After years of moderate growth, Nepal’s insurance sector is seemingly headed for growth by leaps and bounds.

--BY SANJEEV SHARMA

When the outgoing Minister for Finance Krishna Bahadur Mahara signed the approvals in the third week of May to issue new permits to 10 new life insurance companies which had been waiting for up to a decade to receive approval to start operations, it was seen as being a bold move on the part of the government enabling new players to join the insurance market. The ten companies who received their licenses are Sun Nepal Life Insurance, Star Life Insurance, Sanima Life Insurance, Citizen Life Insurance, Reliance Life Insurance, IME Life Insurance, Reliable Life Insurance, Mahalaxmi Life Insurance, Union Life Insurance and Jyoti Life Insurance, respectively.

According to the Insurance Board (IB), the insurance sector regulator, 12 companies had applied for permits, among which two were rejected as they did not meet the standards required by the Insurer Registration and Insurance Operation Directive, 2073 which was issued on March 31.

The companies have been given six months to set up and organise their respective businesses that are subject to be monitored by the IB before the insurers start operations. Meanwhile, four non-life insurance companies, namely Sanima Non-life Insurance, General Insurance, Azod Insurance and Manakamana Insurance are currently waiting to receive the go ahead from IB. With the addition of 10 new insurers, the total number of life insurance companies in Nepal has reached 19. Similarly, there will be 21 companies in the non-life insurance business if the four hopefuls are permitted to operate.

Readying for the Golden Days

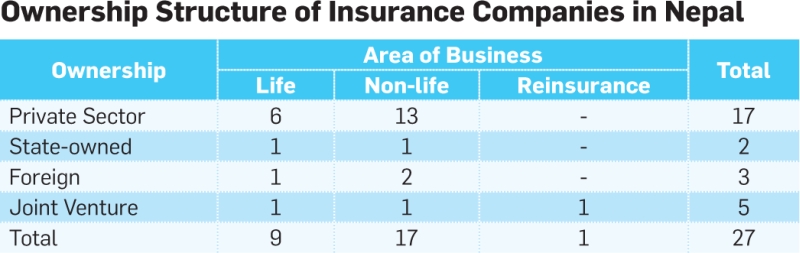

This development clearly indicates that the golden days for the Nepali insurance sector are possibly here. The business of insurance is thriving and insurers are gradually reaching out to many new parts of the country that previously remained out of the radar of the insurance sector. With the new entries, observers say that the growth of the risk-mitigation business is likely to accelerate over the next few years. Presently, there are 27 insurance companies, nine in life and 17 in non-life areas, operating with more than 400 branches across the country.

The addition of the newcomers brings the total number of insurance companies in Nepal to 42, a number that signals a new era for market expansion of insurers and increase in access to insurance in Nepal.

The increasing number also shows rising investor confidence in the domestic insurance market. This is displayed by fact that despite the mandatory hike in paid-up capital of insurance companies, new players want to immediately enter the market while the existing insurers are looking to further strengthen their position. The IB in late March announced a fourfold requirement for increment of paid-up capital of both life and non-life insurance companies giving them a deadline of mid-July 2018. As per the directive issued by the regulator, the new paid-up capital requirement for an insurance company has been set at Rs 2 billion from the current level of Rs 500 million. Likewise, non-life insurance companies have been told to increase their paid-up capital to Rs 1 billion which is presently Rs 250 million.

Similarly, the interest of general public towards insurance over the last few years has grown as more Nepalis are looking to get insured. The devastating earthquake of 2015 with the huge loss of human lives and property proved to be an important lesson in this regard. As a consequence, people have become more aware that insurance can be instrumental to mitigate the risks in the future. More than 9,000 people lost their lives, 22,000 got injured and damage amounting to USD 10 billion was registered due to the natural disaster.

The Companies

Among the insurers in the life insurance business, six have investment from Nepali private sector investors. The companies are National Life Insurance, Nepal Life Insurance, Surya Life Insurance, Prime Life Insurance, Asian Life Insurance and Gurans Life Insurance, respectively. The government-owned Rastriya Beema Sansthan is also in the life insurance business.

