FDI is knocking on Nepal’s door but more needs to be done to turn pledges and promises into action and words into deeds.

--BY SANJEEV SHARMA

Things have been progressing quite encouragingly following the March 2-3 mega-event that was the Nepal Investment Summit 2017 organised by the Ministry of Industry. Investors, mostly foreign, expressed letters of intent (LoIs) to invest a total of USD 13.52 billion, in various sectors in Nepal. Following the summit, the number of investment intents has grown sharply as the Investment Board Nepal (IBN), the government body to facilitate investments, has received additional LoIs amounting to over USD 22 billion till date.

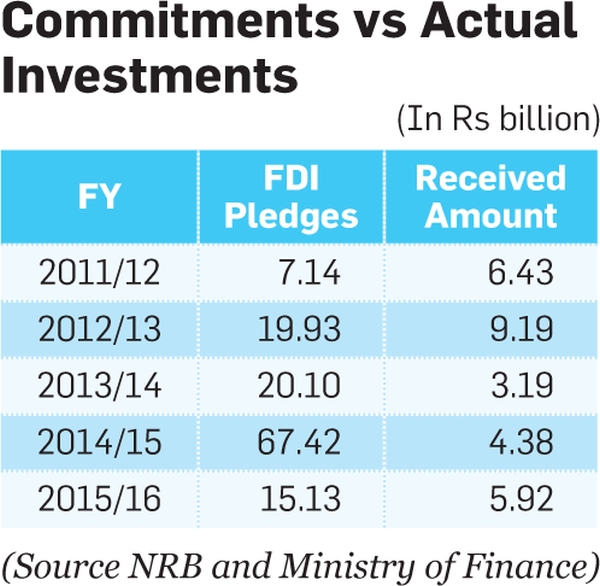

However, some big questions now lie ahead. Will Nepal be able to realise the investment intents into actual investments? Is Nepal actually on the path to become a lucrative FDI destination? Or will the LoIs just end up like the investment pledges made each year by foreign investors? It is estimated that Nepal receives just 20-25 percent investment out of the total commitments filed by investors on a yearly basis.

