Many believe that Nepal is still an under-explored market given the potential it has. The market is growing and chances of further expansion are still very high due to the increased awareness and affordability of consumers. The world’s leading brands available in Nepal have created an environment in which consumers can expect to get what they want. Every product has been putting their effort to get a hold in the market by expanding their consumer-base.

Based on Purchasing Power Parity (PPP) Nepal’s Per Capita Income has doubled in 32 years. Recently released Human Development Report 2013 by the United Nations Development Program (UNDP) has revealed that the gross national income (GNI) per capita in PPP increased by 101 percent to US$ 1,137 in 2012 compared to 1980. Inflow of remittance and an large portion of youth population has made Nepal a potential market to companies.

In this issue, New Business Age provides marketers and companies with some interesting insights to know the changing consumers landscape in Nepal.

In the capital Kathmandu, varieties of goods and shopping places can be found within a few minutes from their homes. People can find products according to their affordability. There are varieties of price ranges and choices to consumers. Family run groceries are still the norm in Nepal, but supermarkets and malls are also doing good business.

Despite economic slowdown, the consumption of fast-moving consumer goods (FMCGs) has not dropped but constantly going up. Nepal has been witnessing satisfactory growth in per capita food and non-food consumption expenditure. Household consumption of fast moving consumer goods (FMCGs) has also gone up. Multiple factors have contributed in expansion of Nepal’s market.

The visible growth of Nepal’s economy, especially income of the people, over the last decade has put more money in the pockets of the country’s middle class, prompting retailers to target this group of consumers.

Census 2011

In the report of National Population and Housing Census 2011 published by the CBS, the population of the country has grown to 26.6 million with 1.35 percent annual growth rate since the last census that was concluded in 2001.

Thus, Nepal is the market of 26.6 million consumers including 12.8 million male population and 13.64 female. The census report shows that Terai region constitutes of 50.27 percent (13.31 million) of the total population. Similarly, hilly and mountain areas constitute 43 percent (11.39 million) and 6.73 percent (1,781,792) respectively.

Highlights:

- Population: 26,494,505

- Households: 5,427,30

- Average household size: 4.88

- Sex ratio (number of males per 100 females): 94.2 (Number of male per 100 female)

- Urban population: 17 per cent

- Population density (average number of population per square km): 180

Age Groups and Corresponding Market

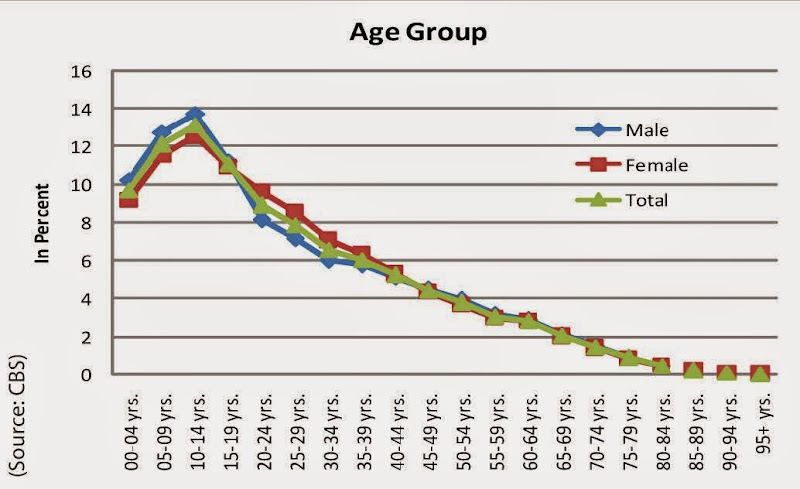

The age of the consumer determines the type of products sellable in the market.

Normally, a young person is fashion conscious in the choice of products, while a middle-aged person is status conscious.

