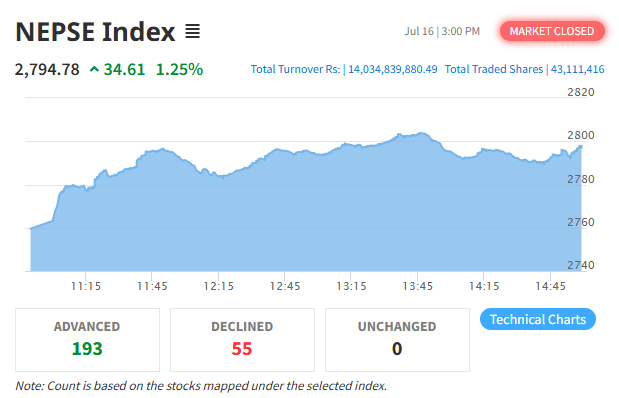

The Nepal Stock Exchange (NEPSE) Index surged 1.25% on Wednesday, July 16 climbing 34.61 points to close at 2,794.78, building on Tuesday’s 1.26% gain.

After the monetary policy announcement for fiscal year 2025/26, the index had climbed 1.06% on Sunday, driven by interest in banking and microfinance stocks. However, it dipped 1.27% on Monday before recovering on Tuesday.

Earlier last week, NEPSE also saw gains of 0.95% on Thursday and 0.82% on Wednesday after four straight days of losses.

Investor sentiment also remained strong on the week's fourth trading day, with total turnover soaring to Rs 14.03 billion, a sharp increase from Rs 9.41 billion in the previous session. The last time turnover surpassed this level was on March 3, when trades totaled over Rs 14.28 billion.

Trading volume also increased significantly, with 43.11 million shares changing hands across 99,505 transactions, compared to 26.51 million shares and 74,057 transactions on Monday.

All major indices advanced. The Sensitive Index rose 1.63%, the Float Index added 1.39%, and the Sensitive Float Index gained 1.71%.

Out of 248 listed companies, 193 gained while 55 declined.

Two stocks hit their upper circuit limits: 10% KBL Debenture 2090 (KBLD90), which closed at Rs 1,412.90, and Three Star Hydropower Limited (TSHL), ending at Rs 731.70 per share.

Mai Khola Hydropower Limited (MKHL) was the session’s biggest loser, falling 7.87% to Rs 915.95.

Butwal Power Company Limited (BPCL) topped the turnover chart at Rs 618.73 million, followed by Radhi Bidyut Company Ltd (RADHI) at Rs 566.95 million, and Sanima Mai Hydropower Ltd. (SHPC) at Rs 399.26 million.

Twelve of the 13 sectoral indices closed in the green. The Development Bank Index led with a 3.86% gain, while the Trading Index was the sole decliner, edging down 0.18%.

Total market capitalisation rose to Rs 4,656.99 billion, up from Rs 4,599.32 billion the previous day.