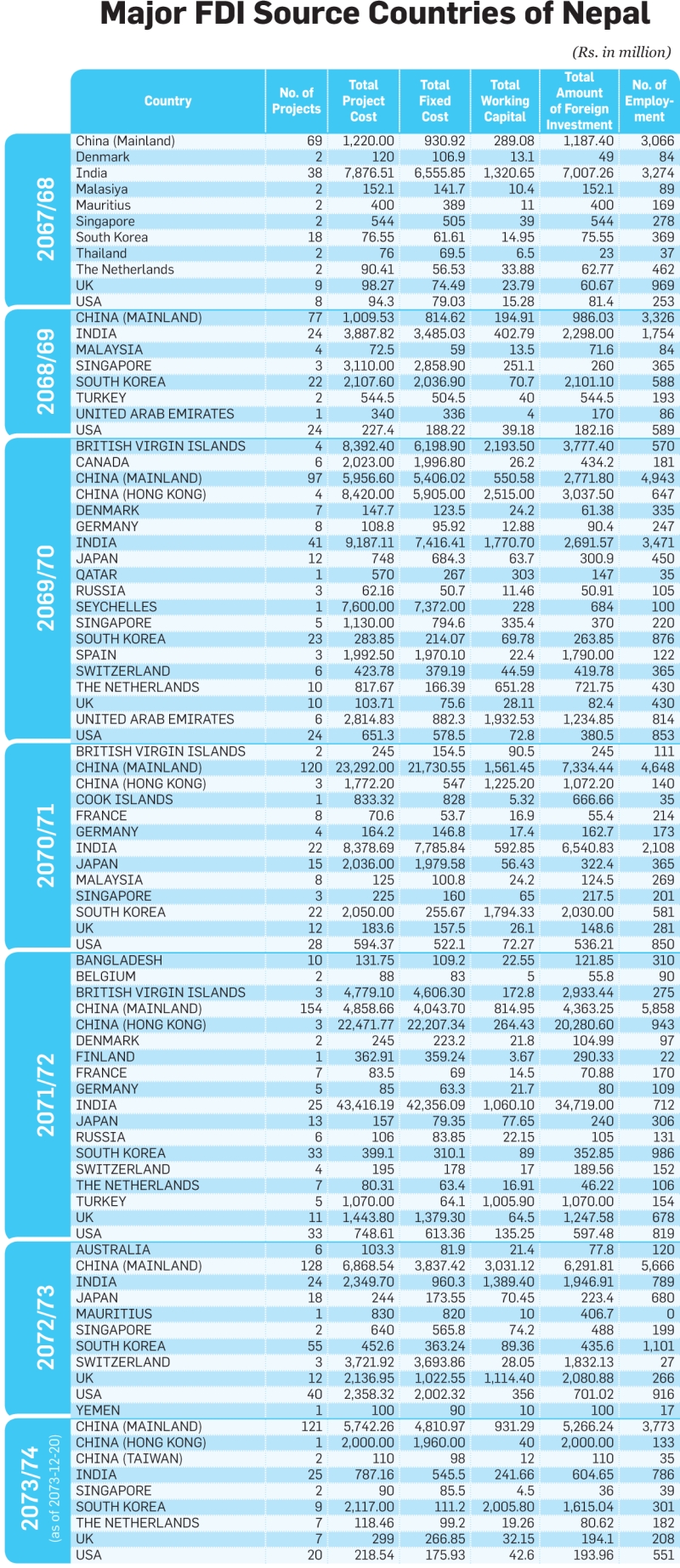

The FDI data compiled by national and international institutions show that Nepal has a long way to go to become an economy with a bed of competitive and comparative advantage for foreign investors. The self-explanatory government statistics of investment commitments made by foreign investors versus actual investments received by the country on a yearly basis over the last five fiscal years clearly indicates this.

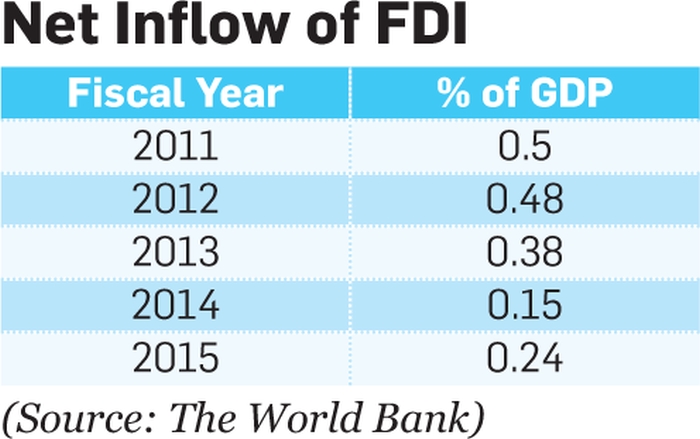

This lacklustre situation is being reflected in the meagre contribution of FDI inflow into the country’s GDP.

