By NewBiz Team

The changes in tax rates will have impacts on several sectors and industries, including agriculture, transportation, travel and tourism, and the share market. These alterations may also result in price variations across different goods and services, as well as artificial shortages in the market. The government, however, has defended all new taxes and tax revisions.

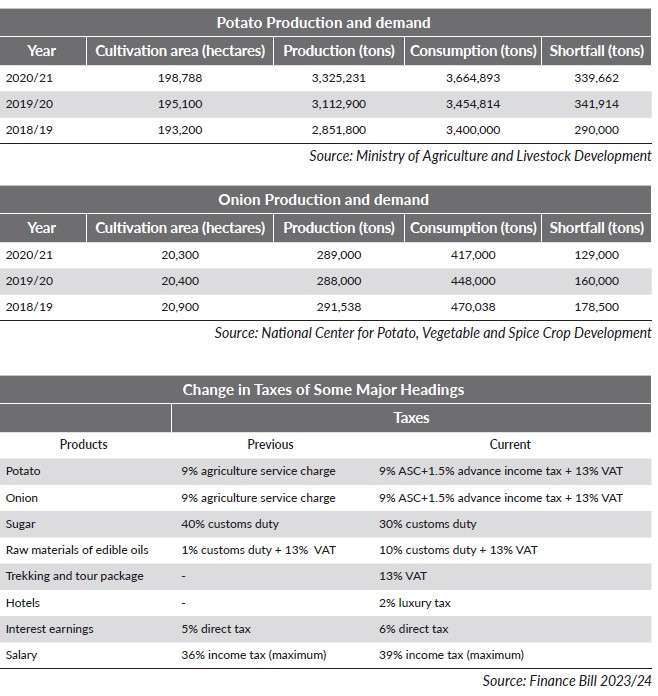

The government has implemented new taxes, fees, and charges, as well as modified the existing ones, through the Finance Bill, 2023. These amendments have significant implications for the daily lives of the general public. Economists and market analysts have identified a number of tax anomalies in the budget for 2023/24. Specifically, the adjustments to various tax rates in the latest national budget are likely to directly impact the public's routine shopping, income, and expenditure. Moreover, the changes in tax rates will have impacts on several sectors and industries, including agriculture, transportation, travel and tourism, and the share market. These alterations may also result in price variations across different goods and services, as well as artificial shortages in the market. As expected, the government has defended all new taxes and tax revisions. “The government has revised tax rates in a scientific manner, increased the tax bases and rationalised them in a meaningful way,” said Minister for Finance Dr Prakash Sharan Mahat, while responding to queries of the lawmakers in the House of Representatives on June 12, some two weeks after he presented the budget for the new fiscal year which begins in mid-July. Mahat, however, said the government could revise tax structure under different subheads once their actual details are received. Taxing Potatoes and Onions In the budget for the upcoming fiscal year, the government has introduced a notable measure that will significantly affect the importation of various kitchen commodities, particularly two staple items: potatoes and onions. These commodities will now be subjected to a 13% Value Added Tax (VAT) on imports. Government authorities argue that the VAT has been imposed on several kitchen items to encourage domestic production. However, this policy change has inadvertently presented an opportunity for unscrupulous traders to exploit the situation, leading to an artificial scarcity in the local market. While Minister Mahat has assured that the imposition of VAT would not result in an increase in the prices of agricultural products, the reality tells a different story. The actual market prices have indeed experienced a significant surge. Immediately after the budget announcement, consumers had to pay as high as Rs 120 per kg for onions, whereas prior to the budget, it was available for Rs 40 per kg. While the finance minister's strategic move may have been intended to protect local goods, it has inadvertently caused an unprecedented increase in market prices for vegetables and fruits. VAT has also been imposed on importation of fruits such as apples, avocados, kiwis, yellow Himalayan raspberries, cherries, coconuts, blackberries, strawberries, and persimmons. Furthermore, imported bananas, corn, spinach, beans, coffee, and raisins have also been subjected to this tax. This is certain to impact their affordability and lead to an escalation in consumer costs. Consumer rights groups have responded appropriately to these escalating prices by making a strong call for removal of VAT. Data released by the National Center for Potato, Vegetable, and Spice Crops Development shows that Nepal has the potential to achieve self-sufficiency in potato production by increasing its output by 342,000 tonnes per year. Currently, Nepal produces 3,325,231 tonnes of potatoes annually across 198,700 hectares of land, while the market demand stands at 3,667,256 tonnes. Based on these figures, the shortfall of 342,000 tonnes needs to be met through imports from countries such as India. According to Basu Dev Kafle, the head of the centre, the current potato productivity stands at 16.05 tonnes per hectare. In order to attain self-sufficiency, Nepal needs to expand the cultivation area by 20,400 hectares and increase the productivity to 18.44 tonnes per hectare. Analysis of available statistics reveals that 18% of the country's potato production occurs in the highlands, 42% in the mid-hills, and 40% in the Terai region. But the government has implemented no significant program to increase either productivity or production. Similarly, according to market data, Nepal consumes over Rs 25 billion worth of onions, totaling 417,000 tonnes, annually. However, the centre reports that Nepal produced only 289,000 tonnes of onions in the fiscal year 2020/21, leaving a shortfall of 129,000 metric tonnes that had to be imported to meet demand. Additionally, Nepal exported 11.5 tonnes of onions in the same year. The short supply in onions is met through imports from countries like India. In the fiscal year 2019/20, Nepal produced 288,000 tonnes of onions, while 160,000 tonnes were imported to satisfy domestic demand. The data related to onion imports highlights the government's lack of emphasis on increasing domestic production of this crucial ingredient in Nepali cuisine. Although Nepal has the potential to cultivate onions abundantly, recent trends indicate a decline in onion cultivation area. However, the per hectare yield is increasing. In 2018/19, onion cultivation covered an area of 20,900 hectares. However, in subsequent years, the cultivation area gradually decreased. Onion was cultivated on only 20,400 hectares in 2019/20 and 20,300 hectares in 2020/21. Officials at the centre acknowledge the absence of significant programs to promote onion production. They highlight that while Nepal has promising prospects for onion cultivation, the lack of high-quality seeds poses a challenge. The current seeds used in Nepal are of subpar quality, and even imported seeds from India are not readily available. Previous government initiatives to enhance onion