Maha Prasad Adhikari assumed office as the 17th Governor of Nepal Rastra Bank (NRB) on April 6, 2020, during a time of national crisis. The country had just entered a strict lockdown in an attempt to contain the spread of the COVID-19 pandemic imposed on March 24, 2020. At a moment when the economy was beginning to unravel due to halted economic activity, supply chain disruptions, and plummeting consumption and investment, Adhikari was entrusted with leading Nepal's central bank and steering its financial system through uncharted territory.

Adhikari brought with him extensive experience in economic management having served as the Chief Executive Officer of the Investment Board Nepal and also worked at Nepal Rastra Bank in various capacities, including its Deputy Governor, which gave him a solid understanding of the central bank’s inner workings.

Immediately after taking charge, Adhikari moved to introduce a series of monetary policy measures aimed at containing the economic fallout of the pandemic. Recognizing the urgent need to revive economic activities and ease the burden on borrowers, he implemented a 10 percent discount on the interest to be paid by borrowers and announced a 2-percentage-point reduction in interest rates charged by banks and financial institutions. These measures were designed to provide short-term relief to the business community and revive investment sentiment, especially in the pandemic-hit sectors.

Despite these initiatives, economic recovery has remained sluggish. In the second quarter of the current fiscal year, there were signs of improvement in some sectors, but the momentum was not strong enough to push the economy onto a sustained path of recovery. According to estimates by the National Statistics Office, the economy grew by 5.1 percent during this period, but this growth has failed to create widespread optimism.

Although the banking sector has excess liquidity, they have failed to expand credit flow. Meanwhile, the banking sector grappled with an increasing volume of non-performing loans, a mismatch between deposits and credit demands, and weakening governance among financial institutions. The country has been placed on the grey list for anti-money laundering.

Although Adhikari had an encouraging start to his term as the Governor, the overall economy still looks bleak as he bids farewell.