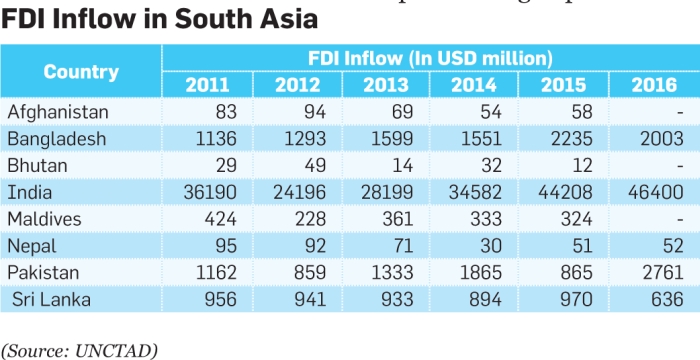

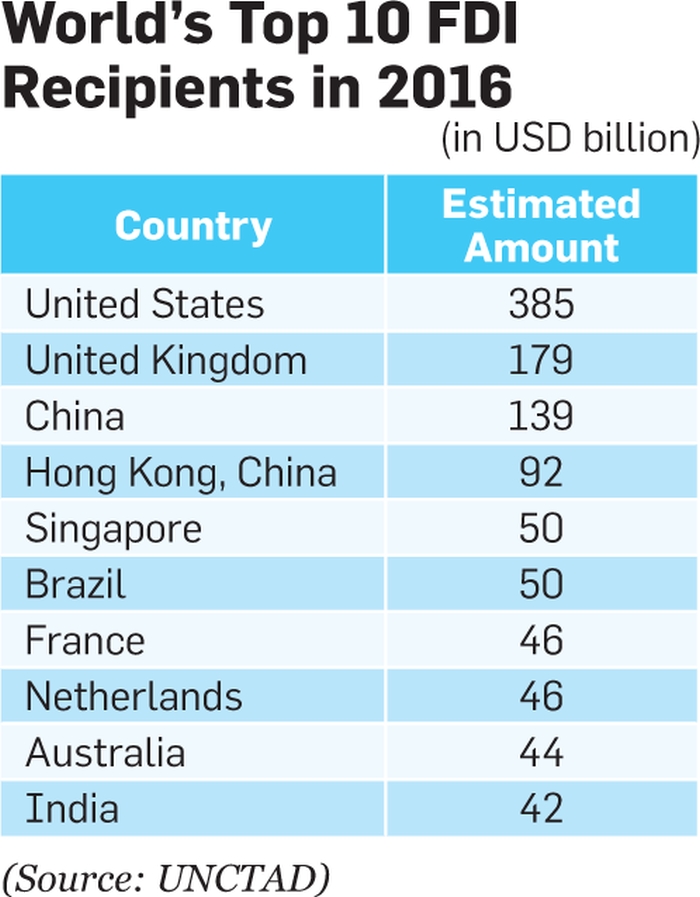

Similarly, yearly figures published by the United Nations Conference on Trade and Development (UNCTAD), a UN body to help countries in their trade, investment and development efforts, show that Nepal has been receiving the smallest net FDI inflows in South Asia after Bhutan. As per UNCTAD, India has successfully maintained its position as the largest recipient of FDI in the region followed by Bangladesh, Pakistan, Sri Lanka, Maldives and Afghanistan.

The Discourse on FDI

Though the dust of political uncertainty is yet to settle, discussions and debates about the economic ambitions of Nepal and the ways in which to achieve them have been raging in recent years. Creating an environment conducive for business in the country has been an issue of focus in such discourses. A recent discussion titled ‘The Symposium on FDI in Nepal: Sharing Experiences’ organised by the Embassy of India in Nepal in association with Professional Managers Forum held on March 27 in the capital also highlighted the issues being faced by joint venture companies operating in Nepal. The event saw encouraging participation of top officials of Indian JVs in Nepal, high level government officials, Nepali private sector leaders and experts. Industry minister Nabindra Raj Joshi and the newly appointed Indian Ambassador to Nepal Manjeev Singh Puri were also present in the programme. The officials of Indian JVs namely, Surya Nepal, Nepal SBI Bank and SJVN Arun III Power Development Company (SAPDC) shared views on the problems they have been facing in Nepal. In the panel discussion at the event participated by Naindra Prasad Upadhyay, Secretary of Commerce, Shanker Koirala, Secretary of Industry and Maha Prasad Adhikari, CEO of Investment Board Nepal, the JV representatives pointed to various policy level issues that have been making their operations in Nepal difficult. According to them, the issues are related to:

Repatriation: Foreign investors say they are facing problems frequently when they have to repatriate funds and dividends, service fees etc. According to them, authorities demand proof of financial investments even though the paperwork is complete. “One of the main objectives for anyone coming here with the FDI will be to maximise the profit and remit the money back home. Our experience in this regard has been mixed,” shares Abhimanyu Poddar, CEO of Surya Nepal, a subsidiary of Indian conglomerate ITC Limited that has been operating in Nepal since 1986. “There are companies here that have struggled to remit back their dividends and there are companies that have done it very easily,” he says. Poddar stresses that there should not be a requirement for foreign companies to present the same documents year after year. He suggests that asking the JV investors who have been working here for many years to show their initial investments is pointless and should be avoided. “The concerned authorities can ask them about their current profit and loss accounts and balance sheets,” he mentions. However, he also says that there are lapses also from the side of the companies. For example, documentation they prepare may not be clear or the clarifications they submit may lack clarity. Companies with foreign investments have been demanding that once they submit the relevant documents to the Department of Industry (DoI), Office of the Company Registrar and Nepal Rastra Bank (NRB) with the equity structure approved by DoI, the concerned authorities should accept the documents and approve the remittance of dividends.

Taxation: While Nepal is considered to have reasonable corporate tax rates in the South Asia region, there are some pertinent issues in the tax system that limit Nepal’s potential in receiving high FDI inflow. JVs have been asking the government to reintroduce a tax rebate on profits that gets reinvested. Such a provision used to exist in the past was discontinued since 2058 BS. Similarly, there are no policies to provide tax incentives to reward companies for their positive undertakings such as CSR, green energy and waste water utilisation etc. Though the new Industrial Enterprises Act has a provision to encourage such initiatives, the same is yet to be included in the tax law.

The non-existence of a policy to allow diversified foreign companies, having multiple businesses within one corporate entity and same tax code to set off losses from different businesses, a practice common in India and many other countries, is also an issue. Currently, the government policy does not categorically allow any company to set off losses arising in one business with profits made from its other business line even if it has been carrying out business underthe same PAN number. JVs argue that this issue, if addressed, will act as an incentive to invest in new businesses leading to new employment opportunities to Nepali citizens.

Meanwhile, the manufacturing JVs here also have been facing excise duty related tax issues. They have been asking the government to grant an excise duty rebate on the import of primary packaging materials. According to them, such rebate is a common practice in international taxation to make local manufacturing viable. JVs suggest the government should abolish the five percent excise duty levied on products that are classified as packaging under current arrangements. Internationally, excise duty is not levied or rebated on packing materials including containers, bottles, caps, laminates, labels and tubes.

Another major taxation related issue is the higher duty rates on the import of raw materials than finished goods. Interestingly, this has been raised every year with government authorities who seem to appreciate the issue. But whatever policy changes are made to address this prove to be only marginal.

The customs duty levied upon putty and its main raw material white cement is another example in this regard. Customs duty on the import of white cement is presently 30 percent, whereas it is 10 percent for the import of putty which is the finished product. As per the companies, the government needs to increase the duty on the import of putty to 30 percent as this differential duty structure is detrimental to local manufacturers. Likewise, fruit concentrate, the raw material used to produce fruit juice, and the actual fruit juice which is the finished product both are charged 30 percent as import duty. This is particularly disadvantageous for local manufacturers of fruit juice as their cost of production increases due to the unreasonably high duty rates on the import of raw materials.

Likewise, depreciation claims of the companies on assets rented out to their local distributors has been an area of concern for foreign investors in Nepal. They say any organisation buying an asset and renting it out to its distributors should be allowed to claim depreciation on the assets even when there is an agreement with provision of transferring the assets to distributors after the rental period. In the meantime, JVs have also been suggesting change in the legal provision that states the companies can provide donation only up to Rs 100,000 or five percent of the taxable income, whichever is lower. This is very low amount because the actual donation amount is always much higher than that.