production, such as the four-year potato and “mission onion” programme starting in 2019/20, remained limited to paperwork. The government allocated Rs 50 million for a programme aimed at increasing onion production between 2007 and 2012 in selected regions. However, this initiative faced challenges due to irregularities in the purchase and distribution of production materials. A spokesperson for the Ministry of Agriculture and Livestock Development admitted that the central government has not implemented any programme to boost onion production. He explained that past failures have deterred the introduction of new initiatives. Due to the sensitive and complex nature of onion seed production, seeds need to be imported from India. However, India does not provide the required quantity of seeds, leading to a scarcity that hampers efforts to increase domestic production. There is a clear correlation between the implementation of VAT and the noticeable increase in prices. There is no evidence to suggest that the domestic production of staple vegetables has increased recently or is expected to increase in the foreseeable future, nor are there any concrete plans in place to address this issue. Consequently, the VAT imposed on the import of staple vegetables can be considered regressive, as it places a heavier burden on lower-income individuals compared to those with higher incomes. Lowered Customs Duty on Sugar Explained The government has made alterations to the customs tax on another important ingredient in Nepali cuisine - sugar. As per the recently introduced Finance Bill, the customs duty on sugar has been reduced by 10 percentage points to 30%. This adjustment is anticipated to result in a slight decrease in the prices of imported sugar, primarily sourced from India, thereby benefiting consumers. However, the decision is expected to have a discouraging impact on domestic sugar producers. Government officials emphasise that the reduction in tax is also intended at discouraging illicit imports or smuggling of sugar from India. However, businesspeople and industrialists reject this claim outright. “I can tell you that the illegal smuggling of sugar from India is not going to decrease by even one kilogram because of this decision,” said Shiv Ratan Sharda, chairman of Sharda Group, an industrial and business conglomerate of the country which also runs sugar mills. Available data shows domestic sugar production has experienced a decline over the past few years, primarily due to a decrease in the production of sugarcane - a crucial raw material for sugar and a significant cash crop for Nepali farmers. The government statistics reveal that sugarcane production has declined by over 305,000 tonnes in the last three years. Experts and stakeholders point to factors such as escalating production costs, an uncertain market, limited competitiveness, and challenges associated with obtaining credit for selling sugarcane behind decline in sugarcane production. Recent data released by the Ministry of Agriculture and Livestock Development reveals concerning trends in sugarcane cultivation in Nepal. In the fiscal year 2018/19, sugarcane was cultivated across an expansive 71,625 hectares of land, resulting in a substantial yield of 3,557,934 tonnes. However, by 2020/21, the cultivation area shrunk by 7,271 hectares to a total of 64,354 hectares. Consequently, the production of sugarcane plummeted by 373,991 tonnes to a total of 3,183,943 tonnes. Sugarcane productivity also decreased to 49.47 tonnes per hectare compared to 49.6 tonnes per hectare in 2018/19. The lack of substantial government initiatives aimed at boosting sugarcane production in the country, coupled with an increasing number of sugarcane farmers abandoning the crop, presents a bleak outlook for domestic sugarcane production. These cumulative factors have caused a notable decline in sugar production, demanding immediate attention from relevant stakeholders and policymakers alike. The plight of sugarcane farmers in Nepal has gained significant attention in recent years, leading to protests organised by the Sugarcane Farmers Struggle Committee. While the sugar industries and government have faced accusations, there is another important factor often overlooked in the discussion. According to Samriddhi Foundation, a think tank promoting civil, political and economic freedom, sugarcane farming in Nepal has low productivity and profitability compared to top producers like Brazil and India. Despite recommendations from the Nepali National Seed Centre for higher productivity, Nepali sugarcane farmers have not embraced the suggested varieties of sugarcane to cultivate. The government runs various programmes to support sugarcane farmers, including the Minimum Procurement Price (MPP). But studies suggest the benefit-to-cost ratio is only 1.17. Farmers have been protesting against the MPP fixed by the government even though the MPP is already high compared to neighbouring countries. The government implements additional programmes such as insurance schemes, machinery subsidies, and awards for the best sugarcane farmers. However, between 2015 and 2021, the area of sugarcane plantations decreased by 20.48% and production declined by 26.75%, according to the Samriddhi Foundation. The low recovery rate of sugarcane in Nepal further affects the quality of sugar production, as the sugar yield in Nepal is only 9% of sugarcane compared to the world average of 12-14%. So it becomes clear that producing sugar in Nepal is costly due to the low recovery rate and high prices, making it difficult for sugar industries to compete with cheaper imports. According to the ministry, Nepal has the capacity to produce 477,450 tonnes of sugar annually. But the actual production is lower due to a decline in sugarcane production. Out of 31 sugar factories in the country, 21 are closed, and in 2021/22, only eight industries operated and that too well below their full capacity. In this context, the government's decision to reduce the customs duty on imported sugar by 10% is expected to