The age group of 10-14 years of the population is seen the highest (when compared to other 5-year gap intervals) in Nepal as per the 2011 census data. Also, the female population is slightly more than that of males. There are 13,645,463 women in Nepal, which accounts for 51.5 percent of the total population, while the number of males is 12.84 million. Higher population of women shows that the market of cosmetics items, clothing and boutiques are very good in the country.

Youth Population

The census data shows that more than half of the population, about 55 per cent, is below 25 years of age. According to the 2011 census report, some 34.91 per cent of the population is aged below 14 years and another 19.97 per cent is aged between 15-24 years.

This is one of the reasons why many world players are coming and establishing their presence here in the Nepali market. Young Nepalis today expect a lot more from their lives, and often face pressure that was unfamiliar to earlier generations. Young people often want to keep up with global fashions and market trends. Their passion of following global fashion and trends has created many opportunities in Nepali market. Though Nepali population is mostly young, the size of old-age population has been increasing as well offering increased opportunity for business that provide goods and services to aged.

Family Size and the Family Life Cycle

The buying decision in a large family is more complex as several individuals play different buying roles, such as that of initiator, influencer, prayer, buyer and users, economist Dr Chiranjivi Nepal says. He opines that the large families generally buy a single brand while small families are found to be more brand-switching. Consumers’ product varies according to the stage of their family life cycle. The consumption pattern of a bachelor is different from that of a man with several children.

The average household size of Nepal is 4.88 as per the 2011 census data. The household size of the urban and rural was seen 4.32 and 5.02 respectively. The largest household size was seen in Rautahat district with 6.44 and the lowest of 3.92 in Kaski district.

Remittance

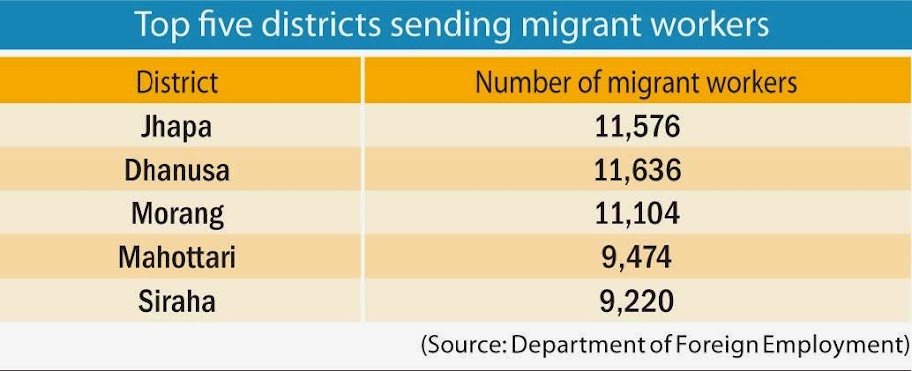

Around 1,500 Nepali workers go abroad for employment every day and it is their remittance that keeps the Nepali economy afloat, opines economist Nepal.

According to the World Bank, Nepal ranked 6th in the world among top remittance-receiving countries in 2011, with remittances making up 20 per cent of its GDP. A total of 56 per cent of the total households in Nepal receive remittances. Of which, 48 per cent comes from international labour migration, according to Central Bureau of Statistics. Accounting for more than 20 per cent of the GDP, migrant labourers brought in Rs 359 billion in the last fiscal year alone.

Education

Of the total population, 39.04 percent are at the level of primary education. The male population dominated all the regions of the country in the literacy level. 65.94 per cent of the total population are literate (can read and write) in Nepal. 2.52 percent of the population of Nepal can read only as per census data. Kathmandu has the highest literacy rate and Humla, the lowest with 86.3 per cent and 47.8 per cent respectively. The school enrollment of Nepal is seen at 95.1 per cent as per census data. This means over 95 per cent of school going age population is actually enrolled in schools. This indicates to very good market for educational material and education-related services.