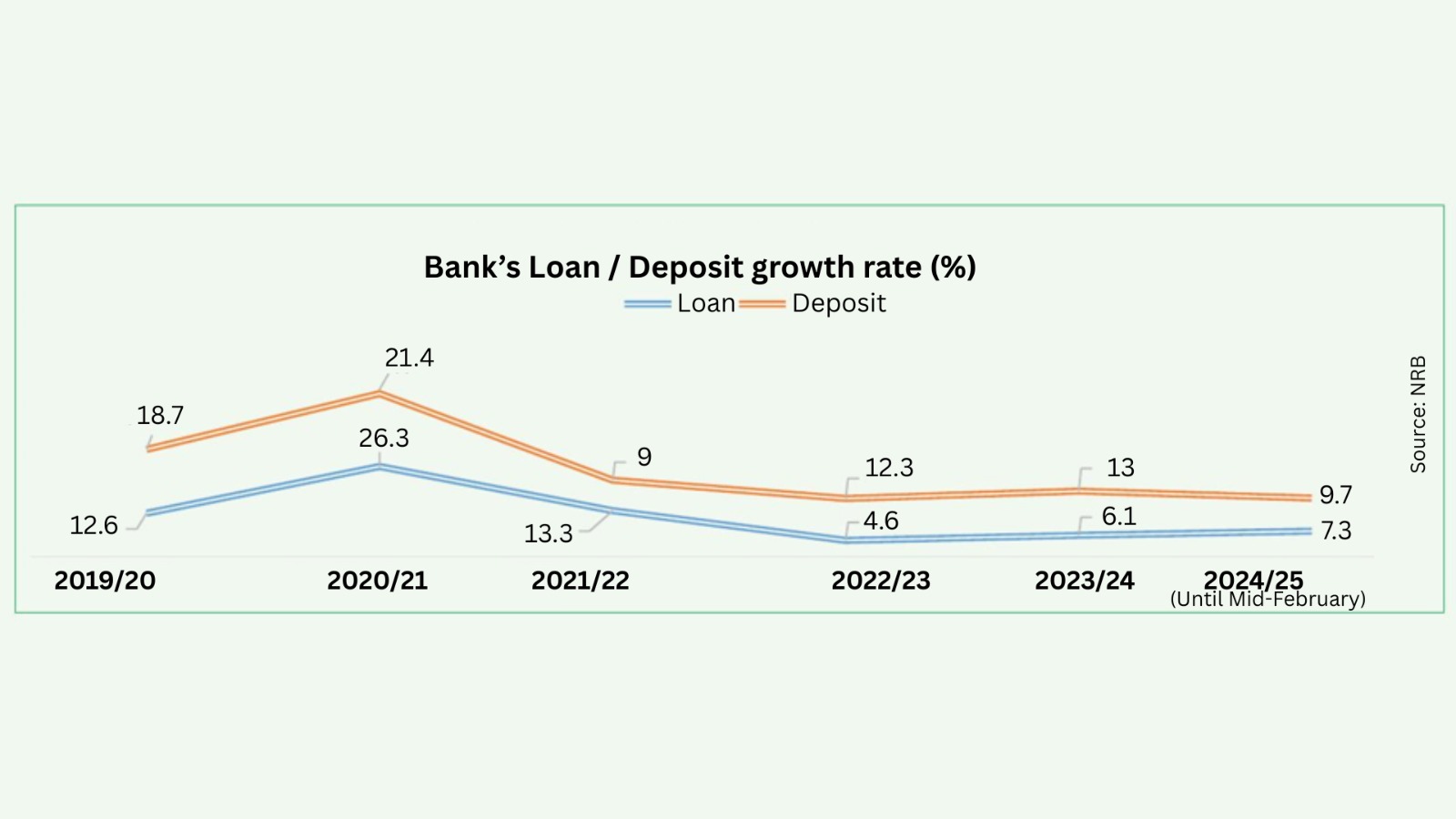

Governor Adhikari, who issued five monetary policies during his tenure, was 'liberal' in the initial years to improve the economy affected by Covid. In order to revive the Covid-affected economy, the central bank adopted a flexible and expansionary monetary policy in the first two years after Adhikari took charge.

While monetary easing increased liquidity in the market, much of that liquidity was funneled into unproductive sectors, such as real estate, luxury imports, and the stock market, rather than being invested in sectors with the potential to generate employment and sustainable economic returns. This pattern of spending led to a widening trade deficit and increasing pressure on Nepal’s foreign exchange reserves. At one point, the foreign reserves had shrunk so severely that they were insufficient to cover even seven months of imports—far below the minimum requirement.

To address the emerging macroeconomic imbalances, Adhikari and his team at the central bank were forced to pivot toward a tighter monetary policy. Starting in Fiscal Year 2022/23, Nepal Rastra Bank began implementing contractionary measures to reduce inflation, improve the balance of payments, and restore external sector stability. These included increasing the policy rate, tightening refinancing windows, limiting credit expansion, and revising the guidelines for working capital loans. However, these sudden changes created a credit crunch, which discouraged investment and slowed economic activity. Businesses began to feel the strain, and criticism of the central bank's approach grew louder, especially from the private sector.

Nar Bahadur Thapa, a former Executive Director of Nepal Rastra Bank, remarked that the overly expansionary policies adopted in FY 2020/21 and 2021/22 had backfired. According to him, the central bank had injected excessive liquidity in the name of pandemic relief, much of which was diverted to sectors like stock trading and luxury imports, weakening the economy in the process. When the policy stance shifted abruptly to a restrictive one, it added more pressure on borrowers and businesses that had already over-leveraged themselves during the earlier easy money period.

As a result, industrialists and business associations protested the sudden policy U-turn. They criticized the central bank for not adopting a gradual approach and demanded corrective measures. Their demands included lowering the policy rate, restoring concessional lending, offering refinancing options, and revising the ceiling on working capital loans. The business community also raised concerns about the volatility in interest rates and urged the central bank to introduce a fixed interest rate regime to promote predictability and planning.

In the midst of growing dissatisfaction, Governor Adhikari faced a political storm. In April 2022, he was abruptly suspended by the government following a dispute with then Finance Minister Janardhan Sharma. The government alleged that Adhikari had failed to take adequate steps to support the economy during a critical time. A committee was formed to investigate accusations that the governor had been uncooperative with the government’s economic plans, had disclosed sensitive and classified economic information to outsiders without proper authorization, and had failed to fulfill his core responsibilities as the head of the central bank.

Adhikari challenged his suspension at the Supreme Court, calling the government’s move unjust, politically motivated and against the autonomy of the central bank. The Supreme Court issued an interim order in his favor and reinstated him to his position, though the final verdict on the case is still pending. The incident raised serious concerns about the autonomy of Nepal Rastra Bank and the extent of political interference in the functioning of independent regulatory bodies.

Despite facing both economic and political challenges, Governor Adhikari did achieve notable progress in advancing the country's digital financial ecosystem. Recognizing the need to modernize Nepal’s payment systems and reduce dependence on cash, he prioritized digital transformation within the banking sector. Under his leadership, NRB introduced policies to encourage banks and financial institutions to expand digital banking infrastructure and services. The central bank provided regulatory support and incentives to fintech companies and launched awareness campaigns to boost digital literacy among the public.

As a result, the use of electronic payment platforms increased significantly during his tenure. Data from Nepal Rastra Bank show that the number of transactions through QR codes rose from 855,566 in June 2020 to 2,636,975 in January 2025. The value of these transactions jumped from Rs 3.65 billion to Rs 77.9 billion in the same period. Similarly, mobile banking, digital wallets, and Real-Time Gross Settlement (RTGS) systems witnessed a surge in usage, signaling a major shift in consumer behavior and banking practices.

Adhikari credited this transformation to coordinated efforts among regulators, financial institutions, and technology providers. He often highlighted that such progress was only possible due to the timely incentives offered by the central bank, the readiness of the financial sector to invest in digital tools, and the public’s growing comfort with cashless transactions—fueled in part by the contactless needs created during the pandemic.

Governor Maha Prasad Adhikari’s tenure was marked by a series of unprecedented challenges, including a global pandemic, macroeconomic instability, public criticism, and direct political confrontation. While his policy decisions drew mixed reviews from different stakeholders, his efforts to modernize the banking sector and promote digital finance left a lasting impact.

you need to login before leave a comment

Write a Comment

Comments

No comments yet.