result in a decrease in the prices of imported sugar to some extent. However, this measure alone will not effectively address the issue of illegal smuggling of sugar from India to Nepal. As the illegal importation of sugar is likely to persist, the intended goal of the government in lowering the customs duty is unlikely to be achieved. Moreover, this decision may further discourage domestic sugarcane and sugar production in the country. Duty on Raw Materials of Edible Oil The government has taken a tough stance against edible oil producers. The budget has eliminated tax incentives previously granted on imported raw materials used in the production of edible oils. According to the Finance Bill, 2023, a 10% customs duty and a 13% VAT will now be imposed on these imported raw materials. In contrast, the government had previously offered a generous 90% discount on customs duty for such materials. Consequently, importers had been paying a mere one percent customs duty on imported raw materials of edible oil. In a move driven by allegations of misuse of government-provided benefits, the budget for the upcoming fiscal year has revoked these privileges for oil producers. Minister Dr. Mahat has alleged that the oil producers failed to demonstrate willingness to lower prices in the domestic market. As a result, the government has withdrawn the privileges previously extended to the oil industry. The removal of facilities by the government is anticipated to have a negative impact on the export of edible oils in the upcoming fiscal year. The Nepal Vegetable Ghee and Oil Producers Association has expressed concerns that Nepali products will struggle to compete in the Indian market under the new circumstances. This is due to the fact that India imposes a Goods and Services Tax (GST) of only 5%, while Nepali products will face higher costs in the Indian market. A total of 26 firms are engaged in the production of vegetable ghee and vegetable oil. This sector has witnessed a significant investment of approximately Rs 100 billion. These companies play a vital role in meeting the demand for edible oils in the domestic market and contribute to the overall economy. With substantial investments and a considerable number of firms operating in the sector, it highlights the significance and potential of the vegetable ghee and oil industry in Nepal. Over the past few years, the export of edible oil has played a crucial role in generating substantial foreign currency earnings for the country. In the fiscal year 2021/22, Nepal exported palm oil and soybean oil worth Rs 89.2 billion - approximately 45% of the country's total exports. Capitalising on a provision within the South Asian Free Trade Area (SAFTA) agreement, Nepali traders have been able to export edible oil to India. The agreement offers zero tariff on goods exported from underdeveloped nations such as Nepal. Leveraging this advantage, Nepali traders have been importing raw oil from other countries, paying minimal tariffs, and subsequently exporting the finished products to India without any tariff. This strategy has facilitated the growth of the edible oil industry in Nepal. However, a few months ago, the Indian government raised the import duty on edible oil imported from Nepal. This unexpected development has dealt a severe blow on traders who now face a challenging situation. On one hand, the decision to increase the import duty is likely to diminish the export potential of one of Nepal's major commodities. On the other hand, the rise in raw material costs will inevitably lead to an increase in the local market prices of finished goods. This decision by the government has created a complex scenario, impacting both the country's export prospects and the affordability of edible oil in the domestic market. “If the decision is implemented, we will have to pay a total tax of 25% - 10% customs duty and 15% excise duty – on the import of raw or unrefined oil. That means our finished products like vegetable ghee and vegetable oil will not be able to compete in the Indian market and we will be forced to close our industries,” said Bipin Kabra, a member of Nepal Vegetable Ghee Oil Producers Association. Sandeep Kumar Agrawal, the president of the association, says that in 2022/23, the government had imposed only one percent customs duty on the import of raw materials of soybean, mustard, sunflower, and palm oil. It had given a 90% waiver on the 5% customs duty on imported mustard seeds. “The taxes introduced through the budget for FY 2023/24 are outrageous. To protect the investment made in 26 industries and the employment of some 15,000 people, the government needs to make an immediate amendment to the new taxes,” he added. Negative Impact on Stock Market Some of the policies introduced in the federal budget for the upcoming fiscal year 2080/81 have already had a notable impact on the country’s stock market. These changes, particularly in relation to taxation on balance sheet items carry significant implications on stock prices of companies listed on the exchange. Notably, a key provision requires that a company that has in the past issued shares at premium prices and a company that merged another entity in it by making a bargain gain in the valuation, has to pay tax on such premium gain and valuation gain if such gains are not distributed to the shareholders as bonus shares. As a result, numerous public limited companies, particularly banks and insurance sector ones, will experience an impact on their financial statements, potentially leading to a decrease in dividend capacity. In the past, the practice of issuing Initial Public Offerings (IPOs) and Further Public Offerings (FPOs) at premium prices increased significantly due to the income tax exemption offered by the government. However, the new Bill specifies that companies which have not paid income tax on such gains will be required to settle all outstanding taxes. While companies can enjoy waivers on penalties and interest if such outstanding tax is paid by mid-November, this situation has led to a