Land acquisition: Availability of land has been one of the most problematic areas for foreign companies in Nepal. JVs particularly in hydropower, infrastructure and manufacturing have been facing multiple issues in the acquisition of land. Such problems are seen as one of the main reasons for significantly slowing down the progress of various projects. “As per the PDA, we were supposed to conclude the financial closure by November 2016 which was extended up to September 2017 due to the unavailability of forest land and the acquisition of private land also got delayed,” says SC Agarwal, CEO of Arun III HEP developer SAPDC.

According to him, the project’s construction which is expected to be completed five years after the finalisation of the financial closure will be delayed if the developer does not get support from the government to resolve the issues in land acquisition. SAPDC has not been able to move ahead smoothly due to the unavailability of forest land for constructing access roads to the project’s dam and powerhouse sites, and the right-of-way for access roads has yet to be accorded. As per Agrawal, the government owns 70 percent of the land required for the project and the forest area covers a large part of it. He urges for a simplification of procedures in order to address the problems in land acquisition.

The Upper Karnali Hydropower Project, another mega HEP being constructed by the multinational Indian contractor GMR, has also been facing similar problems. The project which had finalised its PDA in September 2014 has still not received the necessary approvals for acquisition of government and forest land, while the acquisition of privately owned land is still pending.

Cement manufacturers have also been dealing with this issue. Construction of the cement plant at Nawalparasi belonging to Hongshi-Shivam Cement, a Nepal-China JV, for instance, slowed down last year as the company struggled to acquire the land for the project. The plant is estimated to cover an area totaling 40 hectares. As per current arrangements, cabinet level approval is needed for companies to purchase land over eight hectares. Likewise, the JV, a few months ago, also faced problems in acquiring a quarry at Jyamire in Palpa where the locals forcefully prevented the company from developing the limestone mine site. Due to the unclear laws and rules, scuffles between the local residents and companies are a common sight in Nepal regarding land acquisition.

Labour issues: Disruptive activities of labour unions are seen as being one of the major reasons for degrading the industrial and business environment as investors both domestic and foreign often feel the brunt of militant trade unionism in the name of collective bargaining. Colgate-Palmolive, Surya Nepal’s John Player and various garment plants with foreign investments were forced to shut down their manufacturing operations in Nepal permanently in the past due to labour unrest. The month long closure of Unilever Nepal is a recent example of this. The company over the last 10 years has seen forced to close its factory units on multiple occasions. Similarly, strikes are also common in the country’s hospitality sector.

While labour disputes are resolved using the pragmatic method of Alternate Dispute Resolution (ADR) that includes arbitration, early neutral evaluation, mediation and conciliation in developed as well as in many emerging economies, in Nepal, labour related issues are settled as per the provisions of the Labour Act, 1992. The law has largely become obsolete in today’s global context of economic competitiveness ultimately obstructing productivity in industrial and business sectors. Many see the existing law as ambiguous as its interpretation varies from person to person. The law has reserved the rights of workers but has failed to secure the interests of investors. Experts speaking at the Symposium demanded the government to introduce a progressive labour law in accordance with international standards which would protect not only the rights of the worker but also the interests of the investor.

Labour registration: Meanwhile, the process of labour registration is also burdensome for foreign companies here. As per the existing arrangements, JVs are required to go to the Department of Labour where it takes at least six months to register their employees from other countries. “Labour registration is among the many problematic areas the government of Nepal needs to seriously look at,” says Anukool Bhatnagar, CEO of Nepal SBI Bank. According to him, Nepal needs to have a reciprocal approach if it wants people from international organisations such as SBI and Standard Chartered Bank to work here and in turn Nepali citizens to go to work in places such as Singapore, USA, Canada and Japan to gain relevant experience. Also problematic is the educational qualification set by the regulators, especially in the insurance sector. The rules bar JV insurance companies from bringing expatriate staff to Nepal who have gained years of relevant experience and expertise working across the world. As per the directive of the Insurance Board, CEOs of insurance companies in Nepal are required to hold a Masters Degree in some specific subjects, whereas the minimum required educational qualification for the highest level posts in Indian government-owned insurance companies is graduation. JV leaders say that this directive narrows the selection base considerably and thus, finding suitable persons will be a big challenge. “The JV companies that have been working in Nepal or are interested in coming here have vast experience. They have employees with decades of relevant experience and considerable knowledge. If we need such people to work here we need to relax the requirements of academic qualification,” opines Bhatnagar “The NRB has been pragmatic in this regard but the Insurance Board is yet to adopt such a policy,” he adds.

