The state-owned Nepal Electricity Authority (NEA) opened financial proposals from 127 solar developers in early November through a competitive tariff-based bidding process, and ultimately selected 64 companies. These companies will add a combined 974.5 MW of solar power to the national grid. The capacity of these projects ranges from 5 MW to 50 MW.

This initiative is part of NEA’s broader 2,200 MW solar energy strategy. Under this strategy, NEA is preparing to procure 1,000 MW from solar developers from this bidding round. This is the first time that NEA adopted competitive bidding for power purchase agreements with solar developers, moving away from the previous fixed-rate regime. The final selection for Power Purchase Agreements (PPAs) will depend on pricing and substation capacity. NEA has set a price ceiling of Rs 5.94 per unit for solar energy. It is offering 25-year PPAs for the awarded projects that are close to its 200 kV, 132 kV, and 33 kV substations.

The interest on solar can be gauged by the fact that NEA received proposals for a combined 3600 MW in this latest bidding. NEA Spokesperson Chandan Ghosh told NewBiz that the utility is committed to expanding solar energy as it is now in the process of signing PPAs with these selected projects.

Investors, including major business houses, have shown a growing interest in solar energy. Large enterprises are investing in solar projects as they require less time to build compared to hydroelectric projects. The legacy business groups such as Golyan Group have initiated investments in the solar energy sector in a massive way.

Nepal currently generates 110 MW of electricity through solar energy - fraction of its potential capacity. Sixteen solar plants contributing 82 MW of this solar power are operated by the private sector. A study conducted by the Investment Board Nepal (IBN) shows the country receives solar radiation capable of producing 3.6 to 6.2 units of solar electricity per square metre and enjoys over 300 days of sunshine annually.

Among the largest winners in the latest bidding round is the GEPPERT-RAPTI Consortium which secured 10 projects with a total capacity of 125 MW. The company has proposed a PPA rate of Rs 5.49 per unit. Similarly, the Mountain-Dordi Consortium has won bids for seven projects with a combined capacity of 105 MW. It also quoted Rs 5.49 per unit.

Likewise, Golyan Power-Pure Energy JV has received five projects with a total capacity of 100 MW. PPA rates of these projects range from Rs 5.38 to Rs 5.51 per unit. Solar Farm, on the other hand, secured three projects totaling 90 MW, quoting a PPA rate of Rs 5.50 per unit. Go Green Energy won bids for two projects with a combined capacity of 80 MW. It has quoted PPA rates of Rs 5.39 and Rs 5.44 per unit. Eco Sun Power Development, which quoted Rs 5.52 per unit, has been awarded with four projects with a combined capacity of 38 MW. Likewise, the Mechi Solar-Future Holding JV has received three projects with a total capacity of 28 MW. The venture has quoted PPA rates ranging from Rs 5.28 to Rs 5.54 per unit.

Growing Interest

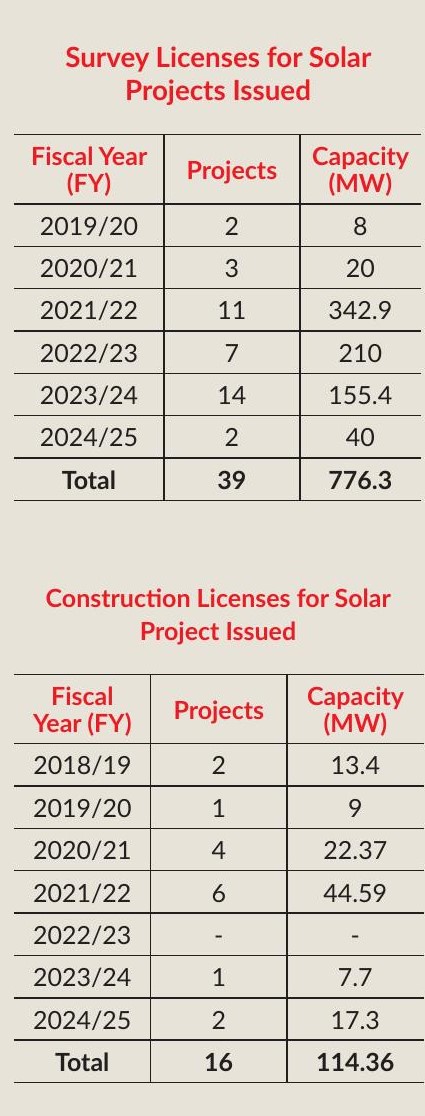

The issuance of survey and construction licences reflect a growing interest in harnessing solar energy in Nepal. The Department of Electricity Development (DoED) has granted 39 survey licences with a total capacity of 776.3 MW. This trend shows notable growth, particularly during the fiscal years 2021/22 and 2022/23, when 11 and 7 projects with capacities of 342.9 MW and 210 MW, respectively, were approved.