substantial amount being owed in corporate income tax. Consequently, companies such as Nepal Life Insurance, Shikhar Insurance, Standard Chartered Bank, NMB Bank, Nepal SBI Bank, and Nepal Investment Mega Bank, which previously launched FPOs at premium prices, are now faced with a significant tax burden which they have to clear by November. Additionally, the new arrangement introduces taxation on gains from bargain purchases during mergers or acquisitions. Previously, companies would generate income by offering a lower swap ratio to weaker entities during such transactions. However, the revised legislation will impose taxes on those who profit by acquiring other companies at prices below their actual value. This development has raised concerns, particularly among major banks, as previous mergers and acquisitions transactions will now be subject to taxation. The budget also brings forward the requirement for natural persons engaged in regular trading of securities, land, or real estate to declare income and file tax returns for such transactions. Based on the financial year 2019/20 as the reference year, individuals involved in these businesses must pay income tax from that period onwards. This change has the potential to impact a significant number of investors, including those who have earned substantial profits through regular share trading. In the real estate sector, intermediaries who have played a significant role in buying and selling have also generated significant earnings. However, the specific implications for these intermediaries remain unclear. Nonetheless, the perception that regular trading in the stock market may lead to profit losses and increased revenue scrutiny has caused concern among investors. The consequences of these tax reforms could have both progressive and regressive implications. The taxation on bargain purchases during mergers and acquisitions aims to prevent companies from exploiting weaker entities and profiti ng from underpriced acquisitions. This progressive approach seeks to ensure fair business practices and a more equitable distribution of wealth within the market. However, the overall impact of the tax reforms on the stock market and real estate sector remains uncertain, and it is essential to closely monitor their consequences. Moreover, the requirement for individuals engaged in regular trading of securities, land, or real estate to declare income and pay taxes based on the financial year 2019/20 onwards may affect a significant number of investors. This change, while promoting transparency and tax compliance, could have a regressive effect on small-scale investors who rely on regular share trading for income generation. Furthermore, the implications for intermediaries involved in real estate transactions remain unclear, raising questions about how the tax reforms will impact their earnings and business operations. Tax on Travel Trade and Tourism In the latest budget, the government has implemented several tax measures affecting the travel and tourism industry. These include a 13% value-added tax (VAT) on trekking and tour packages, as well as airline tickets. Additionally, a 2% luxury tax has been imposed on the services provided by five-star and luxury hotels, while a 5% tax has been levied on Nepali individuals travelling abroad for tourism purposes. These tax adjustments come shortly after the Civil Aviation Authority of Nepal (CAAN) raised the airport tax. In June of the previous year, the passenger service charge for passengers flying from the Tribhuvan International Airport to other domestic airports was increased from Rs 200 to Rs 500. The private sector has criticised the move, arguing that these regulations were introduced without thorough analysis and could potentially escalate travel costs, a crucial economic indicator. Travel trade and tourism organisations argue that instead of fostering travel, the government's approach seems to be centred on taxing anything feasible to its maximum extent. Ramesh Thapa, President of the Nepal Association of Tours and Travel Agents (NATTA), expressed concerns about the cumulative tax burden already imposed on the travel sector and believes that the addition of VAT will discourage the industry. Tourists are already subjected to various fees, including national park entry fees and charges for liaison officers during mountain expeditions. Trekkers also pay specific fees. Therefore, industry professionals argue that the introduction of VAT at this point lacks rationale. Furthermore, they highlight that even fees paid to porters, yaks, and mules for transporting goods in mountainous regions are subjected to taxation. Tourism entrepreneurs fear that this new tax regime will negatively impact the recovering tourism sector, which has endured years of shutdowns. They worry that the proliferation of taxes in the tourism industry will make Nepal an expensive destination, potentially deterring foreign travellers. Consequently, higher taxes on airline tickets, hotels, sightseeing, and national parks could harm the industry. Entrepreneurs draw attention to the example set by India, where only a 5% Goods and Services Tax (GST) has been implemented in the aviation sector. They argue that the government's imposition of a 13% VAT goes against the provisions of the International Civil Aviation Organization (ICAO). According to ICAO resolutions, a specialised agency of the United Nations, no taxation should be imposed on the sales or usage of international air transport. The International Air Transport Association (IATA) also urges all states, including their political subdivisions, to fully adhere to ICAO resolutions by ensuring complete exemption for international air transport and granting international air transport enterprises the right to reclaim any VAT paid. Impact of Interest Tax Amidst the significant decline in aggregate demand and a struggling economy, the government, grappling with low revenue collection, has undertaken a comprehensive revision of the tax structure, specifically targeting the provisions of direct