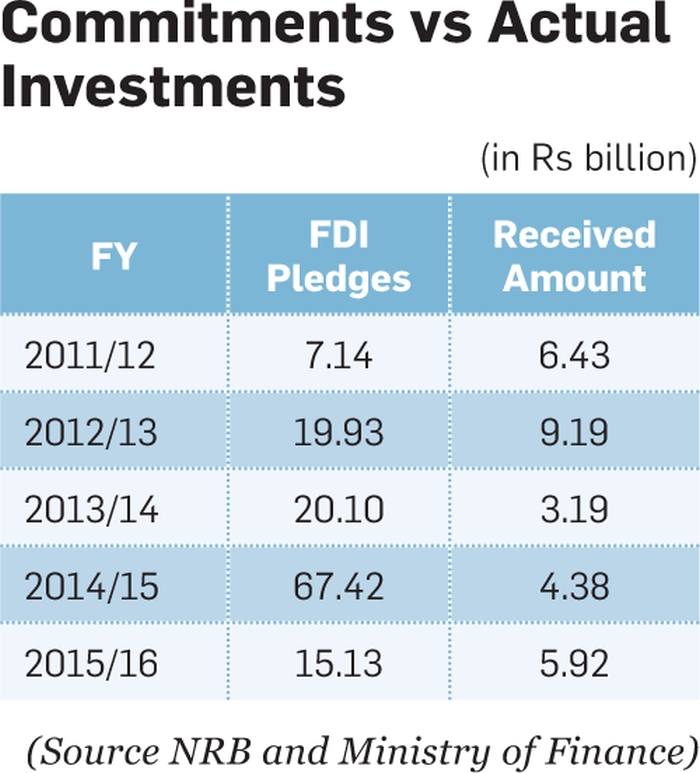

Much has been talked about over the years in terms of making Nepal a favoured destination for foreign direct investments(FDIs). Nonetheless, these talks have so far failed to materialise into anything due to the lack of a positive business environment. Official statistics show that FDI has been averaging less than 10 percent of the pledges initially made annually over the last five FYs.

While foreign investors are drawn towards the lucrative opportunities available in Nepal, the huge difference in FDI commitments and actual investments is simply because of the lack of a conducive investment climate in the country. Experts say that the FDI intents and commitments will be realised if Nepal can work towards bringing higher levels of predictability in policy and political levels and ensuring investors of a sound business climate so that they can invest here easily. “We have openly announced that we are now an investment friendly country catching the attention of many foreign investors. The ball is in our court right now. So it is up to us to see how we can grab this opportunity to quickly clear the existing bottlenecks by improving our policies,” opines Maha Prasad Adhikari, CEO of IBN. Stressing on the need to facilitate the investors at optimal levels, he says that it is necessary to create an environment where investors are provided with all facilities they seek through a single place. “Negative messages about us will be spread among 10 investors if an investor faces hardship while trying to establish a business here. We should not be miserly while providing facilities and services to the investors,” Adhikari adds.“Meanwhile, equally important is our ability to track potential investors who are willing to invest,” he points out.

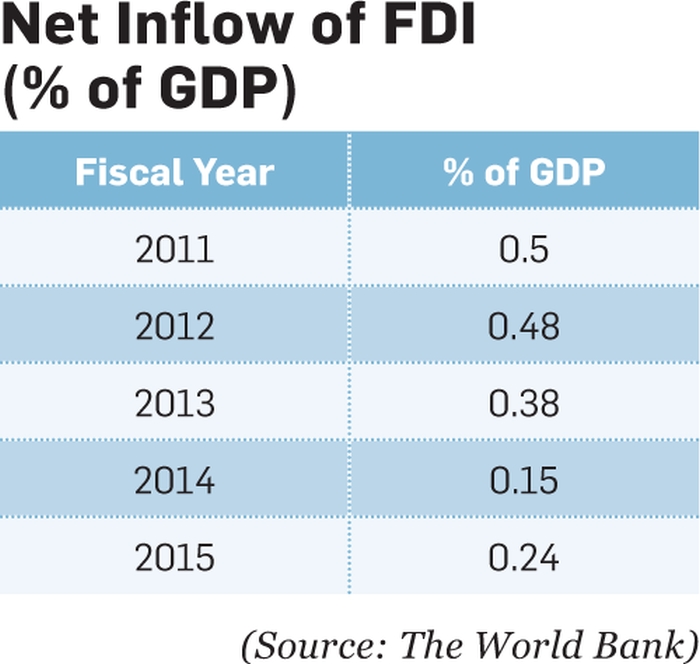

FDI is considered a major contributing source of the capital for underdeveloped, developing and emerging nations. It is regarded as being valuable for the recipient countries not only in terms of inflow of money but also in terms of receiving technological knowhow, exchange of knowledge, and in many other management aspects of business and human resources. The money from foreign investors composes an important part of a country’s GDP. India, for instance, registered 2.1 percent of net inflow of FDI to its GDP in 2015 which was 1.6 percent in 2014. Similarly, Bangladesh logged it at 1.73 percent in 2015 and 1.47 percent in 2014. Meanwhile, FDI composes a meagre part of the GDP of Nepal.

NIS 2017 and Nepal Investment Summit 2017 both highlighted the existing bottlenecks in terms of attracting FDIs. Participants mentioned that foreign investors often complain that they are surrounded by obstacles right after they establish their business in Nepal. From the burdensome process of company registration to problematic land acquisition arrangements and annoying taxation systems, investors often find themselves in a messy situation. Likewise, the existing provisions related to arbitrations to settle business disputes also stop many potential multinational companies from coming here as many MNCs view the provisions as incompatible with their legal risk management and compliance policies. Likewise, there are several difficulties for foreign investors regarding the repatriation of their investments and remit of dividends as the processes are quite lengthy and are often full of discrepancies.

It is particularly troubling for those investing in US dollars. As investors are required to convert the money for investments which they bring as US dollars into Nepali Rupees before investing, the convertibility of the foreign currency leads to various problems due to issues such as the fluctuation in exchange rates.

Similarly, things such as electricity and water are a scarce commodity. The time consuming processes of getting these essentials are often marred by bureaucratic hassles and corruption.

Policy Reforms for a Better Investment Climate

After years of dillydallying, the government has sped up its policy and administrative reform initiatives in order to remove the bottlenecks in investing in Nepal in the second generation economic reform programme. The endorsements of the amended Companies Act, Industrial Enterprises Act by the Parliament and enactment of Special Economic Zone Act, for instance, are seen as important steps to this end. Similarly, the approach of the Ministry of Industry to amend the Foreign Investment and Technology Transfer Act is being regarded as another positive step to bring in foreign investments in the country. The second generation economic reform programme also includes the introduction of the National Intellectual Property Policy and National Mineral Policy that have already been approved by the council of ministers.

Likewise, the government has also been working to establish one-stop centre to facilitate investors in the administrative reform drive. The center will provide all types of services to the businesses under a single roof.