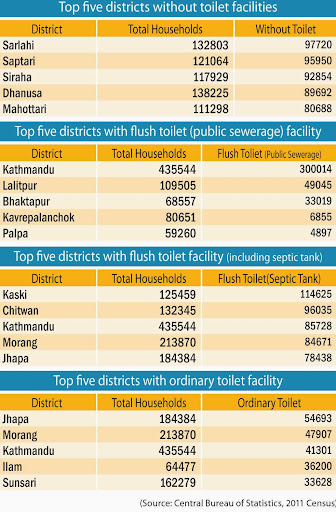

Toilet Use

More than one-third, i.e., 38.17 per cent of the Nepali population does not have toilet facility. In Terai region, a total of 51.24 per cent of population are still without toilet facility.

However, the trend of constructing the flush toilet and squat toilet with septic tank is increasing in the country including both in the rural as well as in urban areas. Therefore, the business of sanitary ware has also been going up.

Rural Market

Though the business volume may be big in Kathmandu and urban areas, Nepali villages offer very good markets in terms of the number of consumers as about 82.30 per cent of the population of the country is living in rural areas.

Interestingly even some parts of the urban population have rural consumption behaviour. And urban characters can be seen also in some rural areas due to the influence of remittance, for example. However, purchasing capacity of rural community is low compared to urban population. Rural population still depends on agricultural activities. The consumption habit, however, has been changing in the rural areas too. One reason is the road access and the other is education. Also the availability of electricity and cable TV as well as opening of cinema halls in those rural areas have been changing the consumption habit in rural Nepal.

Many companies have been launching products targeting the rural population. Comparatively low-cost products and micro-packing are main strategies adopted by companies to get a hold in rural areas.

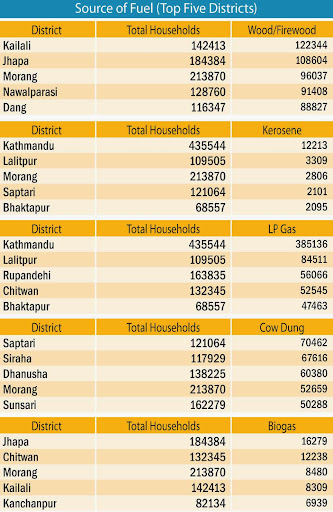

Fuel

According to National Population Census 2011, Nepal still relies heavily on firewood to fulfill its fuel demand for the purpose of cooking. However, the consumption of Liquefied Petroleum Gas (LPG) has significantly increased in the recent years which has created lots of space for the business of LPG stoves, regulators, pipes, cylinders and other necessary accessories.

One interesting fact about source of fuel for cooking is that big urban districts like those in the capital (except Lalitpur), Parsa, Kaski and Morang do not feature among the top users of electricity. Obviously the frequent power outage and cheap price of LP Gas have prompted the households ot shift to LP Gas in those districts.

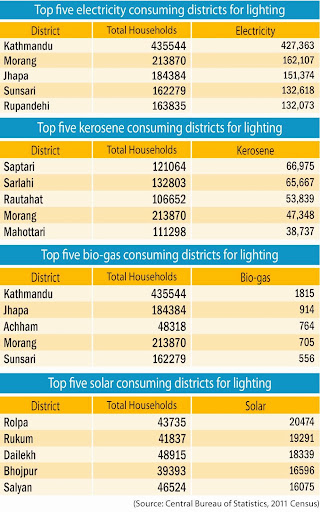

Lighting Sources

Electricity is seen as the major source of lighting for Nepali households. Total of 67.26 percent of the population is using electricity as the source of lighting. Similarly, kerosene is the second major source of lighting (18.28 per cent). But these households suffer from frequent power outage.

This has created much opportunities for the traders of invertors and batteries as well as solar power systems.

Therefore, business of electricity accessories such as bulbs, wires, poles and ceiling lights is doing well in Nepali market. At the same time, business of solar energy has also gone up and possibility of bio-gas related business is also very high in the Nepali market.