taxation. At present, the country is experiencing a recession, which has further intensified the need for effective fiscal measures. As of the end of May this year, the country's budget deficit has reached a staggering Rs 271 billion. While there is a growing demand to curtail the government's recurrent expenditure, it is disheartening to observe that the government has overlooked this crucial aspect. Instead, the focus has primarily been on augmenting tax revenues through the budget announcement. The government's decision to prioritise revenue generation through increased taxation has raised concerns within the business community and among the general public. Many argue that the emphasis should have been on promoting economic growth and reviving aggregate demand, rather than burdening individuals and businesses with higher taxes. The current approach risks further exacerbating the economic challenges faced by the country and may hinder the overall recovery process. The government has marginally increased the minimum tax threshold for salary earners, raising it from Rs 550,000 to Rs 600,000 annually, providing some relief to the lower-income group. However, for those earning over Rs 5 million per year, the government has imposed a high income tax rate of up to 39% on the upper limit. According to economist Prithvi Raj Ligal, the revised rates of direct taxes appear unsuitable during a time of economic recession. "The high rates of direct taxation reduce people's purchasing power, which in turn diminishes aggregate demand in the market," he said. One clause in the new Bill has raised the tax on interest earnings from 5% to 6%. Economists suggest that this new condition may discourage depositors from saving money in banks. Bank depositors are already feeling the impact of the high inflation rate, which has resulted in close to nil or even negative real returns. This has made them hesitant to increase their savings, as evident from the past year when banks struggled to attract deposits. With the introduction of a high tax on interest, the situation could worsen further. The tax on interest primarily affects senior citizens who heavily rely on income from interest on Fixed Deposits (FDs). Individuals in this age group often lack the energy to diversify their sources of income and savings. The combination of low interest income and persistent price increases creates a double blow for this group of savers. The group of ‘fixed income earners’ encompasses the broad spectrum of the middle class, which plays a crucial role in driving the economy through. However, various factors have made old age a challenging experience for the middle class. These factors include the high cost of living, particularly in terms of medical expenses, inadequate social security schemes that leave many without access to pension benefits from their employers, and the burden of supporting their children even after retirement due to high unemployment rates. Therefore, taxing interest income fails to uphold the principle of equality. An increase in direct taxes reduces disposable income, resulting in a decline in people's purchasing power. This, in turn, exacerbates the downward spiral of falling aggregate demand and economic recession. Considering that the government has already borrowed substantial amounts from the domestic sector, the additional burden of higher direct taxes could trigger a severe ‘crowding out effect’. This effect would limit the private sector's capacity to contribute to economic activities. Instead, the government should prioritise reducing unproductive expenses and enable the private sector to inject more money into the economy independently. Corporate tax/ Cooperative tax A corporate tax is a tax on the profits of a corporation. Corporate tax rates in Nepal vary depending on the type of business entity and typically range between 25% and 30%. The standard rate for most entities is 25%, including life insurance companies. However, banks, financial institutions, general insurance companies, and enterprises in the petroleum sector are subject to a higher rate of 30%. Special industries, such as those operating roads, bridges,railways, hydropower stations, and transmission lines on a BOO T (Build, Own, Operate, Transfer) basis, enjoy a reduced rate of 20%. Cooperatives have often been targeted now by the government when it comes to imposing taxes. While a few problematic cooperatives have drawn attention, the positive contributions of the sector often remain overshadowed. In the previous year, the government proposed a 50% increase in income tax on cooperative profits. However, this decision was revoked following protests by the cooperative movement. According to the Cooperatives Act, 2017, the government had established a framework three years ago that imposed a 5% income tax on cooperatives operating within urban municipalities, 7% in sub-metropolises, and 10% in metropolises. Additionally, tax exemptions were announced for cooperatives operating in rural municipalities. Previously, cooperatives were subject to a 20% income tax. Then Finance Minister Dr. Yubaraj Khatiwada revised the tax structure for cooperatives in line with the provisions of the Cooperatives Act, 2017 through the budget for the fiscal year 2020/21. Min Raj Kandel, president of the National Cooperative Federation of Nepal, said that cooperatives should be treated differently from the corporate sector. Stating that cooperatives are member-based organisations where the benefits (read profits) are shared among the members and their primary objective is to uplift the community, Kandel said the decision to impose taxes contradicts the provisions outlined in the Cooperatives Act. In line with the country's recessionary challenges, the cooperative sector is also grappling with liquidity management. Consequently, many cooperatives have encountered financial difficulties, and their operators have fled. The additional burden of an ‘unfair’ tax on these cooperatives is likely to exacerbate their financial distress in the days to come.