Similarly, 13 companies in the non-life insurance business have been operating with domestic private investment. The companies are Everest Insurance, Himalayan General Insurance, Prudential Insurance, Neco Insurance, Premier Insurance, Lumbini General Insurance, NLG Insurance, United Insurance, NB Insurance, Sikhar Insurance, Prabhu Insurance (formerly known as Alliance Insurance), Siddhartha Insurance and Nepal Insurance Company, respectively.

Meanwhile, four insurers have been operating as joint ventures with two each in life and non-life areas. LIC Nepal is the JV company in life insurance, while Sagarmatha Insurance is in non-life insurance. LIC Nepal is a joint venture between Life Insurance Corporation of India and Nepali conglomerate Vishal Group. National Insurance Company Limited (NICL) is a Government of India undertaking which has been operating in Nepal since 1973. Sagarmatha Insurance is a Nepal-Sri Lanka non-life insurance JV with the leading Sri Lankan insurer Ceylinco Insurance PLC being the joint venture partner.

The US-based multinational insurer Metlife (formerly known as Metlife Alico), meanwhile, is the only fully foreign life insurance company in Nepal.In the non-life segment, India-based The Oriental Insurance (Nepal) and National Insurance Company Limited (NICL) have been operating as extended arms of their respective institutions in Nepal since 1956 and 1973 respectively.

There is also a reinsurance company which came into existence in 2014 succeeding the Insurance Pool established in 2003 during the worsening times of the insurgency.

The Untapped Market

The trend in insurance claim settlements after the earthquake shows that a majority of Nepalis and their property remain uninsured which has increased the level of vulnerability to losses if such disasters occur in the future. According to the Post Disaster Needs Assessment (PDNA), the damage to property and infrastructure amounted to Rs 517 billion. However, it is an irony that only 3 percent of the damage was insured. As per IB, 16 non-life insurers have settled 16,836 claims paying Rs 12.81 billion in compensation to the insured as of mid-February. A total of 17,782 non-life insurance claims worth Rs 16.85 billion were lodged by the policy buyers after the earthquake out of which 5,896 claims have been declared as invalid. Meanwhile, the claims for life insurance totaled even smaller at Rs 3.47 billion.

Insurance is considered a sector with vast potential in Nepal as the penetration of insurance is just 1.31 percent of the GDP at present. According to the Financial Inclusion Roadmap 2017-2022 prepared jointly by The Centre for Financial Regulation and Inclusion (CENFRI), Finmark Trust and United Nations Capital Development Fund (UNCDF), 80 percent of the adult population of Nepal do not have any type of insurance coverage. As per IB, the access to insurance in the country currently stands at 12 percent combining both life and non-life insurance coverage. Estimates put just around 5 percent of the country’s population to be covered by life insurance policies at present.

The awareness of insurance among the general people has remained low despite the fact that the first insurance company was established during the Rana regime in 1948 as Nepal Mal Chalani Tatha Beema Company Limited which was renamed Nepal Insurance Company Limited in 1961. It is among the sectors with the lowest rate of contribution to the country’s GDP at just 2.5 percent.

Nevertheless, with an estimated present market size of around Rs 48 billion, the Nepali insurance sector has seen remarkable growth in the post-liberalisation era that started after the political change of 1990. From just five companies in 1992, the number has climbed to 26 over the last two and a half decades.

Insurance Products

Insurance companies in Nepal have various types of insurance products for Nepali policyholders. Life insurers have been selling a range of policies such as whole life policy, term life insurance, endowment plans, money back plans, accident and health related policies, children insurance plans, group insurance/employee benefit, among others. Besides these, companies are also seen launching new products in order attract more Nepalis into insurance. NLIC, for instance, introduced the one-year ‘Smart Life Insurance’ scheme under which the company will provide Rs one million to the nominees if a policyholder dies during the policy period. The insured are required to deposit Rs 10 per day.

