By Chittaranjan Pandey

According to FITTA, 1992, “Foreign Investment” means following investment made by a foreign investor in any industry:

a) Investment in share (Equity),

b) Reinvestment of the earnings derived from the clause (a) above,

c) Investment made in the form of loan or loan facilities.

There are other ways too how foreign investors may show their participation in the Nepali market. One of the best discussable option is “Technology Transfer” agreement between a local industry and a foreign investor. Now, there are few sectors where the law of the land does not entertain the foreign investment like cottage industries, services (barber shop, beauty parlor, etc.), arms and ammunition industries, gunpowder and explosives industries, real estate business (excluding construction industries), etc. There are few benefits too which the government offers with an intention to lure the foreign investors. Some of the major ones are:

• No intervention by the government in the price determination of the products

• Direct access to commercial banks of the country to open Letter of Credit (LC) for the import of required machineries and raw material with this the problem of in getting recommendation letter from Nepal Rastra Bank or the concerned ministry is thus avoided.

• Decisions with regards to industrial license, registration and duty drawbacks are now to be made by authority concerned within 30, 21 and 60 day from the date of application, respectively.

• The act is clear about the facilities and incentives to different categories of industries.

• Repatriation of profits, dividend, technical and managerial fees, and certain portion of salaries of foreign experts has been guaranteed. The corporate income tax for manufacturing units is fixed at 20% and is one of the lowest in the region.

Besides these, there are some important institutional arrangements are made to support the foreign investment in the country:

• Membership of Nepal in international entities like World Intellectual Property Organization (WIPO) and the Multilateral Investment Guarantee Agency (MIGA)

• Bilateral Investment Treaties with France, Germany, Mauritius and United Kingdom

• Double Taxation Avoidance Treaties with India, Pakistan, Sri Lanka, China, Thailand, South Korea, Mauritius, Norway and Austria

• Membership of WTO, SAFTA and BIMSTEC

• Membership of International Centre for the Settlement of Investment Disputes (ICSID)

A very bright future for Nepal would be expected looking at the above measures. But what is the real scenario?

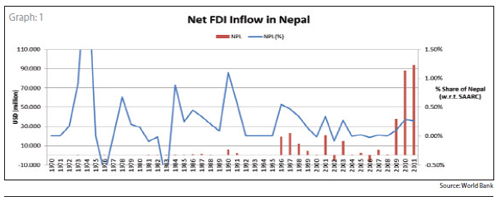

Nepal has not been able to attract a fair chance of FDI that comes to the SAARC region also. It may be very surprising to know that it was only in one year that the once when the FDI inflow in Nepal had crossed 1.10% of the total FDI inflow in the region and this is the highest inflow so far and this was in the year 1990. But in the laster year this percentage went down very low. Is this what was anticipated by the FDI policy? Of course, not. When the above mentioned facilitations and the measures are studies, nobody of us would actually expect this pathetic result.

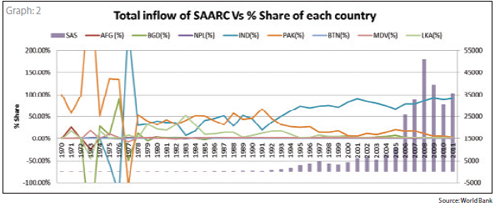

The story does not end here. Graph 2 shows how our neighbouring countries are performing in the FDI inflow scenario:

Also worth mentioning here is that other countries except India and Pakistan have not shown any remarkable growth either. Liberalization policy in India was adopted in 1991 which resulted in the boom of the FDI inflow in the country.

Latest data released in 2011 by World Bank shows Bhutan (BTN) as a country with the least FDI inflow in the SAARC region, that is, 0.05 per cent. Afghanistan (AFG) and Bangladesh have been able to attract 0.23 per cent of the total inflow and Nepal succeded to attract 0.26 per cent of the total inflow. Maldives, Sri Lanka and Pakistan has been successful to achieve 0.79 per cent, 2.68 per cent and 3.66 per cent, respectively. Regional economic giant India remained far ahead in bringing a massive 90.10% of the total FDI inflow in the region.

Politicians in Nepal often try to compare Nepal and India forgetting the fact that Nepal lags far behind India in terms of economic activities. It is worth mention here that Nepal and India adopted the policy of economic liberalization during same period of time. The question, then is: what has been done in India to attract FDI to that level and what are lacking in Nepal?

India started agriculture development campaign long back with slogan “Jai Jawan Jai Kisan”. India had long back understood the importance of agriculture for their economy and started working for it though it took a long time to come at present level. In Nepal, we are yet to promulgate condusive policied for the development of agriculture sector. Nepal’s Agriculture Perspective Plan is on the verge of collapse and no one is sure about fate of Agriculture Development Strategy.

Next point worth mentioning here is about public enterprises. Public Enterprises (PEs) in India are more competent compared to PEs in Nepal. Keeping the effectiveness of PEs on track, India has also formulated policies condusive to promote private sector which is justified by the rank of India in the Doing Business scenario of the country. Nepali public enterprises, however, have been incurring massive losses and suffering from corruption and other malpractices. Nepal is yet to formulate clear legal provisions to spur private sector. Private enterprises are compelled to remain in the condition of uncertainity due to frqeuent stikes and labour trouble created by political parties and their labour wings.

Government pretends that it is serious enough to promote Public Private Partnerships (PPP) forgetting the reality that there is a wide crevasse of mistrust between private sector and the government.

Most of us may be familiar with the campaign “Invest India” that played a significant role in bringing the FDI in India. In Nepal, it took a long time even formulating an entity responsible to promote investment. Nevertheless, we do have Nepal Investment Board now with a responsibility to attract FDI in various identified and permissible sectors of the country.

Evidences have showed that innovations matter much to attract FDI. Most of us might be familiar on how Narendra Modi in Gujarat organised an open conference of investors from all around the globe and investment agreements were signed instantly. Ranchi in Jharkhand of India can be taken as another expample to study how the government utilised tourism sector to promote economic activities. Ranchi has been developed as a main tourist hub and bungy site is developed where there used to be coal mines earlier.This is the innovative way of income generation. Nepal is lucky enough to have many tourist destinations and sports innovations from business perspective but they are not developed in such innovative way.

India is one of the largest investor in Nepal. Japan and USa are far behind. Why does Nepal fail to attract more investment from high income economies? The answer is: insufficient and ambigious legal framework, instability and lack of transparency.

Again, talking about India, we have instances of how India lured foreign companies to collaborate with local industries. Honda came in collaboration with Hero, Kawasaki came in collaboration with Bajaj and so on and now their local industries are more than capable to produce goods having international standards and quality. Furthermore, effective trade facilittion is a must to make the Nepali economy competitive.

In Nepal, policy for foreign investment was developed in 1987 and later Foreign Investment and Technology Transfer Act was introduced in 1992. It is high time to rethink why this country has been far behind inspite of having lots of potential for the economic growth.

- The writer is Assistant Manager of Research and Development at Mercantile Exchange Nepal Limited.