Other Major Tax Changes

NEW BUSINESS AGE July / 2023 railways, hydropower stations, and transmission lines on a BOO T (Build, Own, Operate, Transfer) basis, enjoy a reduced rate of 20%. Cooperatives have often been targeted now by the government when it comes to imposing taxes. While a few problematic cooperatives have drawn attention, the positive contributions of the sector often remain overshadowed. In the previous year, the government proposed a 50% increase in income tax on cooperative profits. However, this decision was revoked following protests by the cooperative movement. According to the Cooperatives Act, 2017, the government had established a framework three years ago that imposed a 5% income tax on cooperatives operating within urban municipalities, 7% in sub-metropolises, and 10% in metropolises. Additionally, tax exemptions were announced for cooperatives operating in rural municipalities. Previously, cooperatives were subject to a 20% income tax. Then Finance Minister Dr. Yubaraj Khatiwada revised the tax structure for cooperatives in line with the provisions of the Cooperatives Act, 2017 through the budget for the fiscal year 2020/21. Min Raj Kandel, president of the National Cooperative Federation of Nepal, said that cooperatives should be treated differently from the corporate sector. Stating that cooperatives are member-based organisations where the benefits (read profits) are shared among the members and their primary objective is to uplift the community, Kandel said the decision to impose taxes contradicts the provisions outlined in the Cooperatives Act. In line with the country's recessionary challenges, the cooperative sector is also grappling with liquidity management. Consequently, many cooperatives have encountered financial difficulties, and their operators have fled. The additional burden of an ‘unfair’ tax on these cooperatives is likely to exacerbate their financial distress in the days to come. Budget 2023/24: Dec oding Tax Anomalies The customs duty on the import of mill and machinery brought in for production purposes by micro, small and cottage industries has been reduced to 1%. The micro, small and cottage industries stand to benefit from this decision. Individuals who are earning foreign currency through the export of IT-related business process outsourcing, software programming, cloud computing etc will get a 50% income tax waiver. The decision to add a 2% luxury tax to various goods and services will make those goods and services somewhat expensive. Such luxury tax has been imposed on the services of five-star hotels, imported liquor, and ornaments made of diamond, pearl and other precious metals costing more than Rs 1 million. The tax on the income from the interest on deposits in banks and financial institutions and cooperatives has been hiked from 5% to 6%. Similarly, a 5% tax has been imposed on the income made by providing software, electronic or consultancy services outside Nepal and on the income made in foreign currency from audiovisual content on social media. Earlier, this tax was just 1%. Thus, the tax on income made through Facebook, Twitter and Tik-Tok has been hiked. Nepali students going abroad for studies now have to pay a 3% Education Service Charge while exchanging foreign currency. Earlier, this was only 2%. Similarly, the tax on Nepalis going abroad for travel and tour has been increased. Travel agencies will have to pay a 5% Foreign Tourism Charge on every travel package sold. This provision is surely going to make foreign travel packages expensive. Recruitment agencies (manpower companies) now need to pay 1% Foreign Employments Service Charge on the amount raised from sending Nepali migrant workers abroad. Similarly, 13% VAT has been imposed on air travel for the first time. This will make the air services expensive by at least 13%. The provision of 100% tax exemption on agricultural businesses has been scrapped and a 10% tax has been imposed on agri-business. Imported cement, iron and steel, iron and plastic pipes, zinc sheets and electric cables will be more expensive after the government announced that there will be no customs duty exemption on the import of such goods. This decision is expected to support the domestic manufacturers of these products in which Nepal has almost achieved self- reliance.