Non-life insurers, in the meantime, also have various products in their portfolio. As per the Insurance Regulation, 1993, non-life insurance companies are allowed to sell policies in Fire Insurance, Marine Insurance, Aviation Insurance, Motor Insurance, Engineering and Contractors All Risks Insurance and Miscellaneous Insurance. The Miscellaneous Insurance covers areas including accidents of individuals and groups, transit, third party liability, industrial accidents, damages to households, livestock, crops and medicine.

New Frontiers

Agriculture Insurance

The last few years have seen some progress in terms of policy initiatives to expand the insurance business in the country. The government, for example, has come up with policies in agriculture and micro insurance in a bid to increase the access of insurance in rural areas. IB in January 2013 implemented the Crops and Livestock Insurance Directives and six types of insurance policies have been issued in this regard. The policies cover various types of crops, vegetables, cereals, fruits, poultry, fish, cattle and farm animals. Despite a lukewarm response after the implementation of the policy due to lack of awareness among the farmers, there has been a significant jump in sales of agricultural insurance products in recent years.

According to IB statistics, non-life insurers in the first four months of the current fiscal year collected Rs 119.90 million in premiums from the sales of agricultural insurance products, up 65 percent from Rs 72.7 million in the corresponding period of the last fiscal year. In the last four years, non-life insurers are estimated to have collected over Rs 6.5 billion in premiums by selling such types of products. Activities in agricultural insurance are likely to expand in Nepal in the next few years. The government has been providing a 50 percent subsidy on insurance premiums of crops, livestock and poultry from FY2013/14.

Meanwhile, suggestions have been made to further strengthen the agricultural insurance practices in Nepal. “Given the high exposure to agriculture across the population, agriculture insurance and disaster risk protection products are a gap in the market that should be further investigated,” states the Nepal Financial Inclusion Report 2016.

Micro Insurance

Micro insurance is being seen as a tool to increase insurance in Nepal. The government led by former Prime Minister KP Sharma provisioned the micro insurance programme in the budget for FY 2016/17. Under this, both life and non-life insurers are mandatorily required to provide at least 5 percent services in micro insurance out of their total services. The programme sets out to minimise the financial risks associated with agriculture, cattle/livestock and other small rural businesses. IB has already introduced the Micro Insurance Directives in 2014 which has set the insurance policy amount at a range of Rs 100,000-Rs 200,000 with the annual premium being 0.1-5 percent.

Currently, the government has been working to amend the existing Insurance Act, 1992, the draft of which has included the mandatory provision of micro insurance for insurers. According to a source at the Ministry of Finance, the new insurance bill will have a provision for the licensing of micro-insurance companies.

Migrant Worker Insurance

Getting migrant workers under insurance coverage has been an area of focus for the authorities in recent years and has also opened new doors for the Nepali insurance sector. A new health insurance policy was implemented in mid-February that enables Nepali migrant workers who have bought term life insurance to receive coverage for critical illnesses of 15 types against an insurance premium for Rs 400. Earlier in January, the government announced it would increase the insurance coverage to Rs 2 million from Rs 1.5 million for migrant workers who work in 110 countries. Under the programme, the government will bear half the premium amount while the remaining has to be paid by the workers themselves.

In the first nine months of the current fiscal year, insurers have sold 876, 950 insurance policies to migrant workers collecting premiums worth Rs 21.89 billion. Meanwhile, the claim settlement of such policies during the period has totaled Rs 636.25 million. The policy is considered as being beneficial for 5 million migrant workers who are the major remittance senders as well as the insurers who have been looking to expand their business.

Reinsurance

Reinsurance is a new area of insurance business in the context of Nepal. Reinsurance basically is a risk management practice where insurance companies transfer a portion of their risks to other insurers (reinsurers). Insurance companies in Nepal mostly rely on reinsurers in India, Singapore, Japan and Hong Kong and Africa for reinsurance. However, the prospect of reinsurance has risen with the establishment of Nepal Reinsurance Company Limited (NRCL) in December 2014. Operating in the PPP model with a 43 percent stake of the government, 39 percent of non-life insurers and the remaining 18 percent from life insurers, the company has gained notable momentum in just two and a half years. Its transaction amounted to Rs 2 billion in its first year.