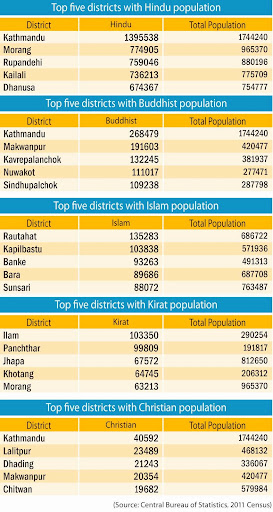

Religious Cultural Factors

In September 2012, World’s famous fast food chain McDonalds launched its first vegetarian restaurants in India targeting Indian Hindu. The reason of launching vegetarian products was obvious that McDonalds did not want to lose Hindu consumers.

Cut-throat competition among various companies and outlets has created a scenario whereby all companies try to lure consumers by offering what they want. Nepal is multi-religion country and companies may want to tap consumers according to religion.

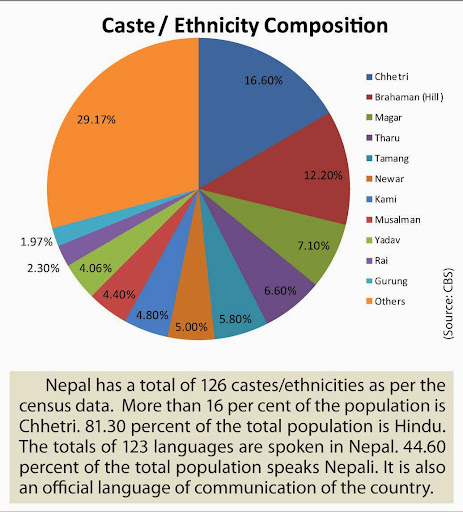

Consumer diversity is obviously very high in the country and creating more challenges for the marketers. There is diversity at multiple levels: ethnic and caste differences, religious diversities, rural-urban diversities, diversities in source of income and educational level along with others. Yet, there are many opportunities since the Nepali market is not fully explored so far. On top of all, Nepali consumers are very eager to try new products and services.

Absent Population

One in every four households (25.42%; 1.38 million households) reported that at least one member of their household is absent or is living out of country. Total number of absent population is found to be 1,921,494 in 2011 census against 762,181 in 2001. The highest proportion (44.81 percent) of absent population is from the age group 15 to 24 years. Gulmi, Arghakhanchi and Pyuthan districts reported the highest proportion of their population being absent (staying abroad).

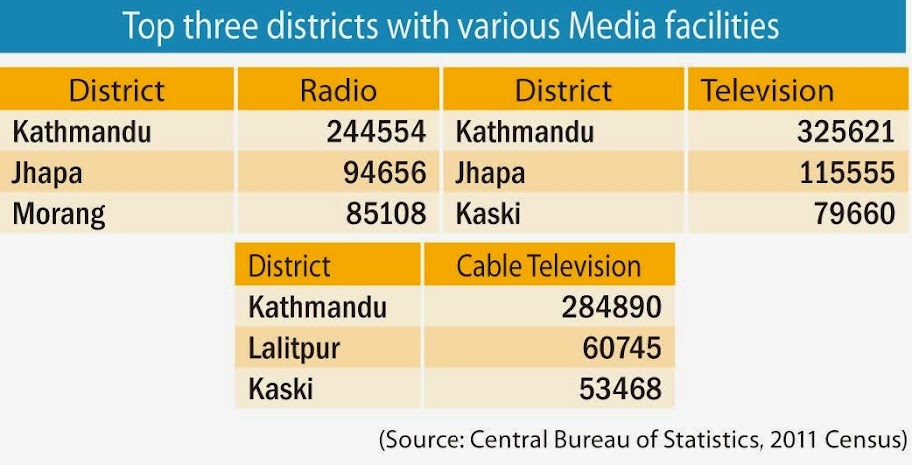

Media Consumption

The media consumption patterns, profiles of audiences on different platforms and media types, and the effectiveness of advertising across platforms have been significantly changed over the last decade. Consumers concentration has been shifted to the television from radio, according to Managing Director at JWT-Thompson Nepal Joydeb Chakravarty. “Ten years back the national media was radio but today more people watch television,” he says.