Govt Needs to Revise Taxation Policy

Pradeep Kumar Shrestha

Managing Director

Panchakanya Group

How have you taken the introduction of new taxes and other tax changes made by the government through the budget for FY 2023/24? The expectations surrounding the budget are always high, and it's impossible to please everyone. However, the key aspect is to address the genuine concerns raised. Regarding the size of the budget and its potential revenue generation, we have doubts that these targets will be met. Considering the prevailing world recession and the challenging phase our country is going through, it is crucial to handle this situation intelligently and gain the confidence of the private sector, development partners, and the general public. In general, I must say that the expectations from this budget were higher than ever before, mainly because the finance minister himself possesses extensive experience and is an educated and intellectual individual. However, there have been numerous complaints, and it can be seen that several suggestions have not been taken into consideration. What are the tax anomalies in the new budget? The construction-based industry, which is considered a fundamental sector, plays a significant role in the country's development. There have been some commendable aspects that have been addressed, such as measures to increase the use of cement for road construction. However, when it comes to steel, particularly in the case of Panchakanya, where we primarily manufacture high-quality products, the suggested duty structure to support quality manufacturing has been overlooked.

For instance, while the duty on scrap is set at zero, the excise duty or charge for importing quality products within the country has been set at 1% or even zero in some cases, which creates a substantial tax disparity. This disparity will not only impact the quality of construction projects but also have adverse effects on revenue generation. It is estimated that the government stands to lose a considerable amount, around Rs 8-10 billion annually, due to this decision, resulting in a significant loss for the country. We have been advocating for these issues for quite some time. Additionally, there are other instances that raise concerns about the government's tax policies. For example, the duty for any medicinal item is not set at zero; instead, it carries a certain tax burden. This brings into question the rationale behind setting the duty at zero for scrap while imposing a 1% duty on sponge iron, a product that is not consumed domestically. Such decisions reflect a significant oversight on the government's part and can discourage genuine industries. Moreover, it creates reluctance among those who have already invested in the sector. There is a pressing need to correct these discrepancies and bring about changes in the taxation policy. How has the new tax regime affected the products of Panchakanya Group? As I mentioned earlier, the new tax regime has had a significant impact on Panchakanya Group's products, particularly steel. We take pride in being a quality manufacturer, distinguishing ourselves from those who use scrap and employ the induction route for manufacturing. However, due to taxation, there is a price difference of around Rs 7-8 between us and our competitors. Moreover, we also bear additional manufacturing costs. As a result, our operations are currently running at less than 40% capacity, which is a significant setback for us. This sends a negative message to other manufacturers as well. It sends a negative message also to the construction industry, say in Kathmandu, where there is a rapid increase in construction after the earthquake. This issue needs to be addressed seriously. Unfortunately, Panchakanya Steel, our core company, had been hit hard, even during the tenure of the former finance minister, Janardan Sharma. It is indeed a very unfortunate situation for our country. It seems the government just wants to raise taxes anyhow. Is it so? It is not a good concept and has a negative impact on all sectors. Revenue can be generated or increased when the business community makes money. So, you cannot keep on squeezing them or pulling them. That way, the government ultimately becomes a loser at the end of the day. It's similar to a goose that lays golden eggs - if you try to take all the eggs at once, you end up killing the goose. It simply doesn't work that way. What are your suggestions to the government regarding the new tax rates on various goods? Tax should be given a serious consideration. Merely addressing a few issues is not enough. The government needs to be mindful of how it handles the situation. Otherwise, the country's economy, which is already in a dire state and in a bad shape, will deteriorate further. My suggestion is that we should not only focus on addressing the concerns of those who have access but also take the general public's attention and interest into serious consideration for taxation policy. Is there anything else that you would like to say? The country is actually not poor in itself, but it is due to the country's politics. When some industries are struggling, it is not because of them but because of misguided government policies. This aspect needs to be addressed for Nepal to progress towards becoming a developed country.