The company is currently engaged with both domestic and foreign clients. According to NRCL CEO Chirayu Bhandari, the company’s reinsurance portfolio of domestic clients has reached Rs 2 billion as of the end of the 3rd quarter. He informs that NRCL has been working with 17 Nepali non-life and four life insurance companies at present. Likewise, the reinsurance transaction amount from its foreign clients has totaled Rs 30 million during the period. The company has been providing reinsurance services to 26 insurers from 15 countries.

There have also been some policy level initiatives to stop the outflow of funds from the country in reinsurance. The government in the budget for FY 2017/18 has announced that a mandatory arrangement will be made for Nepali life and non-life insurance companies to reinsure a major share of their insurance policies to Nepal Reinsurance Company. It is estimated that Rs 10-12 billion goes out from the country for reinsurance annually.

Insurance of Government/ Public Property and Infrastructure

Government and public-owned property and infrastructure sustained heavy damage from the earthquake of 2015. The government now seems to have realised the importance of insuring such property and infrastructure to minimise losses in case of disasters in the future. Though no specific plans have been laid out, the concerned authorities are said to be thinking of formulating mandatory provisions for insurance in this regard. Such a provision can be largely beneficial to the insurers as the number of government and publicly-owned property and infrastructure is substantially high in the country.

Emerging Trends in Insurance

E-insurance

The business of insurance is all about providing practical solutions to the clients using latest technologies. While the concept of e-insurance has gained prominence in developed and many emerging economies, Nepal has lagged behind in terms of expanding the insurance business through digital means. Nevertheless, the digital gap in insurance innovation has narrowed with the launch of the portal www.ebeema.com. Introduced in April 2016, the insurance portal enables users to compare and purchase insurance policies being offered by a number of insurers in the country. Its portfolio is composed of a variety of insurance schemes including endowment, money back, home, health, automobile, travel, child, whole life, term life, pension and education. Users of the policies can track their policies, receive reminders for expiration and payments, schedule medical check-ups and physical surveys and make claims for settlement.

Bankaassurance

Introduced in Nepal in 2006, Bankassurance has remained a low profile insurance service due to the lack of interest among the customers, banks and insurance companies. However, with more banks and insurance companies joining hands to provide insurance services to their clients Bankassurance has been speeding up over the last few years in Nepal. It is basically an arrangement in which banks and insurers enter into a partnership to sell insurance products to the client base of the banks. The IB is also said to be working to introduce the Bankassurance Policy whereby customers can receive insurance services through all branches of banks throughout the country.

Problems in the Insurance Industry

Despite the promising prospects, the Nepali insurance industry has some challenges to overcome. There are issues related to policies that hinder the growth of the business. The rigidity in the Investment Guidelines for insurance companies can be taken as an example in this regard. The investment restrictions in the guidelines have obstructed the growth of Nepali insurance companies. As per the current arrangement, life insurance companies are required to invest a minimum of 75 percent of their investible funds in government securities, treasury bills, schemes of mutual fund and Citizen Investment Trust and short and fixed term deposit in commercial banks and development banks, promoters’ shares, loan certificate and debentures of BFIs. It is 65 percent for non-life insurance companies. Similarly, the guidelines allow insurers to invest in general shares of publicly listed companies not exceeding 5 percent. A prior approval from IB is mandatory if the companies want to invest in areas other than those specified in the guidelines.

The existing insurance law has become outdated and does not comply with best international practices. Meanwhile, there is no insurance contract law in place to address issues related to misinterpretation of the insurance policies, non-disclosure of agreements and remedies, among others. Similarly, the country lack actuaries for actuarial evaluations, an insurance appraisal based on economic and demographic assumptions for estimating future assets and liabilities, for non-life insurers. Foreign actuaries are hired for this at present. Likewise, the absence of policy for appointing third party administrators (TPAs) is also another area of concern for insurers here. TPAs are considered important to expand the insurance schemes and to settle claims made by the policyholders. The appointment of TPAS can be a new business under insurance industry. Similarly, brokerage service too can be started under this sector. Presently, foreign brokers, mostly from India, are providing such type of service here.