It is the lack of a policy of reciprocity that has created difficulties for Nepal to welcome the best foreign talents from whom the country can benefit in terms of knowledge sharing and bringing in new and effective ways of corporate management and governance. “There are many employees in our organisation who are citizens of Singapore working in Australia, trained in USA and UK. But when it comes to working in Nepal, most are reluctant to come due to the lack of reciprocity,” shares Bhatnagar, adding, “Such a policy approach is especially important for the large JVs that are supported by the governments.”

IPR: Infringements of copyright, trademark and patent of international brands are rampant in Nepal. Currently, there are various cases pending in concerned government offices and courts about industrial and intellectual property disputes. As per the DoI, the government body that handles the registration of copyright, patents and trademarks, there are around 600 registered complaints of trademark violations among which about 100 have been settled. Nevertheless, legal experts working on IPR issues cast doubt on the government data and say that the number can be as high as 1,200 with some cases continuing to go undecided for over 15 years. Some of the trademark disputes include cases of multinational firms Pepsico, Havells and Kansai Nerolac. After losing the case in both district and appellate courts, the Japanese paints JV Kansai Nerolac Nepal Pvt Ltd recently changed its name to KNP Japan Pvt Ltd. The Japanese paints giant which entered Nepal in 2012 partnering with the local firm Shalimar Paints is now said to be thinking of withdrawing its investment amounting to Rs 350 million as a result to the IPR dispute with a Nepali company.

As per the current provisions, trademarks are awarded to the applicants under a ‘first come, first served’ basis. This makes it quite hard for foreign brands to claim themselves as the rightful owner of their trademark, in case somebody has already registered the trademark. “There are issues with the IPR that have been going on for a long time. The case of Kansai Nerolac is a clear example here,” says Saurya SJB Rana, President, Nepal India Chamber of Commerce and Industry (NICCI), who was a participant at the Symposium.

Recalling his recent meeting with the Japanese Ambassador to Nepal, Rana mentioned that the Japanese envoy was highly upset on this particular issue. “If the foreign companies don’t get their respective industrial and intellectual property rights, Nepal will have to face an extraordinary amount of difficulty in terms of receiving FDIs,” he warns. As per Rana, there are already a lot of Indian companies whose brands here are registered by some other parties. “They cannot bring the products due to the IPR problems,” he says.

The irony is that Nepal has not been able to formulate intellectual property rights (IPR) laws despite being a signatory of the Paris Convention on the Protection of Industrial Property and a member of the World Intellectual Property Organisation (WIPO), a specialised UN body to monitor and promote the protection of intellectual property across the world, and the World Trade Organisation (WTO). Nepal joined WIPO in 1997, signed the Paris treaty in 2001 and became a member of WTO in 2004. Industrial and intellectual property in Nepal is still governed by the five decades old Patent, Design and Trade Mark Act, 2022 BS which has become outdated in terms of providing protection to globally recognised brands.

Infrastructure: Lack of roads, hydropower plants, industrial facilities along side ports and customs infrastructures for cross-border trading are impediments to the high FDI inflow in Nepal. Similarly, the inferior condition of roads both inside and outside the industrial areas is a matter of concern particularly for manufacturing JVs as it hinders them to smoothly supply products from factories to the market. Due to the poor condition of roads, vehicles with full-load are not operable which adds to the supply costs of the companies.