Interview:

10% Duty Reduction Alone Won’t Prevent Sugar Smuggling

Shiv Ratan Sharda

Chairman

The government has altered various tax rates through the budget for the new fiscal year which begins in mid-July?. How has this affected the country’s industries? As far as I know, the new tax rates have not caused any significant impact on industries. However, there have been discussions regarding the retrospective tax, which pertains to taxing profits from three years ago. The budget speech mentioned this tax, but there has been a lack of clarity on its implementation so far. Government agencies have conveyed through various forms of communication, both written and verbal, that it will not be applicable to us. In the budget, the government also addressed the taxation of profits from share transactions and the buying and selling of land that occurred three years ago. Sometimes, there are counterarguments in letters from the Finance Ministry and the Inland Revenue Department (IRD). As a result, this situation has created ambiguity and caused unease. This is the foremost sentiment shared by me and my fellow industrialist friends. Apart from this, there has been an introduction of luxury tax this year. For instance, it has been applied in the hotel industry as well as in liquor. People are investing in new hotels to attract tourists. Why was the government so hasty in implementing the luxury tax? I recall back in 1997, when the Value Added Tax (VAT) was introduced, the government assured that it would solely enforce VAT and abolish all other taxes. There are official agreements supporting this claim. However, subsequently, the government continued to levy excise duties and has now introduced the luxury tax. The provincial governments have become proactive in various regions, taking measures to increase their tax revenue.

This has created a big problem. It seems the government just wants to raise taxes, come what may? In my perspective, the issue lies in government expenditure. How can this spending be minimised? The government's primary focus is on increasing revenue, which is understandable since it's their duty to impose and collect taxes for the benefit of the people. However, the current situation depicts a lack of investment in the well-being of citizens. Instead, these funds are being utilised for regular government expenses. Moreover, the burden of expenditure is becoming increasingly difficult to bear. To make matters worse, the government is resorting to loans to sustain salaries, pensions, vehicles, fuel, and the operation of government offices. This is an alarming situation posing a significant threat to the country.

The government has taxed even onions and potatoes? What do you say? As a result of the taxation, onions and potatoes have vanished from the market. Consumers are facing immense difficulties. Moreover, there is a lack of clarity regarding the future of locally cultivated onions and potatoes. Some individuals even suggest that other crops might also be subjected to taxation. The imposition of taxes on paddy, onions, and potatoes is essentially the same thing. While paddy remains untaxed, it seems unjustifiable to impose taxes on onions and potatoes. The government should have exercised patience before introducing these new taxes. If it was necessary to implement them, a gradual approach, starting with a minimal 1% could have been considered. This sudden and substantial tax burden has had a profound impact on both farmers and consumers. Therefore, I believe that the government acted hastily in this matter. What is your assessment of the decision to reduce customs duty on sugar? The tax decrease on sugar is a nice thought, but it falls short in its sufficiency. Frankly speaking, a mere 10% reduction will not effectively deter sneaking and smuggling. Previously, the tax stood at 40%, and now it has been reduced to 30%. However, no revenue has been collected on sugar. In this context, domestic sugar production is enough only for a period of 6-7 months, while the remainder is illicitly smuggled from India. Consequently, the government neither receives taxes on these transactions nor experiences any impact on sugar imports. Despite the government's decision to decrease taxes by 10%, not a single kilogram of sugar will be imported adhering to tax regulations. What about the tax adjustments in the electric vehicles sector? I don't believe there is any malpractice from the government regarding this matter, as people have been claiming. The demand for electric vehicles is on the rise. The tax imposed by the government on EVs is considerably low. However, there is one aspect to consider: EVs incur higher costs in foreign currency. On the other hand, the duty imposed is also minimal. Hence, the government finds itself facing challenges from both sides. How has the new tax regime affected the products of Sharda Group? The sole factor that has significantly impacted us is the tax on raw oil and oil seeds. There has been a noteworthy 10% increase in duties. At present, there is no excise duty escalation in India, and this will remain the case until 2024. Edible oil is more affordable there while it has become costlier here. It would have been justifiable to raise the duty here if a similar increase had occurred in India. However, considering Nepal's context, the imposed duty is impractical.