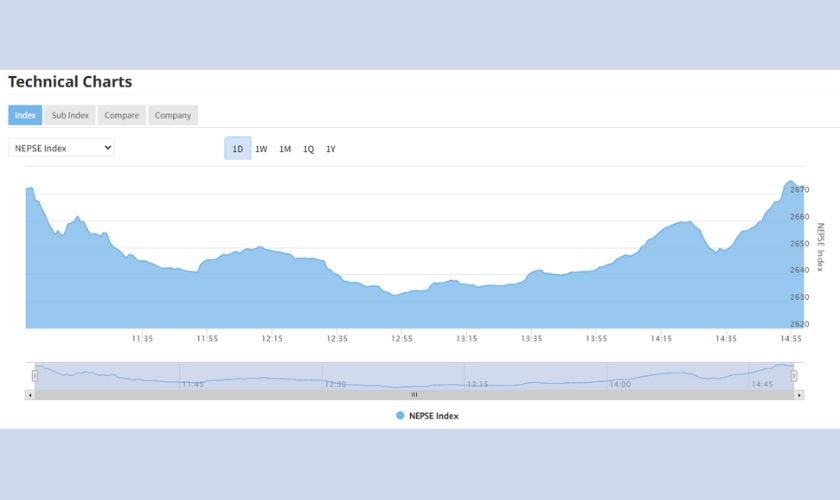

The Nepal Stock Exchange (NEPSE) index ended Tuesday’s (April 8) session on a cautious note, closing at 2,666.61 points—down 0.12% from the previous trading day. The benchmark index fluctuated significantly during the day, hitting an intraday low of 2,632.13 and climbing to a high of 2,674.88 before settling slightly lower.

Analysts noted the appearance of a hammer-shaped candlestick on the NEPSE chart—a technical indicator often interpreted as a potential sign of a market reversal. This comes after the index had declined 1.23% on Monday, largely in response to global volatility sparked by a tariff-related dispute.

World markets recovered Tuesday after three days of heavy selling that wiped trillions of dollars off the value of shares, reported Reuters. But caution prevailed with focus on whether Washington might be willing to negotiate on some of its aggressive tariffs, added the London-based news agency.

“Asia stocks bounced off 1-1/2 year lows, European shares rallied over 1.5% and the US stock futures pointed to a positive open for Wall Street where shares had fallen to their lowest in over a year on Monday before steadying,” the report said.

Apart from external factors, domestic pressures are also weighing on investor sentiment, market analysts argued. They pointed to end-of-fiscal-month effects, with the Nepali month of Chaitra ending on Sunday, April 13. This period typically brings caution among investors, particularly institutional ones, due to portfolio adjustments and cash flow requirements.

Additionally, rumors of an imminent drop in gold prices appear to have diverted investor focus toward bullion, with many choosing to hold liquidity instead of investing in equities.

The day's trading saw mixed results across listed companies—122 registered gains while 123 recorded losses. Notably, two stocks—Bottlers Nepal (Balaju) Limited (BNL) and Wean Nepal Laghubitta Bittiya Sanstha Limited (WNLB)—hit their upper circuit limit. Meanwhile, Nepal Micro Insurance Company Limited (NMIC), which debuted on the exchange, surged 9.99%. NMIC shares opened at Rs 302.30 and closed at Rs 332.50, making it the most sought-after stock of the day with 210 units traded for a total value of Rs 68,624.

On the losing end, Barahi Hydropower Public Limited (BHPL) posted the sharpest decline, with its stock falling 5.85% to Rs 1,047.66.

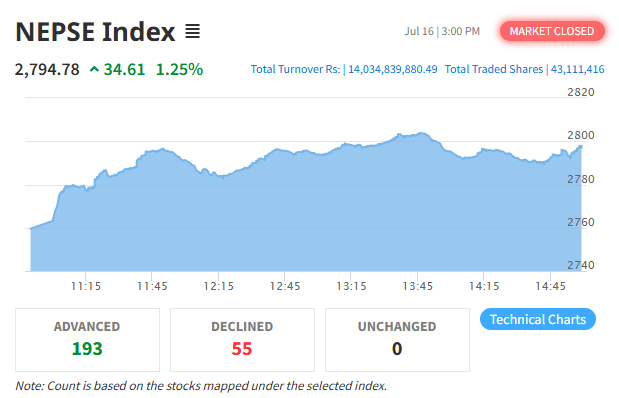

Turnover was slightly lower than the previous session. While more than Rs 5.65 billion worth of scrips changed hands on Monday, Tuesday’s total fell to just over Rs 5.3 billion. The number of shares traded exceeded 10.64 million.

NRN Infrastructure and Development Limited (NRN)led in transaction volume, trading over Rs 591 million worth of shares. Its stock rose by Rs 46.88, closing at Rs 1,678 per unit.

Market capitalization also took a minor hit, declining by Rs 5.72 billion to settle at over Rs 4.42 trillion.

From a sectoral standpoint, the Manufacturing & Processing group outperformed all others, with its sub-index climbing 1.57%. Gains were also recorded in Trading (0.70%), Finance (0.60%), and Non-life Insurance (0.13%).

However, other sectors ended the session in negative territory with the Others index posting the steepest loss at 0.57%.