Similarly, 16 projects, with a combined capacity of 114.36 MW, have received construction licences. Although the initial progress was slow, with only 2 projects with total capacity of 13.4 MW approved in 2018/19 and one of 9 MW in 2019/20, it picked up in 2021/22 with licences issued for six projects with a combined capacity of 44.59 MW. Following a pause in 2022/23, licence issuance resumed. Three projects with a total capacity of 25 MW received licences in 2023/24 and 2024/25.

In the first five months of 2024/25, 12 companies have received survey licences for the generation of 135.5 MW of solar energy. Prime Power Pvt Ltd has received survey permits for 30 MW in Jawabhari of Kapilvastu, and 15 MW in Jawabhari, Kapilvastu. Vidyut Utpadan Company Limited has received a survey licence for a 15 MW solar project in Dailekh. Likewise, Galaxy Business House and Construction has obtained a permit for 10 MW in Jajarkot, while Vinayak Solar Pvt Ltd has secured survey licence for a 7.5 MW in Tulsipur of Dang.

Similarly, Green Quality Project has been granted a survey licence for a 10 MW project in Khurkot Pang in Parbat, and Quality Renewal Energy Pvt Ltd has secured permission to start survey for a 10 MW project in Parbat. Sunline Energy Pvt. Ltd. has obtained a permit for a 10 MW project in Deuri of Udayapur, while Bizbell Renewables has received a survey permit for a 10 MW project in Netragunj, Sarlahi.

Global Energy & Construction Pvt Ltd has been granted a survey licence for an 8 MW solar project in Mirgauliya of Morang. Additionally, Urja Kendra Nepal and Dhaulagiri Machinery and Tools Suppliers have obtained survey permits for 10 MW each in Baglung, and Utkristha Energy Pvt Ltd has received a survey license for a 5 MW project in Godavari of Kailali.

Solar power developers say solar projects can be completed quickly and provide benefits for 25 to 30 years from a single investment. "While it takes two to five years to build a hydroelectric project, a solar project can be completed in six months to one year. Moreover, it is a renewable energy and lasts for as much as 30 years with a single investment," one investor told NewBiz.

Promoting Energy Mix

NEA’s initiative aligns with the government’s strategy of promoting renewable energy sources, such as solar and wind, to meet rising electricity demand, especially during winter. The government aims to cap renewable energy at a maximum of 10% of the total installed capacity. NEA’s push for solar energy is further motivated by Nepal’s persistent energy deficit during the dry season, despite surplus capacity in the wet season.

Additionally, Nepal’s vulnerability to earthquakes and landslides, which could disrupt hydropower projects at any time, underscores the need to diversify its energy mix to enhance energy security. Most of Nepal's hydropower plants rely on snow-fed rivers. However, snow reserves in the Himalayas are depleting due to the impacts of climate. This has affected water levels in the rivers as well as projects harnessing these rivers. This called for the need to promote alternative energy sources for a stable power supply, though alternative energy still constitutes only a small share of Nepal’s energy mix.

Nepal’s total installed capacity, as per the NEA, currently stands at 3,157 MW, with 95% contributed by hydropower projects. The remaining is contributed by thermal plants, solar energy and biomass projects.

During the wet season, Nepal’s electricity production peaks at around 3,200 MW. About 2,700 MW is consumed which leaves a surplus of 400–500 MW surplus. In the dry season, however, lower river levels reduce generation to about 1,700 MW which results in a 600–700 MW shortfall. NEA covers this shortfall through imports from India.

“Nepal has no option but to invest in solar energy to meet demand during the dry season. Given Nepal's heavy reliance on run-of-the-river type hydropower projects, it is now time for both the private sector and the government to invest in solar energy, as outlined in the National Energy Crisis Alleviation and Energy Development Decade-Related Concept Paper and Action Plan,” said Mukesh Kafle, former managing director of the NEA.

According to Kafle, expanding solar energy production is essential for ensuring long-term energy security by replacing imports with domestic generation. The concept paper advocates diversifying the energy generation mix to include storage-based hydropower (40-50%), peaking run-of-river projects (15-20%), run-of-river projects (25-30%), and alternative sources such as solar, wind and biogas (5-10%).

Apart from the 60 MW Kulekhani I and its two cascade projects of 32 MW and 14 MW capacities, Nepal has no other reservoir-based projects. The 140 MW Tanahu Reservoir Hydropower Project is currently under construction, while the 456 MW Upper Tamakoshi Semi-Reservoir Hydropower Project has been heavily damaged by September floods, rendering its powerhouse non-operational. To strengthen energy security, NEA is working to increase the share of solar energy in Nepal’s energy mix.

NEA concluded PPAs with eight solar projects with a combined capacity of 90 MW in the last fiscal year. As of 2023/24, the NEA has completed PPAs for solar projects with a total capacity of 205 MW. Projects generating 100 MW, including the 25 MW-plant in Nuwakot, are currently operational.

