--By Niranjan Phuyal

Overall indicators of Nepali secondary market remained upbeat throughout FY 2012-13. On July 21, 2014 the trading volume crossed Rs. 1 billion mark and the market capitalization reached Rs. 1106 billion— both figures are the highest for each variable recorded on a single day in the history of Nepali secondary market. Along with them, other indicators also increased substantially in comparison to FY 2012/13. This bullish trend, which started almost two years back, continues the upward trend.

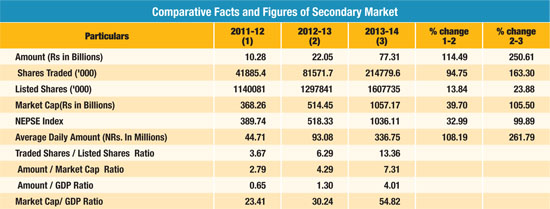

Trading volume in FY 2013/14 increased by 250 per cent to stand at Rs. 77 billions as compared to that of the FY 2012/13.During the review period, Nepse index exactly doubled from 518 to 1036, whereas total market capitalization increased by 105 percent. Number of shares traded has also increased significantly. Although additional 21 companies were listed in the stock exchange for trading during the year, at the end of the year there were only 232 companies were listed. In the previous FY, this number was 230. During the review period, almost all indicators in the stock market have registered double digit or even higher growth rates. Why is the trend is so bullish? What could be the indication of these trends for the general investors?

Possible Causes

Ups and downs are general phenomena of stock markets. However, during the initial phase of the current bull trend, it was considered as the recovery of the market. But the continuous increases cannot be recovery only. There are various causes, not only in the capital market, but also in the economy that increased investors’ confidence. The first reason could be the possibility of political stability after the second Constituent Assembly (CA) elections. More than stability, people felt the law and order situation of the country improving. This confidence has been reflecting in the bullish trend on the stock market. Active participation of institutional investors like mutual funds, financial institutions and insurance companies has also played instrumental role to lift the secondary market.

Although it can have less impact, the technological advancement in the Nepse's trading system, multiple login facility for stock brokers, new remote work stations also induced the secondary market. The major cause for continuous rise in trading volume is the excess liquidity and resultant fall in interest rates in the money market. As the interest rates, the cost of investment, are very low, investors confidence on the stock market boosted. Research and studies have revealed that the low interest rates cause increase in the stock market.

.jpg)

Indications

The main function of secondary market is to provide liquidity to the investors. The bull run of Nepse index along with sharp increase in average daily turnover indicates that the Nepal's stock market is moving towards maturity. The value of ratios of traded shares to listed shares, of turnover to market capitalization, and of the turnover to GDP, have increased significantly during the FY 2013-14. Similarly, market capitalization has crossed 50 percent of the GDP. Although these are very less in comparison to the neighbouring markets, these indicators show Nepali secondary market is improving its performance.

Previously, 57 percent of the total market capitalization was only from commercial banks. The ratio of turnover of top ten companies to total turnover was 55.73 percent and seven commercial banks were under top ten companies. The figure has changed in FY 2013-14 as Chilime Hydropower Company has topped the list of traded companies. Similarly, two insurance companies have entered in the top ten lists. As a result, concentration ratio has decreased to 36 percent in FY 2013-14. This indicates that the investors want to diversify their investment rather than concentrating on few companies. This is also supported by the sector-wise market capitalization of development banks, insurance companies and hydropower, which has increased significantly in FY 2013-14.

Future Steps

The current trading pattern and market trend reveals that investors are getting mature in comparison to the previous bullrun. Increased numbers of stock brokers and outlets out of Kathmandu valley have been contributing to the market efficiency. Furthermore, the investors' keen interest in portfolio diversification suggests that there should be more scrip in the market from real sector companies.

Meanwhile, it is right time for the regulators and market operators to think about the derivative instruments in the market. The trading system should be more techno-friendly, which can strengthen online trading and the stock brokers should be more professional and capable enough to provide margin lending in close monitoring and supervision.

More institutional investors as well as secondary market dealers are required to stabilize the market. As new investors enter into the market the regulator should concentrate on effective stock market education campaign. Digitization of stocks, a decade-long demand, can expand access to stock market throughout the country by initiating the central depository facility immediately. Lastly, investment decision should be made on the basis of analysis and not on the basis of word of mouth.

The author is asst manager at NEPSE and a visiting faculty at KUSOM.