Issues related to moral hazards are also a problem in the Nepali insurance business. Such issues are said to particularly persist in agricultural insurance. Problems arise when farmers supply wrong information, intentionally or unintentionally, during the settlement of claims. The insurance sector regulator has not been able to create an effective framework to reduce the moral hazards. It is quite difficult for the insurers to determine the reason for the losses. Nepali insurers do not have an adequate workforce to evaluate and assess the damages and claims. It needs a team of experts composing of actuary, underwriters, statisticians, risk analysts and loss assessors and specialists in the respective fields to get an actual picture of the damages incurred. The basis of compensation also needs to be revised. Suggestions have been made to compensate the policyholders of crop insurance schemes on ‘weather data basis’, for example.

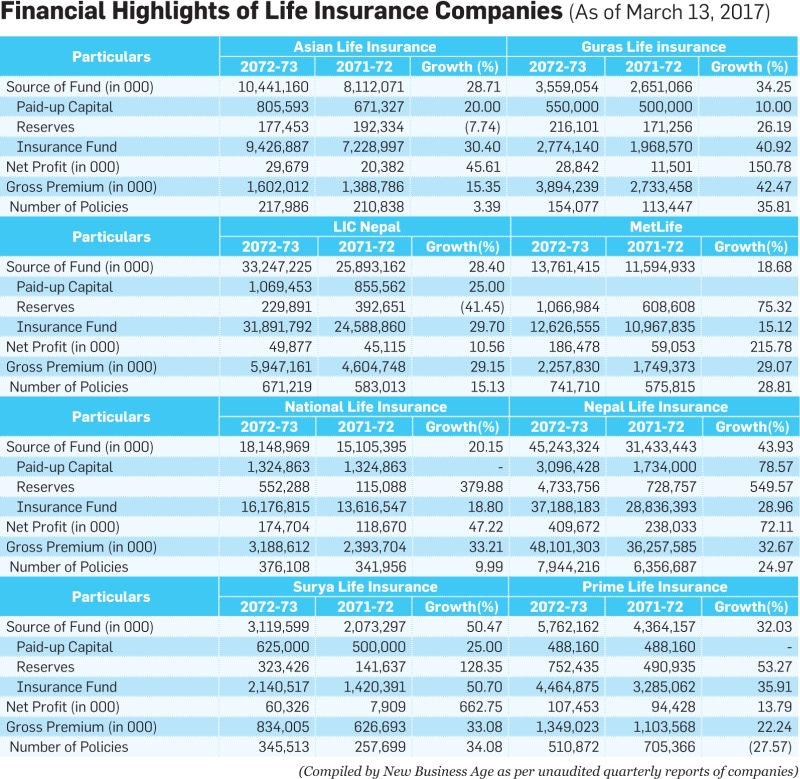

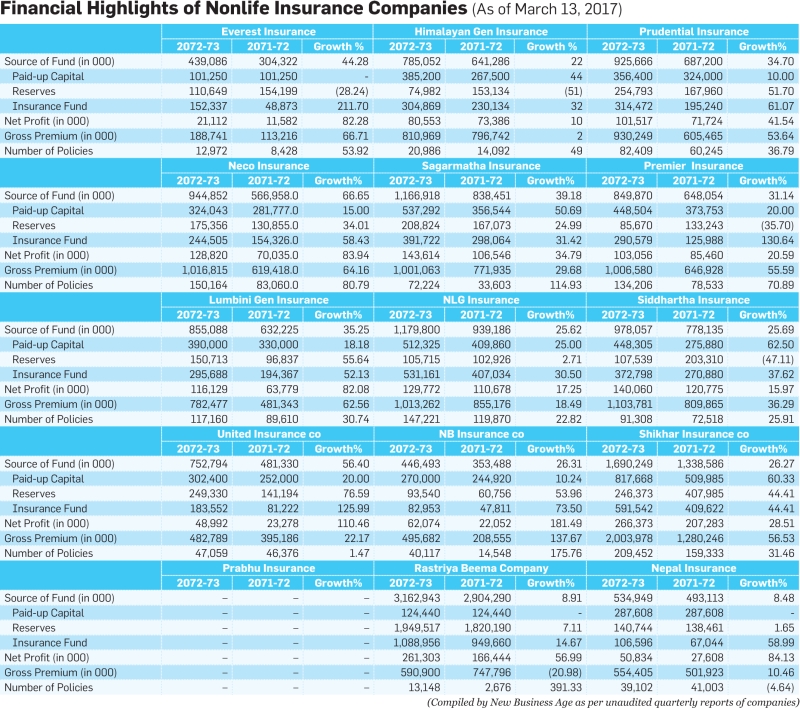

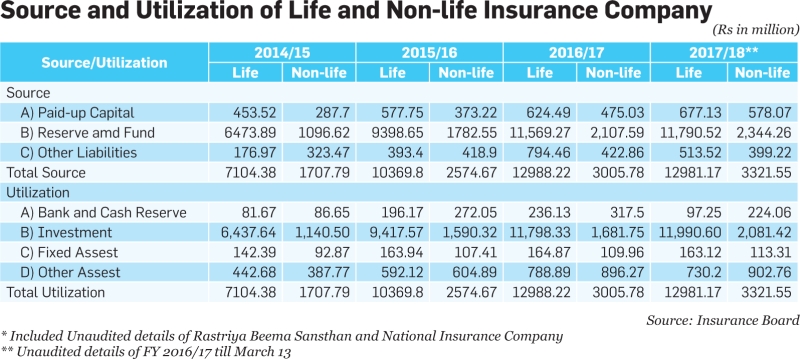

Increase in Financial Source and Utilisation

The total financial source and utilisation of both life and non-life insurance companies in the first eight months of FY 2016/17 has totaled Rs 163.02 billion out of which Rs 129.81 billion belongs to life insurance companies and Rs 33.21 billion to non-life insurance companies. In the current fiscal year, the total financial source and utilisation of insurers has grown by 1.93 percent compared to the last FY’s Rs 159.93 billion.

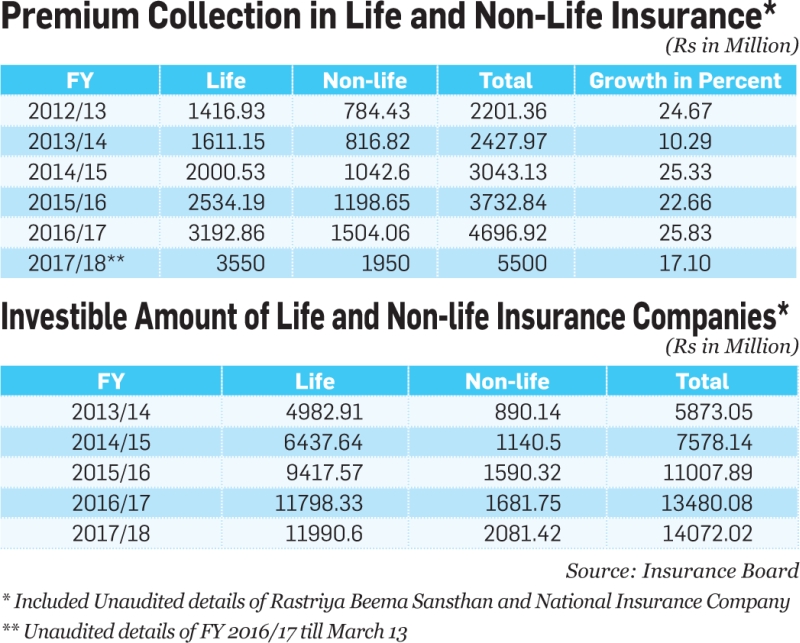

Rising Insurance Premium Revenue

The income generated from the insurance premium of both life and non-life insurance companies which totaled Rs 22.1 billion in FY 2012/13 amounted to Rs 46.96 billion in FY 2015/16. In FY 2016/17, the income is projected to increase by 17.10 percent totaling around Rs 55 billion.