The utility is preparing to sign long-term agreements for solar projects, with terms of up to 25 years. Only Nepali companies are eligible to participate in bidding for these projects. Projects with capacities under 10 MW must begin production within 18 months of signing the Power Purchase Agreement (PPA), while projects above 10 MW must start production within 24 months.

Inconsistent Policies

Investors are worried about the government's inconsistent policies on solar energy, which, they say, have dampened investment despite the sector's potential. "Policy instability for solar energy development has been a major hurdle for us. Issues like securing licences without a Power Purchase Agreement (PPA) have significantly restricted investments," they argue.

According to the 2016 National Energy Crisis Prevention and Electricity Development Decade Concept Paper, the government initially set Power Purchase Agreement (PPA) rates at Rs 9.61 per kWh. Bidders submitted their proposals based on this rate. But subsequent governments unexpectedly lowered the rate to Rs 7.30 per kWh after bids were received.

This move surprised winning bidders, and only a few of them proceeded to sign PPAs at the revised rate. As if it were not enough, the establishment of the Electricity Regulatory Commission (ERC) changed PPA approval procedures, causing delays in negotiations and prompting some developers to abandon their solar projects.

In the 2018 auction, conducted under the Asian Development Bank’s (ADB) Viability Gap Funding (VGF) program, NEA received bids significantly higher than expected. Without bid ceilings, developers quoted tariffs from Rs 17.80 to Rs 49.00 per unit which were well above the anticipated rates. After several negotiation rounds, a consensus was reached to fix the tariff at Rs 16.60 per kWh for all successful bidders until July 2022. This also was not of much help as some developers delayed their response due to tariff uncertainties, and in some cases, survey licenses expired before new PPA terms could be renegotiated with NEA. Delays in tariff negotiations also shortened the project concession period from the originally planned 25 years, thereby impacting projected financial returns.

Moreover, both bid processes required developers to arrange their own land for installations, which led to significant delays. However, securing large land plots in the proximity of NEA substations proved challenging for developers.

Experts argue that inconsistent tariff policies have discouraged investment in solar energy projects. “Solar tariffs are high globally. But in Nepal, they are exceptionally low which discourages investment. The tariff has dropped from Rs 9.61 to Rs 7.30 and now Rs 5.94—almost halved,” said Kuber Mani Nepal, a member of the Independent Power Producers’ Association of Nepal (IPPAN) and Managing Director of Ridi Power Company Ltd. “Although private sector participation in recent rounds of bidding is encouraging due to falling solar panel costs, challenges will arise if prices increase. This would impact banks and small investors participating through IPOs.”

However, Kafle argued that solar investment risks are relatively low. In terms of costs, developing 1 MW of solar capacity requires approximately Rs 50 million, compared to Rs 200 million for 1 MW of hydropower. However, the electricity generation capacity significantly differs: 1 MW of solar produces around 1,800 megawatt-hours annually, while 1 MW of hydropower generates over 5,000 megawatt-hours annually. This difference underscores the cost-efficiency and energy output advantage of hydropower in the Nepali context.

Kafle explained that the tariff is set based on international standards, taking into account project costs, loans, depreciation, equity returns, operating costs, taxes and additional capital. “It is not the PPA rates that have deterred the private sector; they must stay competitive within the government-set rate. With global solar panel prices declining, the private sector should capitalise on this and invest in solar energy,” he added.

Apar Neupane, CEO of Simple Energy, feels the PPA rates quoted by developers raise concern about feasibility of solar projects. "While the cost of solar panels has become more affordable, the increased interest in solar energy seems to stem more from the relatively straightforward investment processes compared to other sectors rather than the inherent viability of the projects," said Neupane.

The fact that solar projects, which can be commissioned quickly, has increased its appeal among the investors. Of late, many hydropower promoters are now venturing into solar energy, possibly leveraging strategies such as issuing shares on the stock market, as has been done in the hydropower sector.

Spokesperson Ghosh said that enthusiastic participation of private sector bidders indicates the attractiveness of the current rates. "If the rates were set too low, it would neither benefit the government nor encourage participation," he said. Ghosh further highlighted that solar projects primarily generate electricity during the daytime, when tariffs are lower compared to peak evening or nighttime hours. "The current rates have successfully attracted serious bidders," he added. While energy experts say the solar radiation in Nepal is favourable for solar energy generation, land availability still poses a significant challenge. Current regulations prohibit the installation of solar plants on agricultural land and areas with irrigation facilities. This limits the scalability of solar projects, according to developers. Because of this, large-scale solar development does not appear to be a viable option in the country.

(This report was originally published in December 2024 issue of New Busineess Age Magazine.)

you need to login before leave a comment

Write a Comment

Comments

No comments yet.