The dominance of banks and financial institutions (BFIs) in Nepal’s financial system is on the decline, according to the latest “ Financial Stability Report” for the last fiscal year, 2023/24, released by Nepal Rastra Bank (NRB).

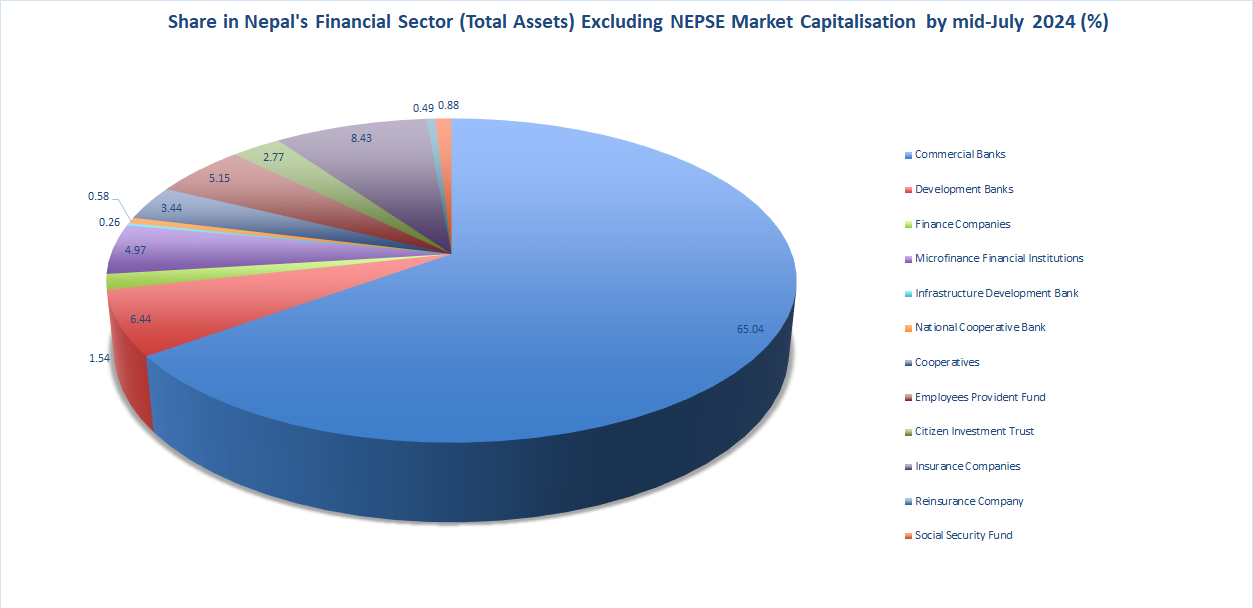

The report shows that the market share of BFIs—measured by total assets—fell to 78.26% in 2023/24, compared to 79.84% in the previous fiscal year. While the total assets of commercial banks increased by 12.01% year-on-year, reaching Rs 7.24 trillion (approximately 65.04% of total assets in the financial system), the overall influence of the broader BFIs sector diminished.

The shrinking market share has been attributed to the growing role of other financial entities, including insurance companies, social security funds, and pension-related investment trusts.

The decline was particularly evident among development banks, finance companies, microfinance institutions, and infrastructure development banks. Development banks’ market share fell from 6.71% to 6.44%, finance companies slipped slightly from 1.55% to 1.54%, and microfinance institutions saw their share dip from 5.09% to 4.97%. Similarly, the cooperative sector’s market share dropped from 4.48% to 4.02% over the same period.

In contrast, some sectors experienced growth. Insurance companies expanded their market share in the financial system from 8.53% to 8.92%. The Citizen Investment Trust’s share rose from 2.66% to 2.77%, and the Social Security Fund also recorded growth, increasing from 0.75% to 0.88%. This trend reflects a diversification of Nepal's financial landscape, with non-bank entities playing an increasingly prominent role.

However, the NRB report also raised concerns about the health of the financial sector. It noted a rise in non-performing loans (NPLs) and a continued deterioration in asset quality, which it largely attributed to sluggish economic activity. In light of these risks, NRB emphasized the need for sustained vigilance, robust regulatory oversight, and prudent financial management to maintain overall stability.

.jpg)