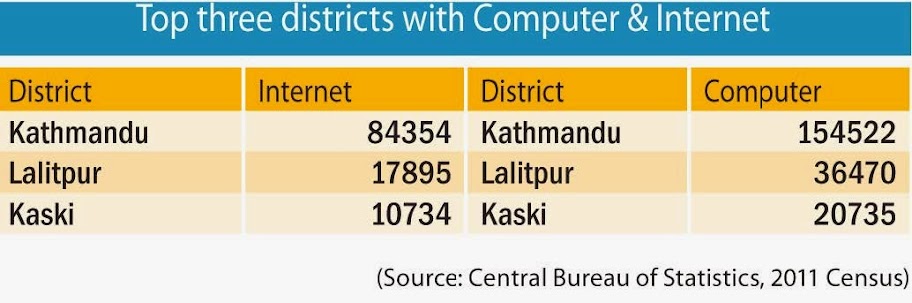

Computer and Internet

Computers and Internet products are also growing day by day. The number of Internet users in Nepal has accelerated in the country. Access to the Internet has positive implications for society and the economy. A study carried out by Computer Association of Nepal (CAN) last year showed that the computer penetration rate in the country had crossed five per cent. The survey was carried out based on the record of import of computer monitors and branded laptops, according to CAN general secretary Narayan Neupane. The penetration rate of computer at present may have crossed eight, he says, adding that the trend of using computers is on the rise since schools, health institutions, clubs and other social groups in far flung areas of the country have started using computers for their day-to-day activities.

Automobiles

Nepal has been seeing the penetration of two- and four-wheelers increasing at a rapid pace, thanks to the expansion of road connectivity and increased income of citizens. Expansions of road network throughout the country and a steep rise in the number of migrant workers have played a catalytic role in the growth of automobile sales.

So, many automobile brands have been able to establish themselves and automobile has become one of the largest customs duty contributors in the country. Nepali consumers have been using four-wheeler ranging from the most expensive one to the cheapest Nano car. Similarly, Nepal-assembled brands such as Mustang and Sherpa has also been rolling on Nepali roads.

ICT and Mobile

Not only telecom sector but also the market of entire Information and Communication Technology (ICT) has expanded over the last few years. As far as mobile market is concerned, Nepal has approximately Rs 15 billion transaction every year, according to chairman of Mobile Traders Association of Nepal Purushottam Basnet. Nepal has been very potential market for mobile phone sets and other ICT products.

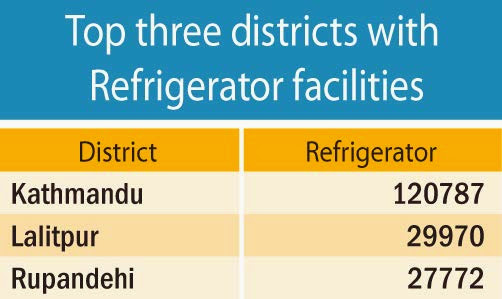

Home Appliances

Sales of the home appliances have tremendously increased over the last year. The sales of refrigerators, washing machines, vacuum cleaners, LEDs and LCDs has boosted in the recent years. Besides, people living in urban areas are continuously upgrading their living standards, and home appliances are deemed as components that add value to their living condition. The market of home appliances has also increased in the rural areas too.

Consumer diversity is obviously very high in the country and creating more challenges for the marketers. There is diversity at multiple levels: ethnic and caste differences, religious diversities, rural-urban diversities, diversities in source of income and educational level along with others. Yet, there are many opportunities since the Nepali market is not fully explored so far. On top of all, Nepali consumers are very eager to try new products and services.