Annual Growth of Insurance Premium of Life and Non-life Insurance Companies

The annual growth of insurance premium of both life and non-life insurance companies has been around 25 percent over the last six years. The growth rate decreased to 10 percent in FY2013/14. It is expected be 9 percent in the current fiscal year.

Ratio of insurance premium to GDP

The ratio of insurance premium to the country’s GDP in FY 2015/16 was 2.09 percent. The ratio which hovered at around 1.4 percent since FY 2012/13 is estimated to be 2.05 percent in FY 2016/17.

Rising Investments

The total investible amount of insurers in life and non-life insurance business has been constantly rising. The amount which was Rs 58.73 billion in FY 2012/13 increased to Rs 75.78 billion in FY 2013/14, Rs 110.07 billion in FY 2014/15 and Rs 134.80 billion in FY 2015/16. The amount is expected to be Rs 140.72 billion in FY 2016/17. Nonetheless, the growth has slowed following the 2015 earthquake. After increasing by 45.3 percent in FY 2015/16 compared to FY 2014/15, the investible amount is estimated to grow by just 4.4 percent in the current fiscal year.

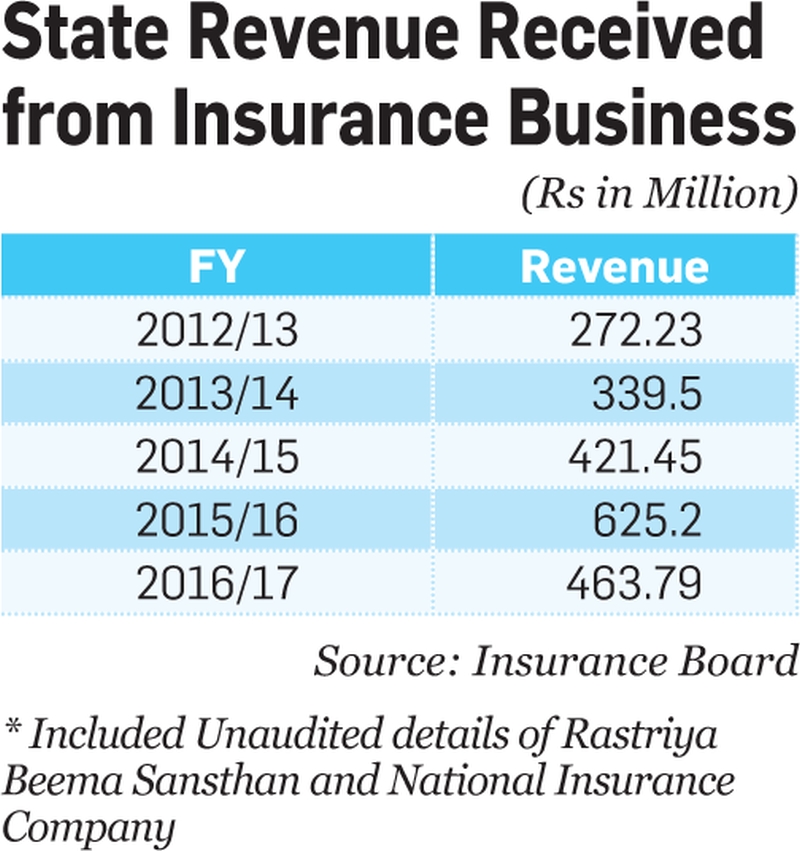

Contribution to Government Revenue

The insurance sector has become an important contributor to the government revenue in the recent years. The government revenue amounted to Rs 2.72 billion in FY 2011/12 which was registered at Rs 3.39 billion in FY 2012/13, Rs 4.21 billion in FY 2013/14, Rs 6.25 billion in FY 2014/15 and Rs 4.63 billion in FY 2015/16. The government revenue generated from the insurance sector which saw a growth of 48 percent in FY 2014/14 declined by 26 percent in FY 2015/16. In spite of the odds created by twin shocks of earthquake and border blockade in 2015, the revenue growth has been regarded healthy for FY 2015/16 compared to many other sectors that were in red in the fiscal year.

(Source: Economic Survey 2016/17)