The Global Competitiveness Index 2016-2017 published by the World Economic Forum (WEF) ranks Nepal in 130th position among 138 countries in terms of infrastructure, clearly indicating the country's deficit in basic infrastructure in connectivity and energy to attract FDI in the country. This sorry state is primarily due to the government's inability to increase the capital expenditure and accelerate and complete the development of infrastructure projects that are under construction and start new ones. Over the last five FYs, the capital expenditure has averaged 40 percent in the first nine months of the fiscal years which only speeds up in the last three months. As of April 26, the government has just been able to spend 28.03 percent of the capital expenditure of the Rs 311 billion allocated for FY2016/17. Except for a few, the progress of most of the “projects of national pride”, from highways to hydropower and irrigation to the new airports, have been disappointing given the sluggish pace of spending.

Speakers at the Symposium highlighted the need to improve existing infrastructure, speed up the processes for those under construction or are planned for construction, and invest into new avenues of infrastructure to lure foreign investors. “Investment is the key to developing next generation infrastructures in both core and social sectors, in rural and urban areas,” said Manjeev Singh Puri, Ambassador of India to Nepal. Puri who recently took charge of the post points out that the next generation of infrastructures include freight corridors, industrial corridors, high speed railways and metro train projects, logistics parks, smart cities, regional airports along with water, sanitation and energy initiatives.

Forex Regulation/ CAC: The rigid foreign exchange regime has led foreign investors to experience a number of obstacles in terms of both investing in and repatriation of profits. Various FDI related laws have not been harmonised which often creates confusion and exasperation. For example, the FITTA Act, 1992 permits repatriation of investment in foreign currency. But provisions in the Foreign Exchange (Regulation) Act, 1962 create difficulties. Investors who come to Nepal are required to show and convert their investments in Nepali currency which is particularly risky due to the fluctuation in foreign exchange rates. There is no risk sharing mechanism or swap market to address this specific problem. On top of this, cooperation among the government agencies is weak which spells trouble for investors. Many foreign companies in different occasion have reported that they have experienced a tough time in getting permission related to investment and repatriation from DoI before obtaining clearances from the central bank. The absence of capital account convertibility (CAC) policy has created problems for FDI. India can be a good example regarding the adoption of CAC. Starting from 2006, the country implemented a five-year programme in three phases to establish a full CAC regime. By removing all forex barriers, India has become a prime FDI destination in the world.

The Civil Code also contributes to the low FDI inflow. The law does not recognise debt agreements made abroad by the investors to invest in projects in Nepal. Due to the absence of a legal framework, disputes over the projects with abroad debt financing agreements are settled in courts of countries including Singapore, Switzerland and London.

Speed of decision making: The slow pace of decision making has always been a major concern for foreign investors. They complain that the authorities make them wait for inordinate lengths of time, sometimes for no apparent reason. There are various examples that show why companies from other countries shy away from investing here. SBI Life Insurance Company, a major undertaking of SBI Bank, for instance, has been trying to enter Nepal but has not received any confirmation from the concerned authorities even after a considerable period. The JV is a partnership between some of the world’s largest names in banking and investment including the France-based BNP Paribas Cardiff, Singaporean sovereign fund Temasek Holdings, American multinational private equity firm KKR and Company and SBI Bank. “In November 2016, the SBI Life Insurance Company notified the authorities that it was interested in starting a JV undertaking in Nepal with a capital of Rs 5,200 crore,” informed Nepal SBI Bank CEO Bhatnagar. “They have said that if they do not get a reply from the authorities in Nepal in the next five months (there are two months left for their deadline to end), the project will shift to South Africa.”

Regardless of some policy initiatives to make the decision making process faster in the recent years, procedural hassles remain that considerably consumes valuable time of investors. The Doing Business Report 2017 indicates that the Nepal has not made significant improvements in reducing the time to give permission to investors to start new business. As per the World Bank’s flagship report, which ranks Nepal in 107th position among 190 countries, it averages 17 days to complete the process of obtaining permission from the government authorities to start new business compared to the South Asian average of 15.4 days.

What the government needs to do

The highly flammable mix of political instability, policy issues and inefficient bureaucracy has long haunted Nepal. However, albeit slowly, the country has been moving in a somewhat satisfactory manner at least in the South Asia region in terms of economic competitiveness in recent years. The Global Competitiveness Index 2016-2017 ranks Nepal in 98th position among the 138 countries which makes the Himalayan nation the fourth most competitive economy in South Asia, ahead of Bangladesh (106) and Pakistan (122). India tops the list in 39th position followed by Sri Lanka at 71 and Bhutan at 97. Improvement in doing business in Nepal has moved up two places in the index from 100 last year, as per the World Economic Forum (WEF). The Geneva-based international organisation has pointed out certain areas where Nepal needs to improve to become an economy with competitive and comparative advantage which are prerequisites for FDI.

Most Problematic Factors for Doing Business in Nepal

• Government instability

• Inadequate supply of infrastructure

• Corruption

• Inefficient government bureaucracy

• Poor work ethic in national labour force

• Access to financing

• Restrictive labour regulations

• Inflation

• Inadequate educated workforce

• Tax regulations

• Foreign currency regulations

• Insufficient capacity to innovate

• Tax rates

• Poor public health

• Crime and theft

In spite of the problems, the improving situation indicates that the policy undertakings of the government have started to take shape after years of dillydallying. The government is currently engaged in what it calls the ‘second generation of policy reforms’ that aims to update the outdated laws and formulate new ones to address the modern day way of doing business and its pertinent issues. The past eight months have seen an amendment of some old laws such as the Companies Act and Industrial Enterprises Act and the enactment of new ones like the Special Economic Zone Act. Similarly, the draft of FITTA Bill has been finalised which will replace the older Act. The Acts include progressive provisions that have been considered essential in order to create a better climate for investment. According to industry minister Nabindra Raj Joshi who was the chief guest of the Symposium, the FITTA Bill has included a provision that will allow investors to repatriate their investments in whatever currency they invest in here. “The entry related hassles for the investors will also be gradually eased with the start of the online registration within the next three months,” he says. Joshi is hopeful that the problems related to digital signature and online payment will also be resolved. “The Governor of NRB has assured me that we can sort out the problem of online payment within the next two months. In the meantime, we are also working to ease the exit related issues that the foreign investors complain here of most often,” he shares. The ministry has also been preparing a draft of the integrated IPR law in order to address the issues in intellectual and industrial property. The council of ministers has already approved the National Intellectual Property Policy in this regard. Likewise, the government has stepped up to implement the one-window policy which is expected to ease procedural hassles and reduce the time-consuming processes in decision making.

Following the Nepal Investment Summit 2017, the main committee and three sub-committees formed to monitor and follow-up on progress of the investment pledges expressed in the summit have already started their works. Chaired by the industry minister, the High-level Committee on Investment is composed of tourism, energy, commerce, physical infrastructure and transport ministers, State Minister for Industry, secretaries, Governor of NRB, a member of National Planning Commission, CEO of IBN and presidents of all three private sector organisations (FNCCI, CNI and NCC). The Policy Coordination Sub-committee for Foreign Investment is led by a member of NPC. Similarly, Investment Promotion Sub-committee is under the coordination of energy secretary and Foreign Investment Projects Sub-committee is being coordinated by the IBN CEO.

Welcoming the policy reform initiatives, Nepali private sector leaders are asking the government to do more on the economic front. “We want the government to introduce the Anti-Dumping Act which is one of the very important laws for Nepal. Similarly, we also would like to see the government bring in the IPR law,” says Hari Bhakta Sharma, President of Confederation of Nepalese Industries (CNI). He asks for an improvement in the delivery of services from the government which will also aid in the betterment of the country’s investment climate.

While the attention of the policymakers at present has shifted mostly towards policy reforms, experts stress that it is equally important for Nepal to retain the existing JVs by satisfying them. Doing this will spread good words about the country among other probable foreign investors. For this, the government needs to listen to their concerns seriously and find ways to address the problems, they say.